What Should I Do If My Portfolio Is Outperforming or Underperforming?

Once you’ve chosen the right benchmark and compared its performance to your portfolio’s, the natural next question is: So what? How good or bad is this, and what should I be doing about it?

July 29, 2025

Establishing a benchmark helps answer the “what” of investing — what outcome your portfolio generated relative to a relevant measuring stick. But the real insight comes from understanding the “why” behind that result, which will also help you decide what to do next (if anything).

… If you’ve outperformed

If your portfolio has beaten its benchmark, it could mean a few things:

- Maybe you (or your investment provider) made some smart choices. That’s ideal.

- Maybe your portfolio was overconcentrated in areas of the market that happened to perform well. That’s less ideal.

- Maybe it means nothing and is simply short-term market noise. This happens a lot.

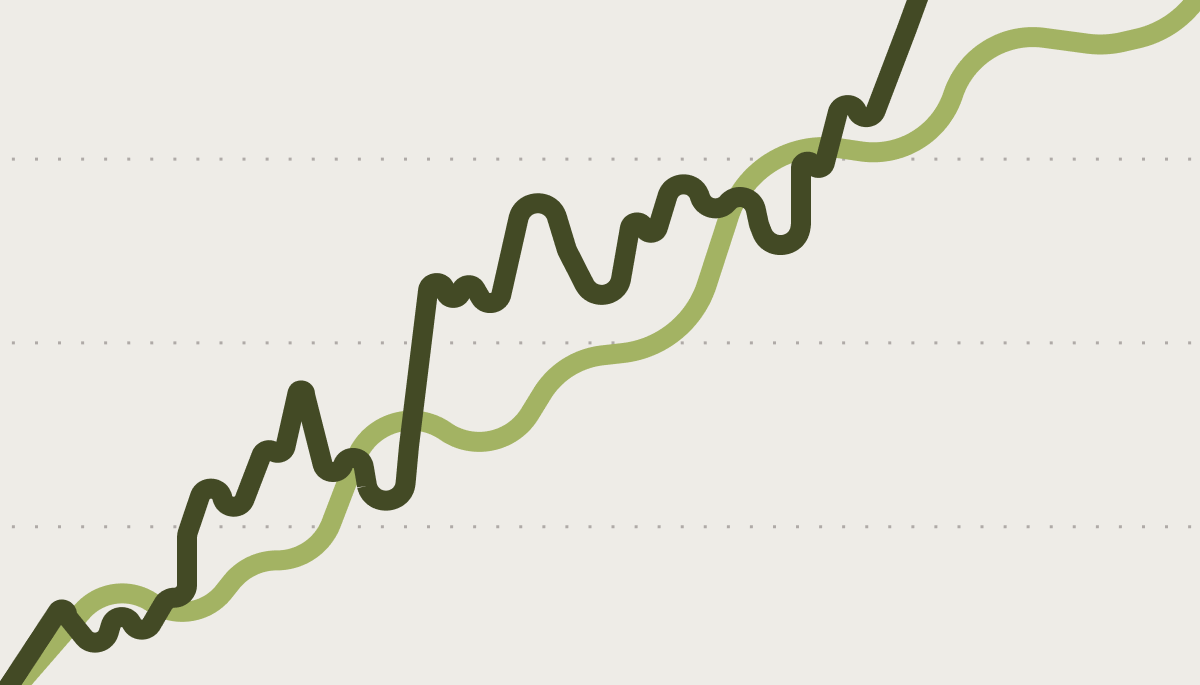

Outperformance over a short period — say six months or a year — often doesn’t mean much. Markets move. Trends come and go. But if you’ve outperformed over longer stretches, that might be more meaningful.

Emphasis on might. Even then, outperformance isn’t always statistically significant. A seemingly large performance gap over 3-5 years could easily fall within the range of expected noise — but investors often fall into the trap of looking at 3-5 year performance windows and assuming that their winning strategy will continue to win. This behavioural bias leads to buying high (loading up on whatever’s been doing well recently) and selling low (abandoning valid strategies that have happened to underperform), which can significantly impact long-term returns. (In a bad way, we mean.)

Try to unpack why that outperformance happened. Did it come from leaning heavily into a hot sector or stock? If so, it might not be a sustainable long-term strategy; no company or industry stays #1 forever. Good performance is more repeatable when you construct a portfolio with diversified allocations that carry a level of risk appropriate for your goals.

… If you’ve underperformed

This one hurts a bit more. But it’s also when good investing habits could start forming. Your portfolio might lag for a few different reasons:

- Maybe you have been paying high fees that are eroding your results.That's avoidable.

- Maybe your portfolio is lacking diversification and you took too much risk. That’s avoidable too.

- Maybe it means nothing and is simply short-term market noise.That’s not avoidable, and it happens a lot.

Just as outperformance over even a 3-to-5 year period often isn’t statistically meaningful, underperformance over these timeframes might not be either. Before making dramatic changes, consider whether the underperformance could simply be normal variation around your expected return. Reacting too quickly is something investors should try to avoid. If your portfolio is built to match your risk tolerance, time horizon, and goals, and you're comparing it to the right benchmark, then what you might actually need … is just patience.

A common source of addressable underperformance can be paying high fees to active managers that ultimately don’t end up adding value once those costs are accounted for. Research continues to illustrate that the majority of actively managed funds underperform their passive benchmarks. In fact, some research has found that simply charging low fees tends to be a surprisingly reliable predictor of good returns.

But sometimes action is warranted - so we’ve come up with a list of questions to ask yourself to help determine appropriate next steps.

Questions to ask when assessing performance:

- Are you using the right benchmark?

- Make sure it reflects your portfolio’s mix of assets, so you’re comparing apples to apples.

- What’s your comparison timeframe?

- Focus on multi-year performance to see the bigger picture. Remember that even 3- to 5-year results can be normal market variation.

- Why did your portfolio perform the way it did?

- Look at factors like risk, diversification, and fees.

- Confirm that your portfolio still matches your time horizon and goals.

- Should you make a change?

- Consider making adjustments for avoidable issues like high fees or diversification, or if your portfolio no longer reflects your goals. But if patience is all that’s needed, staying put can be a powerful strategy.