The six-month portfolio tune-up

Life happens, which is why even a well-diversified portfolio needs an occasional oil change

June 26, 2025

We talk a lot about the importance of setting up your portfolio to match your long-term investment plan, making regular investments, and then getting out of the way. But being hands off on your portfolio isn't the same as being disconnected.

Like puppies or Disney villains, your investments benefit from a little love and attention. That's because disproportionate gains and losses in the market can shift the balance of assets in your portfolio. Also: your goals or comfort with risk can change, and your approach needs to change with them.

To make sure you’re still on track, it’s a good idea to check in on your portfolio periodically. Every six to twelve months works for many investors — or sooner if life calls for it. When the time comes, here are four key questions to ask yourself.

1. Have your goals, financial circumstances, or timelines changed?

If so, you might want to update your risk level or the balance of assets in your portfolio. Say, for example, you decided to move up your dream of being a homeowner by a couple of years. In that case it might be worth scaling back on a riskier investment in favour of a more conservative one so you’ll be more likely to have cash when the time comes. Or maybe you got a promotion and significant raise. That allows you to be more flexible with risk, either taking on more of it given the additional income (there’s more you’d be comfortable losing), or lowering it because you don’t need as risky of investments to hit your goals.

Unlike the knee-jerk reactions to market changes that we recommend against, these adjustments are based on your needs. If nothing has changed in your life, and your goals remain the same, there is nothing you need to do. You’re on the right track.

2. Are you saving regularly and using the right accounts?

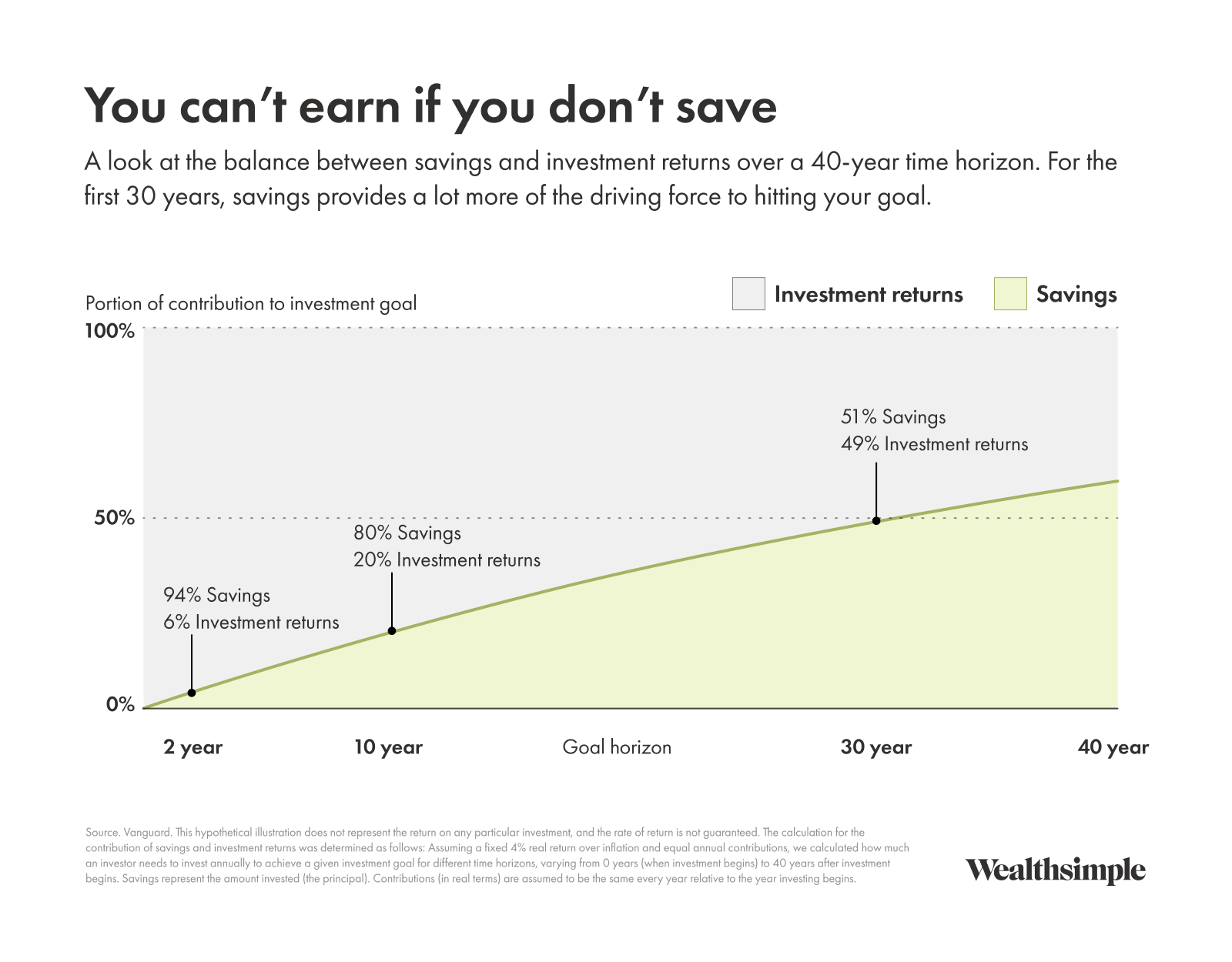

It’s easy to focus on returns when building a long-term portfolio, but savings — as in the amount you set aside toward your goal — are important too. Unlike the markets, however, you actually have control over your savings. Over a 30-year period, savings account for almost half the value of a portfolio. If your time horizon is shorter than that, savings become even more important.

.png)

We advocate the principle of “paying yourself first.” If you’re able to, automatically divert a portion of your paycheque into your investment portfolio. This treats savings like a non-negotiable expense, and that helps keep you on track to attain your goal.

It’s also important to take advantage of TFSAs, RRSPs, FHSAs, RESPs, and other tax-advantaged accounts. You can check your available contribution room for the year on your CRA My Account. You want to hit those caps before you start investing in non-registered, taxable accounts.

3. Are you still appropriately invested for your goal and horizon?

If you moved to cash at an inopportune time, chased a stock because it looked like a good deal, or made any other moves based on short-term headlines, it could be time to realign your approach.

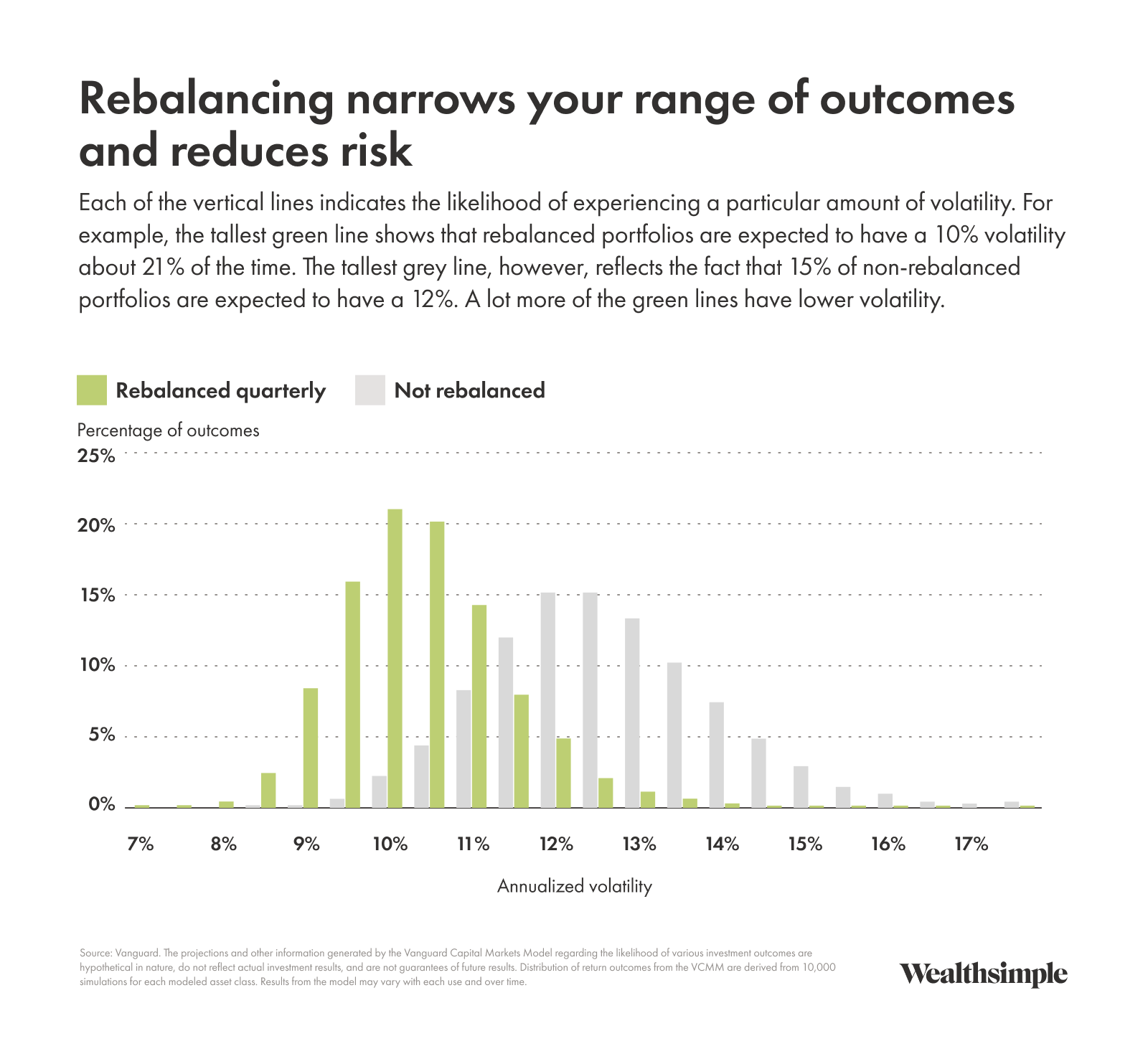

Even if you didn’t make any knee-jerk reactions (we’re proud of you!), periods of volatility can throw your portfolio off balance. When certain assets outperform or underperform, your allocation drifts away from where it started, potentially introducing more risk. That’s where rebalancing comes in.

Rebalancing involves selling assets that have done well and buying those that haven’t kept pace. More important, it brings your portfolio back to the risk level and asset mix aligned with your goals. (If you’re a Wealthsimple client in a managed portfolio, we’re already doing this for you.)

Research suggests that a rebalanced portfolio exhibits fewer swings and generates a better return for the risk it takes (see below). There are also behavioural benefits, since it can be really tough to sell investments that have performed well, but doing so will leave your portfolio in a better position.

4. Are you optimizing your tax situation?

Tax planning doesn’t end in April. You should consider strategies like reinvesting your tax refund, contributing to registered accounts to maximize any tax advantages, and using tax-loss harvesting or spousal RRSPs if possible. These are small decisions that can increase your expected returns without taking on any additional risk. You’re basically getting free money from the government.

You did it!

You’re set for another six months (or until life throws you another curveball). Remember: great financial outcomes are the result of thoughtful planning, steady progress, and regular check-ins, not short-term market moves to try to capitalize on something that may or may not happen.