Should I buy a mutual fund that’s outperformed?

Hint: Past outperformance isn’t a strategy—focus on fit, fees, and staying the course.

September 10, 2025

Let’s say you own an actively managed mutual fund that has outperformed its benchmark. Well, that’s good! But does the fund’s recent performance mean you should keep holding it? Despite what a lot of people, including some advisors, think, perhaps not. It might seem bonkers to let go of a winning fund — until you look at the data. Let’s dive in.

What does the data say?

Actively managed mutual funds that outperform their benchmarks, on an after-fee basis, are rare. On average, less than one in ten Canadian domiciled managers outperformed their passive index over the past 10 years, as measured by the SPIVA Canada Scorecard, across a number of categories.

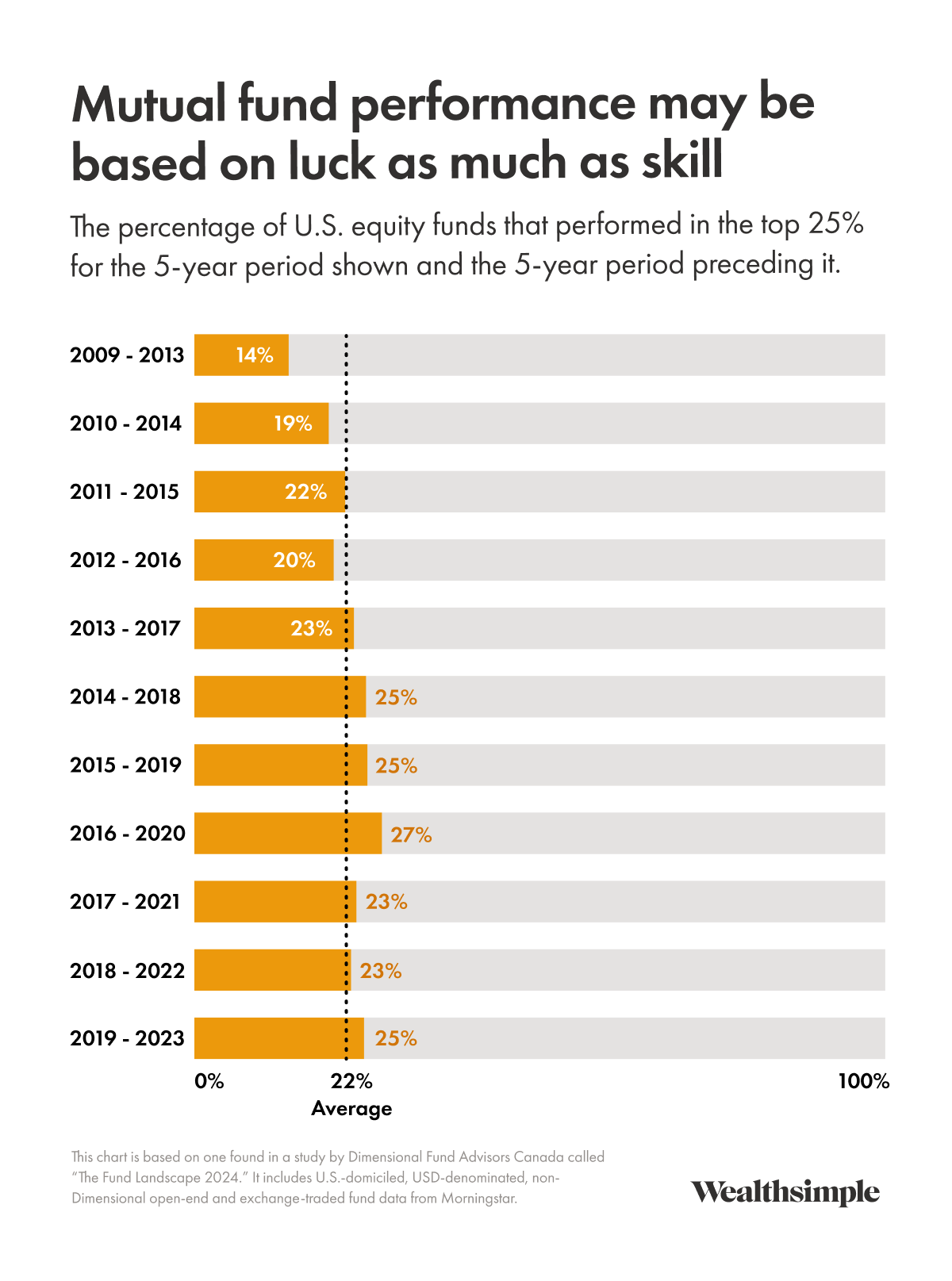

What’s more, even if you are invested in a fund that has outperformed, the odds of that outperformance continuing are low historically. Skill may persist, but luck is random and fleeting. Studies of fund performance consistency show that across asset classes and styles, very few managers remain in the top ranks over time and that periods of outperformance owe more to luck than skill. If you flip a coin 10 times, you could get 10 heads in a row — but you wouldn’t want to bet on it happening again and again.

A super-important math problem (that’s not really boring!))

There’s simple but powerful arithmetic that explains why actively managed funds struggle. The market’s return gets shared by everyone who invests in it. If passive investing captures the entire “market return”, then all active investors combined must also earn the market return (before fees). At its core, active investing is a zero-sum game — for every winner who outperforms, there is a laggard who underperforms.

The returns from actively managed mutual funds also suffer because active management isn’t free. And when you factor in those high management fees, trading costs, and tax implications from buying/selling assets more frequently, collectively, active managers are more or less destined to underperform the market.

This doesn’t mean no active manager can ever outperform the broader market — some will. But identifying those managers is extremely difficult, because past performance isn’t a reliable indicator of future success. Which is why for most folks, investing in low-cost, passive investing is the smarter bet from the start.

So, what can you do? Focus on what matters

Instead of making decisions solely based on how an investment has performed, it’s in your best interest to consider the following:

How the fund fits into your overall portfolio, and if it aligns with your risk tolerance, time horizon, or diversification needs. The fund should play a clear role, complement your broader investment strategy, and fit within your financial plan.

Fees are pretty important, too, because they can erode future returns. The impact of fees compounds over time.

Time and consistency win. All sorts of data shows that the most successful investors aren’t the ones who pick the hottest funds or invest at the absolute perfect time — they’re the ones who stick to a plan through good times and bad.

One more quick thought

It’s important not to let past returns trick you into poor decisions. Instead of asking yourself, “What fund performed the best last year,” ask yourself, “What investments make sense for my situation and have the highest likelihood of helping me achieve my goals?” Your future self will thank you for focusing on what matters most: long-term planning, taking the right amount of risk, and controlling what you can control (like costs).