Markets went back to normal — sort of

A quarterly performance update

October 15, 2025

As you surely need no reminding, the first half of this year was marked by heaps of geopolitical uncertainty and volatility in asset markets. The third quarter, in contrast, was calm — by 2025’s standards anyway. Over the past three months, inflation continued to ease while the global economy remained on track for 3% real annual growth in 2025, which is roughly in-line with the pre-pandemic years. (The Canadian economy bucked the growth trend by contracting 0.1% in June before expanding 0.2% in July, putting it on pace for 1% GDP growth in 2025.)

The big narrative in Q3 was that central banks shifted away from their inflation-fighting campaign and are now focused on ensuring continued stable economic growth as they lower interest rates. Both the Bank of Canada and the U.S. Federal Reserve have adopted cautious “wait-and-see” approaches, signaling that they intend to cut short-term interest rates more in the near future (markets expect two more cuts from the Fed in 2025 and at least one more from the BoC) but that they’re not cutting aggressively in a bid to keep inflation at bay.

Still, the rate cuts we’ve already gotten, plus robust corporate profits, were more than enough to boost equity markets. The U.S. S&P 500 grew steadily in Q3, gaining roughly 8.1% in local terms. The TSX did even better, climbing 11.5% in the quarter. Canadian government bonds, for their part, provided welcome calm for investors as yields stabilized significantly after several volatile quarters; the yield on the 10-year ended Q3 at 3.17%.

Managed portfolios

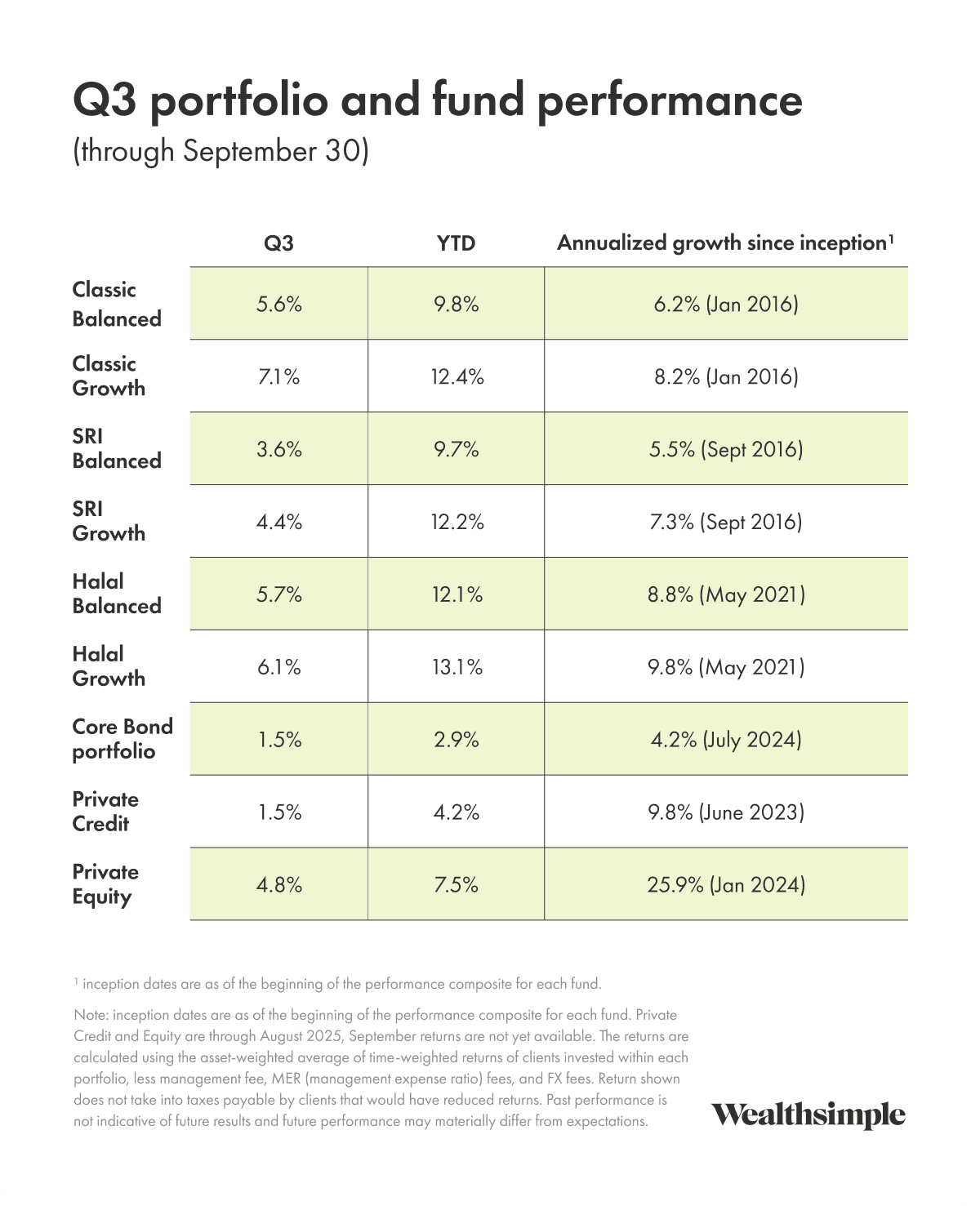

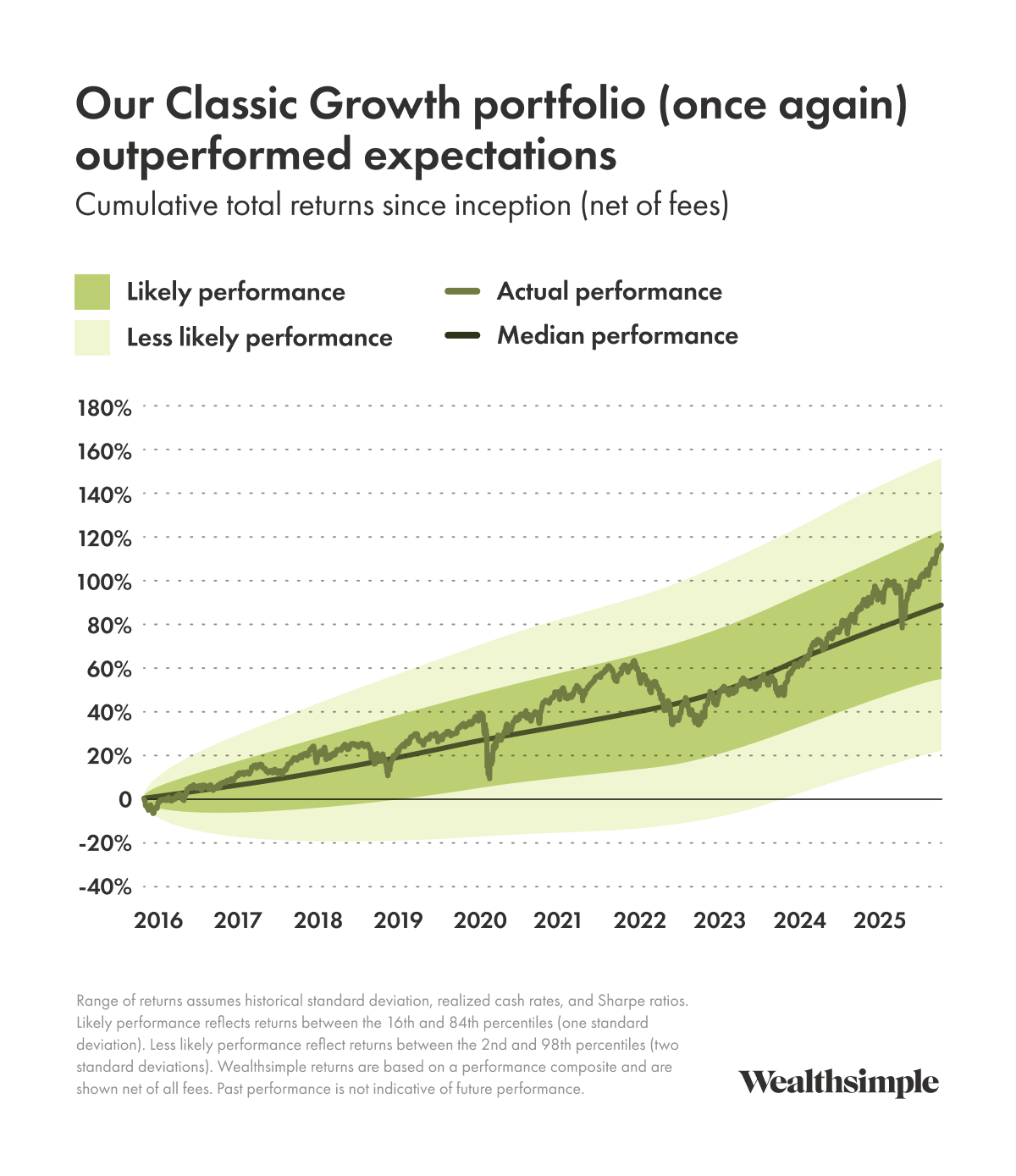

All portfolio types had a strong quarter, with positive performance across stocks, bonds, and other major asset classes. Our growth-oriented Classic, Socially-Responsible Investing (SRI), and Halal portfolios all got an extra boost thanks to their additional equity exposure, while many of our other portfolios benefitted from the continued, yearslong rally in gold prices.

These positive results drove home why we include a blend of diversified assets — across countries and sectors — in our portfolios: it helps them perform well in different economic conditions, increasing our clients’ chances of meeting their investing goals.

Alternative investments

Our alternative portfolios are made up of investments you can’t buy on public stock exchanges. They are intended to provide investors with a mix of higher returns and additional diversification when compared to more traditional assets like stocks.

Our Private Credit fund invests in senior-secured floating-rate loans to medium-size companies. We’re first in line to get paid back, and the payments we receive go up or down based on the current interest rate.

After returning 10.6% in 2024, the fund rose 2.6% in the first half of 2025 and another 1.5% in July and August, bringing year-to-date returns to 4.2%. (September returns are pending.) Performance is slightly lower than last year, but well within expectations. The creditworthiness of our debtors dropped in the first half of 2025 and didn’t improve in Q3, even though they largely continued to make interest payments on time. These concerns have caused the present value of the loans to fall in value.

Since launching in 2023, the portfolio has distributed income at a 9% annualized rate, which continued this quarter, providing high stable cash flows for investors.

Our Private Equity fund offers a globally diversified portfolio of private companies that are owned and operated by managers who work aggressively to improve their value. These investments can outperform public markets, although they tend to be riskier than a typical stock portfolio.

The fund returned 2.6% in the first half of 2025 and 4.8% in July and August (September returns are pending). That brings year-to-date returns to 7.5% and total returns since inception (in January 2024) to 46.8%. This number is at the high end of our expectations.

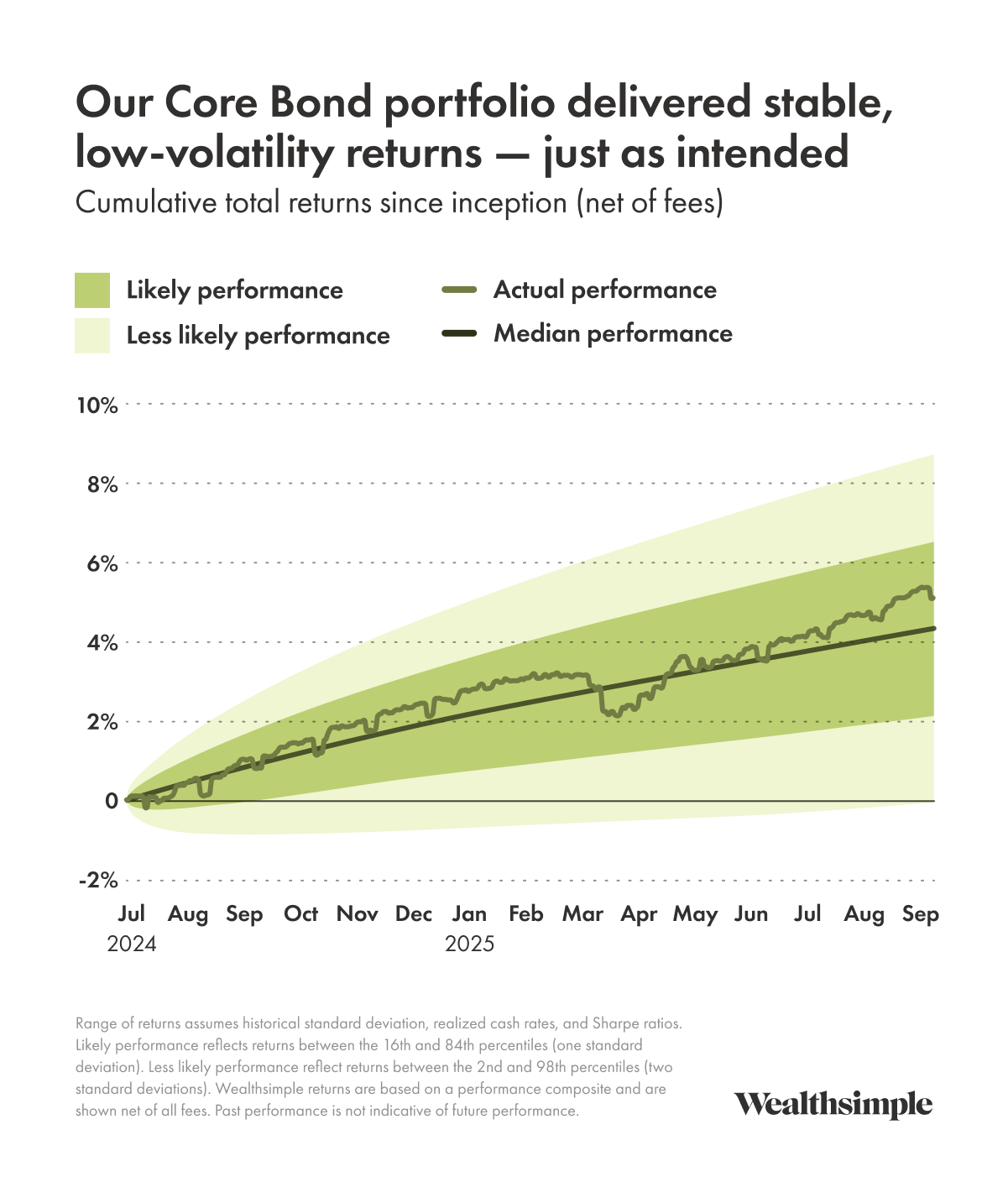

Core bond portfolio

When we launched our Core bond portfolio in July 2024, we designed it for investors who wanted to invest in something that would outperform a high-interest savings account but was lower volatility than our stock portfolios. So far the portfolio is meeting our expectations on both fronts. In Q3, the portfolio returned 1.5%, bringing the total returns since launch to 5.5%. Its yield to maturity, or the expected returns you’d get by holding the portfolio’s mix of securities over any time period, is currently 3.7%, which is roughly 1% above the rates for our Money market portfolio.

Our outlook

Looking ahead to Q4, we expect the central theme will be — fingers crossed — “return to normal,” as markets and the economy transition away from the crisis-driven policies of recent years and into a more traditional economic cycle. We’ll be paying close attention to household spending in Canada, which has remained sturdy but could soften if the economy slows further.

One potential hitch for markets is inflation. Central banks will likely continue cutting rates to support economic growth. But if prices surge again, they’ll almost certainly halt their rate-cutting campaigns, which would be unwelcome news for investors, who have already priced in future rate cuts. We’ll also be watching to see if the U.S. tech giants show any sign of slowing their huge investments in AI. If they do, markets stand to retreat.

Complex situations such as these are precisely why we believe in diversification and patience. None of us can control what happens in markets or the world, but we can take steps, by investing in a broad basket of assets, to ensure we’re on a solid footing no matter what lies ahead.

Thanks so much for investing with us. If you have any questions about this letter, please don’t hesitate to contact us through the feedback buttons below.