How to think about gold in your portfolio

How gold reacts to different market conditions, what it can do for a portfolio, and how to invest in it without a pickaxe

October 22, 2025

Over the last couple of years, everybody’s favourite pinky-ring metal has been on a very long, very lucrative tear. Between November of 2024 and mid-October of 2025, gold was up more than 100%.

Perhaps because of this, we’ve seen a lot of clients adding more gold to their portfolios. Gold can be an important part of a portfolio, of course. But as with any asset, it needs to be understood to be optimized. That’s why we want to take this opportunity to encourage proper caution and provide a bit of education. (To learn even more about how gold works in portfolios, you can check out our recent webinar.)

What is gold like as an investment?

Although many investors view gold as a stable store of value, it’s actually quite volatile and riskier than stocks. Gold tends to do well in the following circumstances (both of which have contributed to its current rise):

- Times of inflation. Since there is a limited amount of gold, when there are suddenly a lot more dollars due to banks printing money or currency being debased, gold sellers demand a higher price.

- Geopolitical uncertainty. When other currencies and financial assets start to feel risky, many investors see gold as a safe haven.

One important thing to remember is that gold offers no natural yield. As a result, it often moves in the opposite direction as assets that do have a yield. This means gold’s value can drop when something called the “real yield” rises, which tends to happen when inflation falls or central banks increase rates.

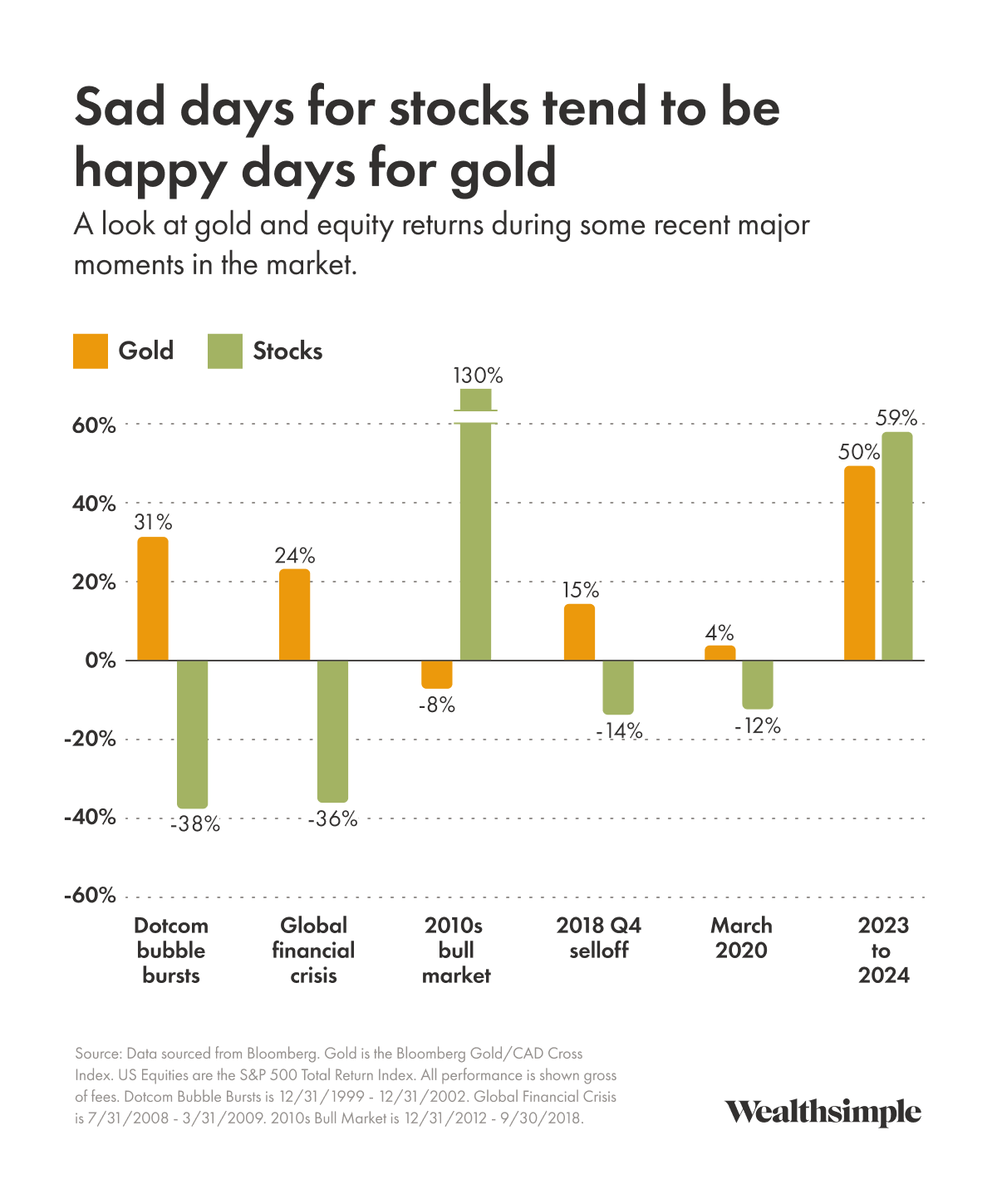

The real yield is the amount you earn on your cash after accounting for inflation. So if the cash yield is 3% and inflation is at 2%, the real yield is 1%. The higher that number is, the less attractive gold becomes. There are exceptions, however. Much of the current run-up, for example, has been during a period of rising real interest rates.The chart below illustrates how gold and equity values have historically diverged during periods of uncertainty. When stocks did poorly, gold tended to perform well — and vice versa. But the past three years have been different. Gold and stocks have surged together, due to a combination of increased geopolitical instability and dollar debasement worries, along with strong corporate earnings.

What is the role of gold in a portfolio?

Gold can help protect against inflation and diversify your portfolio. Given its volatility, however, it doesn’t take much. A small allocation of 2% - 10% is often enough to provide meaningful diversification for many investors. (For context, our classic portfolios have 2% - 4% in gold, which has been beneficial the past couple of years.)

One critique you’ll see from some investors is that, because gold doesn’t pay dividends or earn you rent like many other asset classes, it doesn’t belong in a portfolio. However, its diversifying properties are so helpful (particularly when equities slump), that many investors want to allocate to gold even if you expected it to have no real return at all.

How to actually add gold to a portfolio

If you are interested in investing in gold, there are a few ways to do it that don’t involve a pickaxe:

- Gold ETFs. These funds, which we use in our classic portfolios, are typically backed by physical gold held in trust on behalf of investors. They offer low-cost, easy ways to track the price of gold.

- Gold mining stocks. You can either invest directly in companies that actually extract gold or ETFs that track a basket of miners.

- Gold royalty and streaming companies. Some corporations provide financing to miners in exchange for future revenues or the right to buy a portion of the mine’s gold production (usually at a discounted price).Physical gold. Think bullion bars or gold coins. The benefit is that you own the gold directly, but the trade-off is that you then have to figure out how to store, insure, and sell it. Unless you’re buying gold through Wealthsimple, that is.

Four things to remember when investing in gold

- Understand its role. As a diversifier, gold is meant to behave differently. It could underperform when the rest of your holdings are doing well, but that is by design. Gold is there to have its shining moment when you need it to.

- Don’t chase returns. It’s easy to focus on what’s happened lately and invest based on the assumption that that streak will continue. It’s also easy to end up buying at the top.

- Don’t overcommit. As attractive as some returns might be, putting too many of your eggs in one basket can mean putting your future in a precarious position. With gold, even a small amount can help balance risk and smooth your expected return.

- Don’t forget to rebalance. This can be tough when certain parts of your portfolio have done a lot better or worse than others. But systematically rebalancing your gold position back to its target weight — withdrawing gains after booms and adding to your position after busts — ensures that you take advantage of its volatility.