Why you can't trust market predictions

And how to prepare your portfolio for 2025

January 17, 2025

When it comes to starting off the year, one thing we did not do to was attempt to predict where the market is heading. And clearly we're in the minority there: every financial institution and analyst seems to be weighing in, and their expectations are all over the place. Some say the markets will be up 20% this year, while others say it’ll be down 20%. This is not a new game, of course. Ever since there have been markets (and new years), people have tried to guess where things are headed and how to take advantage of it through their investments.

It’s a losing proposition. One study looked at more than 6,500 market forecasts from 68 experts over a seven-year period and found they were about as accurate as a coin toss. It didn’t matter how much experience the predictors had, or what type of tools or data they used in their predictions. They still had no better than a 50/50 shot of being right.

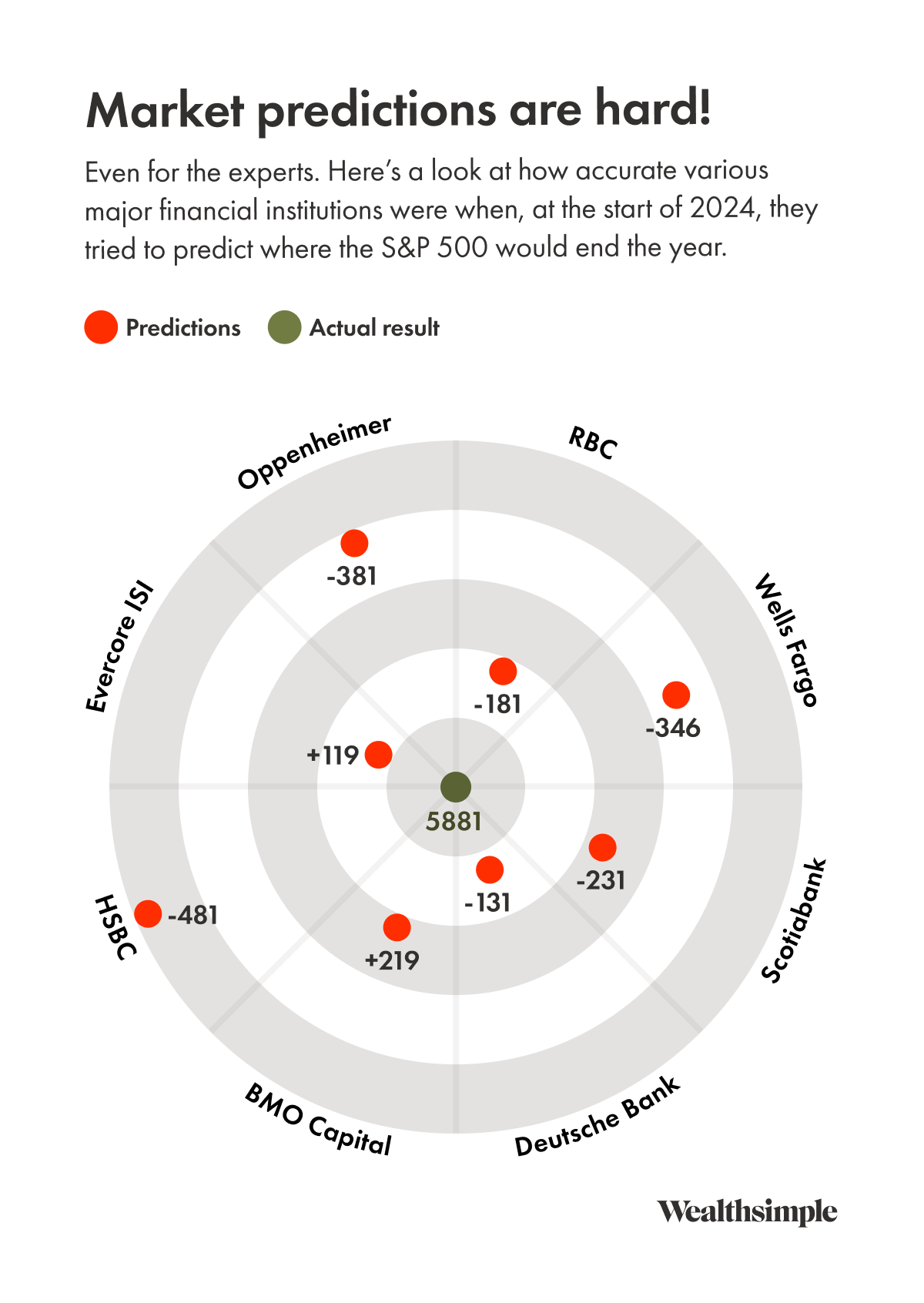

Just for fun, we did our own slightly less scientific study, too. 👇

Predictions aside, 2024 was a remarkable year for the equity markets. The S&P 500 rose 36% and blew through dozens of record highs in one of the U.S.’s best-ever years for stock performance. In Canada, the TSX was up an also-impressive 22%. (Both of those figures are in CAD terms.)

So what’s going to happen in 2025? It’s hard to know — but relatively easy to prepare for. If your portfolio is diversified, you’ll be in the right position for whatever comes. You’ll be set up to take advantage of any gains and to minimize losses if the market drops.

Here are two basic principles to help make sure you’re ready for the year ahead.

1. Temper your expectations

As I mentioned before, the S&P 500 had a great year. It tripled its average annual return from the last century. Global stocks also did well. They were up 28% after inflation, compared to an average annual return of 5.16% between 1900 and 2023.

While you can and should enjoy that, you also shouldn’t get used to it. At some point, the good times have to end. Periods of high returns are often followed by periods of lower returns, a phenomenon known as reversion to the mean.

2. Focus on what you can control

No matter what happens in the markets, it’s up to you to stay focused on your long-term financial plan and hit your savings goals.

During a really good year, we see a lot of investors put more money into whatever asset brought them the biggest returns. But when the market eventually takes a bad turn, those portfolios can take much bigger hits.

We also always see some investors try to time the market and pull their money out when they think the markets are near a peak in order to avoid losses. In theory, this may seem like a good idea, but it often backfires. If the downturn doesn’t happen or isn’t as severe as expected, pulling your money means missing out on gains. Plus, many people struggle to put their money back into the market during a slump. By the time they feel comfortable enough to re-invest, they’ve often missed the biggest gains from the recovery.

Diversification can help manage risk and smooth out returns over time. And consistently saving a significant portion of your income is one of the most reliable paths to long-term financial success; it makes sure you’re invested when it really counts. Instead of trying to predict the unpredictable, you’re better off making consistent, smart decisions aligned with your long-term goals.