We sure do live in interesting times

A look at Q2 performance for our Managed Investing portfolios

July 8, 2025

The expression “may you live in interesting times” sounds a lot nicer than it is, since “interesting” can mean a lot of things. Last quarter, for instance, sure was interesting.

The broad “Liberation Day” tariffs introduced by the U.S. upended markets, with the S&P dropping 10% and the TSX down 9% in the first week. No surprise, expectations of future volatility hit levels not seen since the worst of the COVID drawdown in 2020. But barely a week later, most of those tariffs were paused for 90 days. Even a temporary break made investors happy: the S&P ended up 6% for the quarter, and the TSX rose 9%. Unfortunately, however, an unusual rise in the Canadian dollar (up 5% against the USD) wiped out those S&P 500 returns for most Canadian investors.

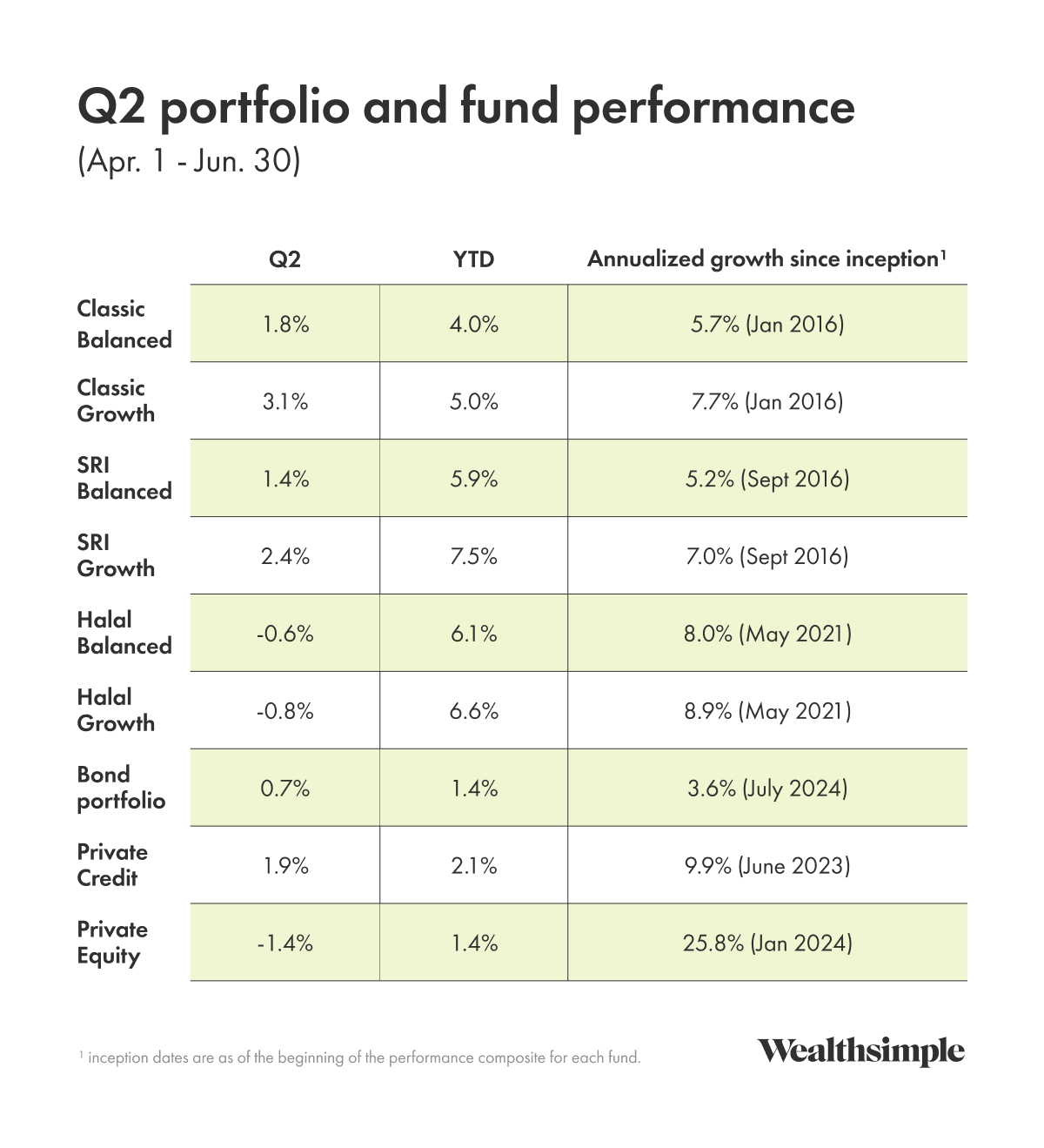

Given that context, here’s a look at how our managed portfolios and funds performed over the past quarter.

Managed portfolios

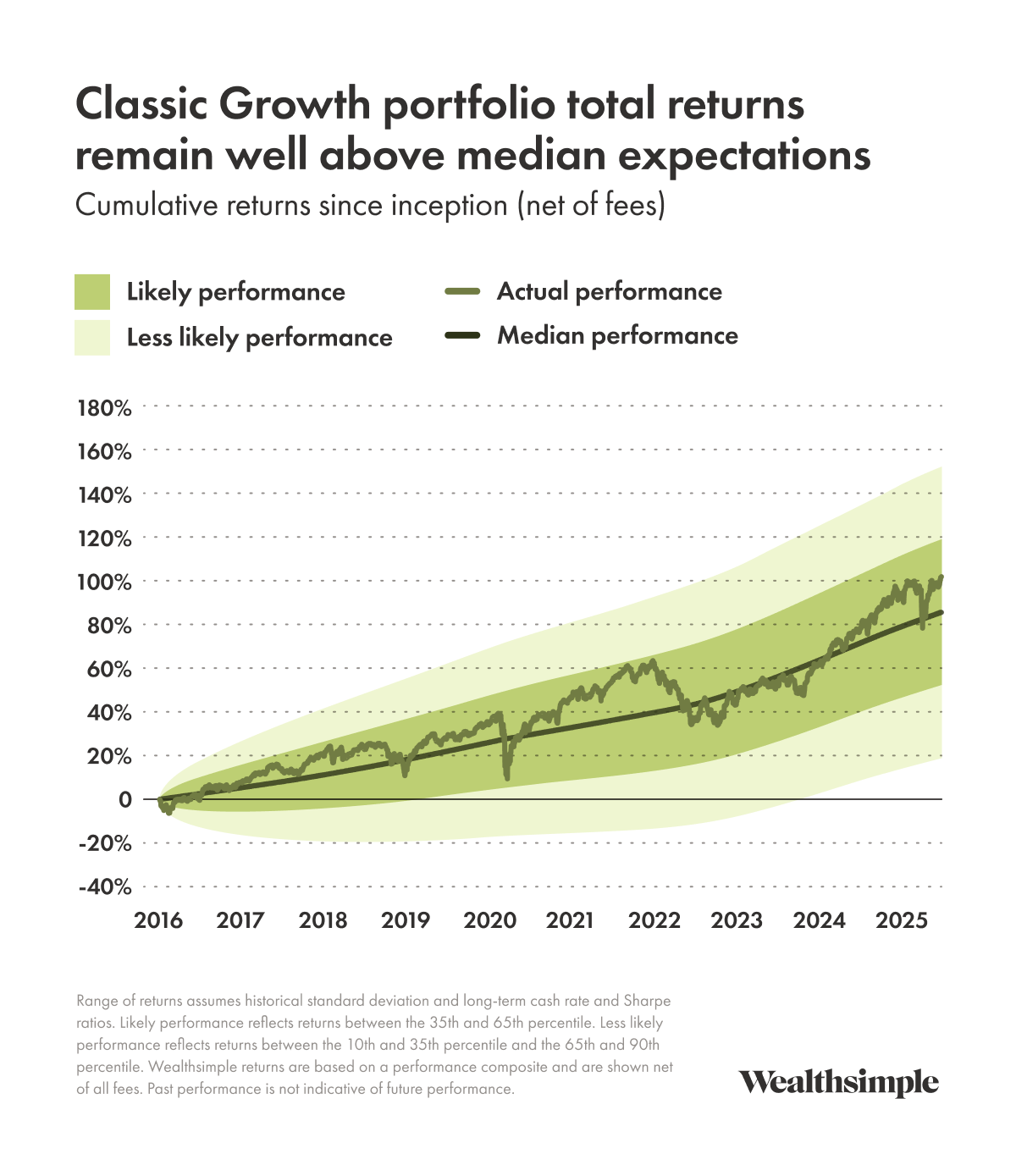

The rise in global equity markets this quarter was partially offset by losses in government and aggregate bonds. Our growth-oriented Classic and SRI Portfolios benefited, thanks to their additional equity exposure, but the opposite was true for Halal portfolios. Halal stocks were slightly down, so having a smaller allocation to them benefitted the balanced portfolio. And the continued boom in gold, which is included in all but our most aggressive portfolios, boosted performance nearly across the board.

This balanced reaction from our portfolios is a good reminder of why we invest the way we do. Our strategy is to offer diversified portfolios of assets that perform well at different times, maximizing our clients’ chances of achieving their investing goals. We do this by adding defensive stocks (utilities, real estate, healthcare companies and other consumer staples that aren’t as affected by economic climate) and other assets that offset the typical equity boom-bust cycle. We believe better returns when markets are weak matters more than good returns when markets are strong because extra income matters more to investors when they have less wealth.

Alternative investments1

Our alternative portfolios are made up of investments you can’t buy on public stock exchanges. They are intended to provide investors a mix of higher returns and additional diversification than more traditional assets like stocks.

Our private credit fund invests in senior-secured floating-rate loans to medium-size companies. That means we’re first in line to get paid back, and the payments we receive go up or down based on the current interest rate.

After returning 10.6% in 2024, the fund rose 0.2% in the first quarter of 2025 and another 1.9% in April and May, bringing year-to-date returns to 2.1%. (June returns are still pending.) This lower performance is due mostly to the fact that, while borrowing companies have continued to make their payments, tension around global growth and international trade has lowered the confidence creditors have in borrowers, decreasing the value of their loans. Since launching in 2023, the portfolio has distributed income at a 9% annualized rate.2,3

Our private equity fund offers a globally diversified portfolio of private companies that are owned and operated by managers who work aggressively to improve their value. These investments can outperform public markets, although they tend to be riskier than a typical stock portfolio.

It returned 2.9% in the first quarter of 2025 and -1.4% in April and May (June returns are still pending), bringing year-to-date returns to 1.4% and total returns since inception in January 2024 to 38.4%, which is at the high end of our expectations. It’s also higher than the 26.2% returns offered by world stocks over the same period.4

Bond portfolio

Our bond portfolio returned 0.7% in the second quarter, bringing the total returns since launch last July to 3.6%. Its yield to maturity, or the expected returns you’d get by holding the portfolio’s mix of securities over any time period, is currently 3.8%.5

This portfolio was designed for investors who want to earn more than they would by keeping their money in a high-interest savings account. It offers lower volatility than our other portfolios, but it can occasionally underperform cash. So far it’s meeting our expectations. The yield to maturity is roughly 1% above the Bank of Canada’s current interest rate.

Our outlook

While markets have erased all of the tariff-related losses and returned to near-all-time highs, we remain cautious as we enter the back half of the year. Between the conflicts in Ukraine and the Middle East, as well as tenuous trade negotiations between the U.S. and China, the geopolitical landscape is as volatile as ever. Stability has never seemed to rest so precariously on the idiosyncrasies of a few world leaders. The good news is that volatility, like any market condition, goes through cycles, and this one will eventually come to an end too.

Diversification (which you already have if you're invested in our managed portfolios), makes you better prepared to handle what’s next, no matter what it is. If you are diversified, our advice remains the same as always: invest for the long term — and do your best to drown out the noise.

Thanks so much for investing with us.

Legal

Have questions? Visit our Help Centre or submit a request to our Client Support team.

1 Returns shown include all applicable fund management fees and performance fees, but exclude Wealthsimple’s standard management fees for its advisory services.

2 Annualized distribution yield based on $0.077/share, divided by NAV of $10.129 (as of May 2025), and multiplied by 12. To calculate this rate, we take a partial year distribution and convert it to a full-year amount as if it were paid in each period. We then divide this annualized amount by the fund’s value at the start of the period. Distributions are not guaranteed. Past performance does not guarantee future results.

3 Between the fund’s inception in June 2023 and the end of September 2023, the management and performance fees were waived to facilitate certain portfolio investments. In the absence of these temporary waivers, performance figures would be lower.

4 Based on MSCI All Country World Index from December 31, 2023 to May 31, 2025. The past performance of private equity or any other security or investment strategy is not an indicator of future performance, and past performance may not be repeated. This is for informational purposes and does not constitute investment advice. All investments involve risk.

5 Yield to Maturity (YTM) for the Bond ETF portfolio is calculated based on a weighted average yield to maturity of all holdings in the portfolio at the time of the calculation. YTM excludes Wealthsimple's standard management fees for its advisory services, but includes the management expense ratio (MER) fees charged by the underlying ETF manager. The yield information is updated on a monthly basis, current as of June 2025. YTM is subject to change due to fluctuations in market rates, ETF prices, reinvestment of matured securities into additional investment, portfolio composition, and fees charged by the underlying ETF holdings. Past performance is not indicative of future results.

Private credit involves risks including, but not limited to, credit risk, liquidity risk, leverage risk and value fluctuation. See here for more information.

Past performance does not guarantee future results. Private equity involves risks including, but not limited to, risks related to economic and market conditions, interest rates, the availability and performance of investment opportunities, regulatory and tax law changes, and business and company news and developments. See here for more information.

Managed accounts are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest account are held in an account with Wealthsimple’s affiliated custodial broker, Wealthsimple Investments Inc. (WSII). WSII is a member of the Canadian Investment Regulatory Organization (CIRO). Customer accounts held at WSII are protected by Canadian Investor Protection Fund (CIPF) within specified limits in the event WSII becomes insolvent. A brochure describing the nature and limits of coverage is available upon request or at CIPF. Wealthsimple Inc. is not a member of CIRO nor a member of CIPF.

The returns are calculated using the asset-weighted average of time-weighted returns of clients invested within each portfolio, less management fee, MER (management expense ratio) fees, and FX fees. Return shown does not take into taxes payable by clients that would have reduced returns. Past performance is not indicative of future results and future performance may materially differ from expectations.

The content of this message is confidential. If you have received it by mistake, please inform us by email reply and then delete the message. Do not copy, forward, or in any way reveal the contents of this message to anyone.

Managed accounts are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada.

© 2025 Wealthsimple Technologies Inc.