The smartest ways to use RESPs

What people don’t know about RESPs

August 16, 2024

As we approach back-to-school season, many families are focused on things like new clothes and finding the perfect rainbow-coloured unicorn lunch box. But there’s another important part of preparing for school that can be easy to forget: saving. It comes up a lot in our calls this time of year, which is why this month I want to focus on the importance of Registered Education Savings Plans.

These accounts help you save for children’s post-secondary education by letting you defer taxes and take advantage of government grants. For parents, the benefits are clear. But many of the clients I speak to are surprised to learn that they can also use RESPs to fund their own education later in life or to support a grandchild, niece, nephew, or a family friend. Here’s how they work.

Benefits of RESPs

Tax-deferred growth: RESP investments compound over time without the impact of taxes. When money is taken out for post-secondary education, returns are taxed at the student’s tax rate, not the contributor’s — which can often mean no taxes at all.

Free money: Both the federal government, and many provinces, have grants available only to RESP holders. One of the most popular is the Canada Education Savings Grant, a federal program that matches 20% of the first $2,500 contributed to a beneficiary’s account each year, with a lifetime maximum of $7,200.

How RESPs compare to other accounts

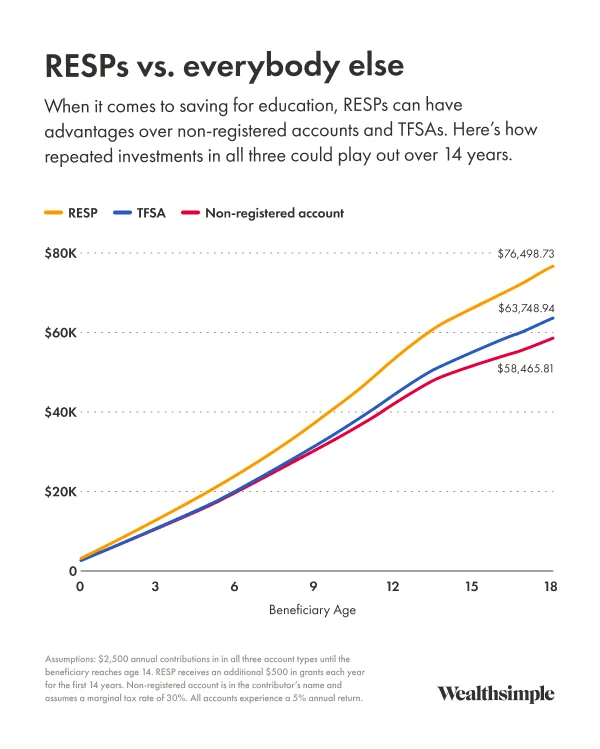

From the contributor’s POV, an RESP has a clear advantage over non-registered accounts, and can often be a better choice than a Tax-free Savings Account because of those grants. (If you don’t qualify for grants, however, RESPs become very similar to TFSAs — and TFSAs have the benefit of increased flexibility.) Here’s how all three would play out over 14 years of investing.

There’s one big caveat to RESPs that I mention to every client I work with: if you withdraw from your account for any purpose other than funding post-secondary education, you would have to pay back the government grants (and donate or pay tax and a penalty on any earnings they accumulated). If that happens, all of the estimates above go out the window. That’s why, for people with limited savings who can’t afford to have their money locked into an RESP, there are usually better accounts to consider.

Smart strategies for building an RESP

You can open an RESP as soon as a kid is born (or in the case of adoptive children, the moment the paperwork is signed). And to fully leverage the account’s benefits, you should. That’s because, in order to qualify for most grants, contributions have to be made before the beneficiary turns 17. Starting early also maximizes the time in the market for any contributions.

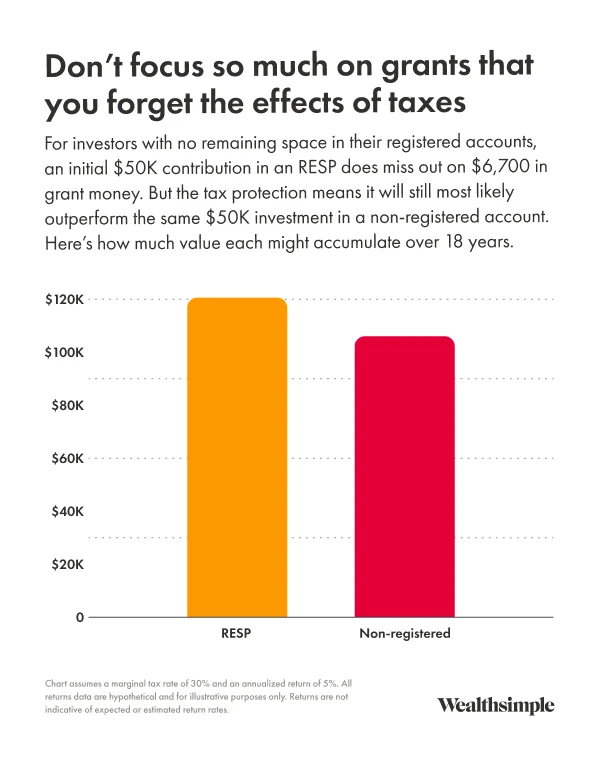

For clients who have already maxed out their registered accounts (and are financially able), a modified front-loading strategy can often be beneficial. That just means putting in a bigger chunk of money — but not all of it — when you first open the account. Think of it this way: a child can receive contributions of up to $50,000 over the lifetime of their RESP. Since the CESG match is limited to $500 per year (out of a possible $7,200), contributing all $50K at once means missing out on $6,700 of grant money. Now, that’s not always the worst outcome (see the chart below). But if you space out $36,000 of contributions ($2,500 every year for 14 years, and $1,000 in the 15th year), that leaves you with $14,000 in contribution room to take advantage of as early as possible — and that money is likely to grow faster in a tax-advantaged account than it would in a non-registered account.

Smart strategies for withdrawing from an RESP

RESP funds are split into two categories. Educational Assistance Payments (EAPs) include interest, dividends, capital gains, and government grants accumulated in the account. These funds are taxable when they’re withdrawn, but since students don’t usually make much money, they also rarely pay much, if any, tax. Post-Secondary Education (PSE) withdrawals come from the original contributions made to the account. They’re not taxable, since they were made with after-tax dollars.

The most EAP you can withdraw in the first 13 weeks of a full-time post-secondary school program is $8,000. After that there is no limit. It can often make sense to take EAP withdrawals first to lower the risk of leaving CESG grants on the table. But think things through first: if the student has a scholarship, part-time job, or some other form of income, EAP withdrawals can push them over the basic personal amount and into a higher tax bracket. In that case, spreading EAP withdrawals over multiple academic years can help reduce overall taxes.

How to handle unused RESP funds

You have 36 years between when you open an RESP and when you have to use the funds. But if you don’t end up needing that money, here are three things you can do:

- Transfer it to someone else. Family RESPs make this especially easy, since contributions and grants can be shared freely among siblings (just remember that CESG withdrawals are still capped at $7,200 per person). You can also transfer an Individual RESP to a beneficiary who isn’t related, but pay extra attention to their contribution limits. If they already have an account with $30K in contributions, transferring more than $20K will lead to penalties.

- Transfer it to your Registered Retirement Savings Plan. If you have contribution room in your RRSP, you can transfer over up to $50,000 of your RESP, tax-free. But that’s earnings only. You’ll still have to return any remaining grant money. This option is only available if the RESP is at least 10 years old and all beneficiaries are at least 21 and not currently pursuing post-secondary education.

- Close the account. Remaining grant money will have to be returned, but you can withdraw any of the original contributions without taxes. Earnings can also be withdrawn, but you’ll be taxed (at your marginal tax rate, plus a 20% penalty — unless you’re in Quebec, where that penalty is 12%). Or you can gift that money to a Canadian educational institution, potentially providing you with a tax benefit.

How to use an RESP for estate planning

Although contributions to an RESP are not tax-deductible, once you make them, those funds are removed from your estate, which could help reduce the taxes your estate will have to pay. Note: naming a successor subscriber (the person who will contribute to the RESP in your absence) is crucial to ensure that the RESP is still managed according to your wishes, including continuing to make contributions from your estate.

That was a long one this month. Thanks for sticking with me. And as always, if you have any questions, please reach out.