The easiest way to reduce your taxes

End-of-year tax tips

November 15, 2023

One of the most common questions we get from clients this time of year is around taxes. Specifically, legal ways to pay less of them.

Here are the two strategies we recommend the most.

Strategy #1: Shelter your income

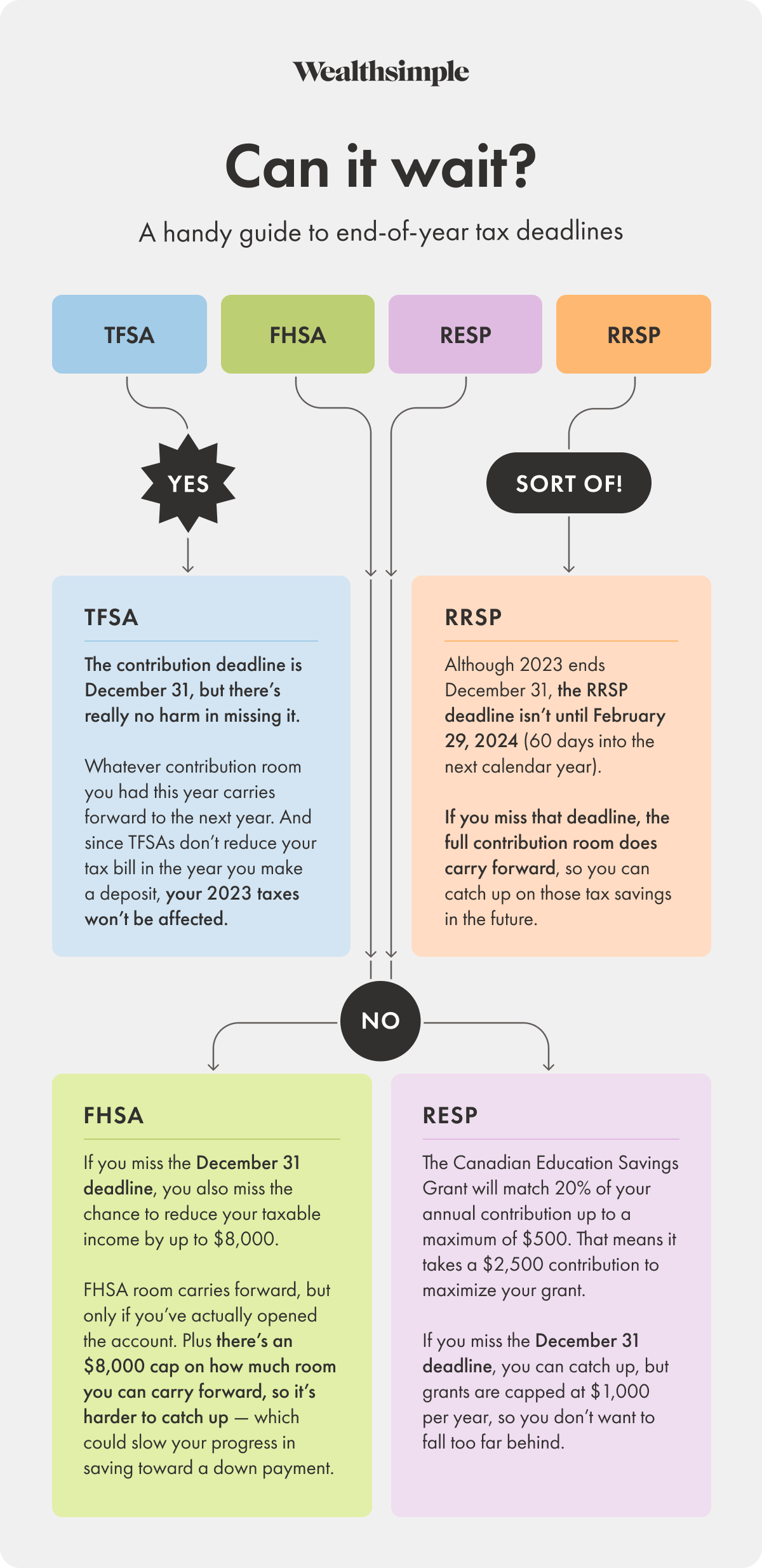

One of the best ways to minimize taxes is to make as much of your income as possible un-taxable — or at least taxed to a lesser extent. Not by hiding it in an offshore account, but by taking advantage of RRSPs, FHSAs, and other registered accounts. The challenge with doing this is balancing all of the different contribution deadlines — and knowing which to prioritize. Fortunately, we made a chart.

Strategy #2: Tax loss harvesting

Saving on taxes gets a little more complicated once you’ve maxed out your tax-sheltered accounts. That’s when you might want to consider a strategy called tax loss harvesting — especially if your annual income exceeds $100,000. (If you’re a Premium or Generation client in a managed portfolio, we use algorithms to do this for you automatically. You just need to turn on the feature on your account.)

Tax-loss harvesting involves selling a losing security and immediately purchasing a similar (but not the same!) one. It lets you use the loss on the sale of the first security to reduce your capital gains for the year, while still participating in gains if the market for the old investment goes back up.

Here’s an example: Say you invested $5,000 in an energy ETF last year, and today it's worth $4,000. You think energy stocks are going to go up, but until they do, you’d like to take advantage of the paper loss and save a little on your taxes. So you sell your ETF, immediately buy a similar ETF with that money, and claim the $1,000 loss against other capital gains for the year. If your marginal tax rate is 34%, you’ve saved $170 in taxes. And you still have basically the same position in the market.

The most complicated part of tax loss harvesting might just be filing your taxes. Fortunately a lot of tax software (including Wealthsimple Tax) makes that part easy.