The 6 most common investing mistakes

How to avoid big investing traps

November 18, 2024

Navigating the world of investing isn’t just about crunching numbers (and calling your advisor when you don’t feel like crunching numbers on your own). It’s a real psychological journey, filled with mental traps that can negatively affect your financial health.

After years of helping clients resist and recover from misguided financial impulses, I’ve noticed that it’s often the same few things tripping people up. In order to help you not be one of them, this month I’ll cover the most common behavioural mistakes investors make.

- Recency bias

Recency bias means overreacting to recent trends and assuming that what’s currently happening is going to keep happening. Over the past decade, for instance, the U.S. stock market has been — well, the technical term is “on fire”: total returns were 193% for the S&P 500 (11.3% per year) and 382% for Nasdaq (17% per year). Will this continue? Maybe! But probably not forever. Global markets are cyclical, and history shows that no single market stays dominant forever.

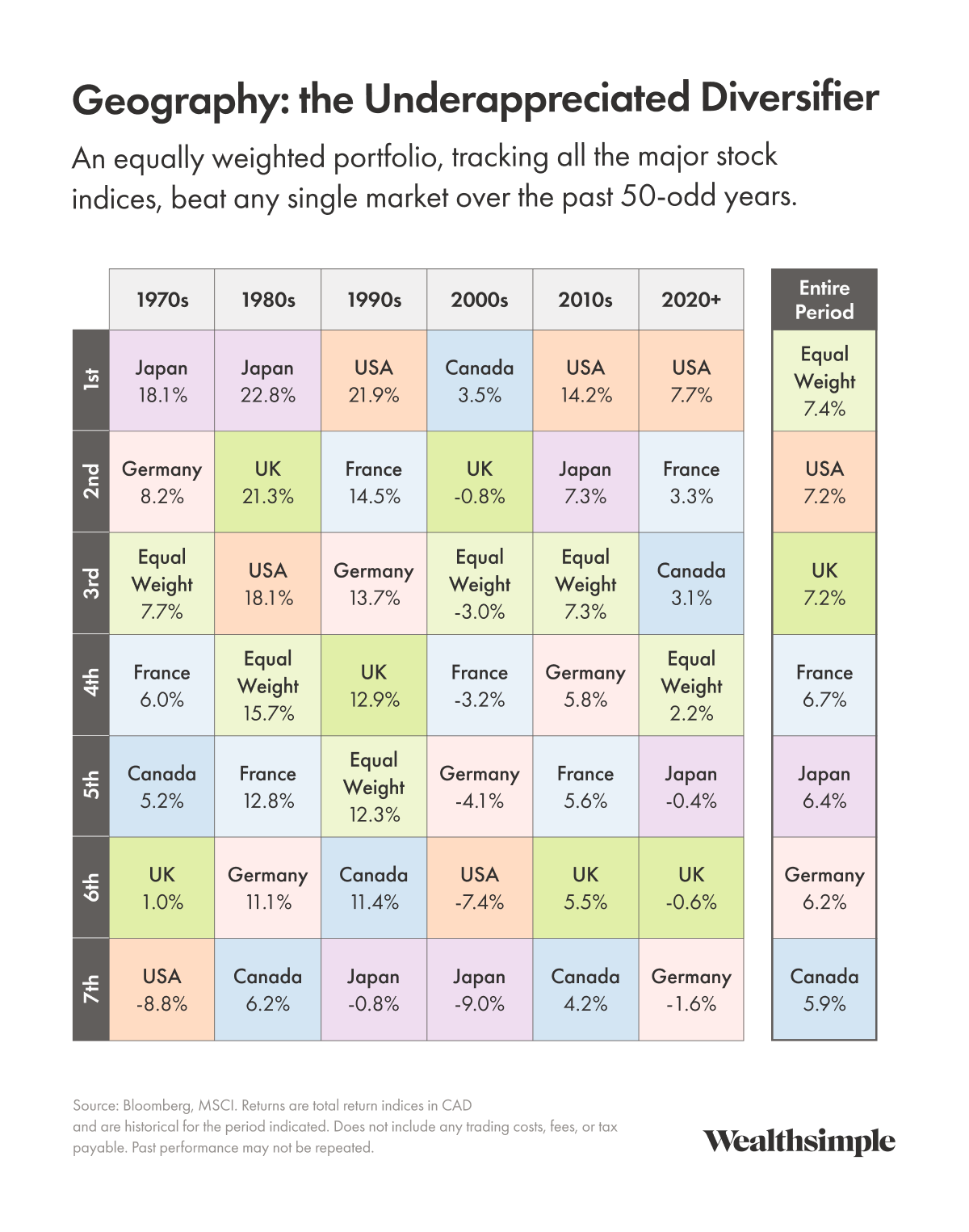

Here’s an example: in the 1980s, the Japanese market was dominant, gaining 1,193% (almost 30% per year). But then it was flat for more than two decades. In the last 34 years, it’s up only 163%, or 3% per year. Or look at the 2000s, when emerging markets returned 80% while world stocks were down 30%. With a globally diversified portfolio, you would have benefited from the upswings of both — and not suffered as much when their fortunes turned.

By focusing solely on U.S. stocks, you might not only be exposing yourself to major losses in the event of a downturn but also missing out on potential growth in international markets that could lead the next market cycle. (Our CIO, Ben Reeves, went into this in more detail in a previous newsletter.)

2. Overconfidence

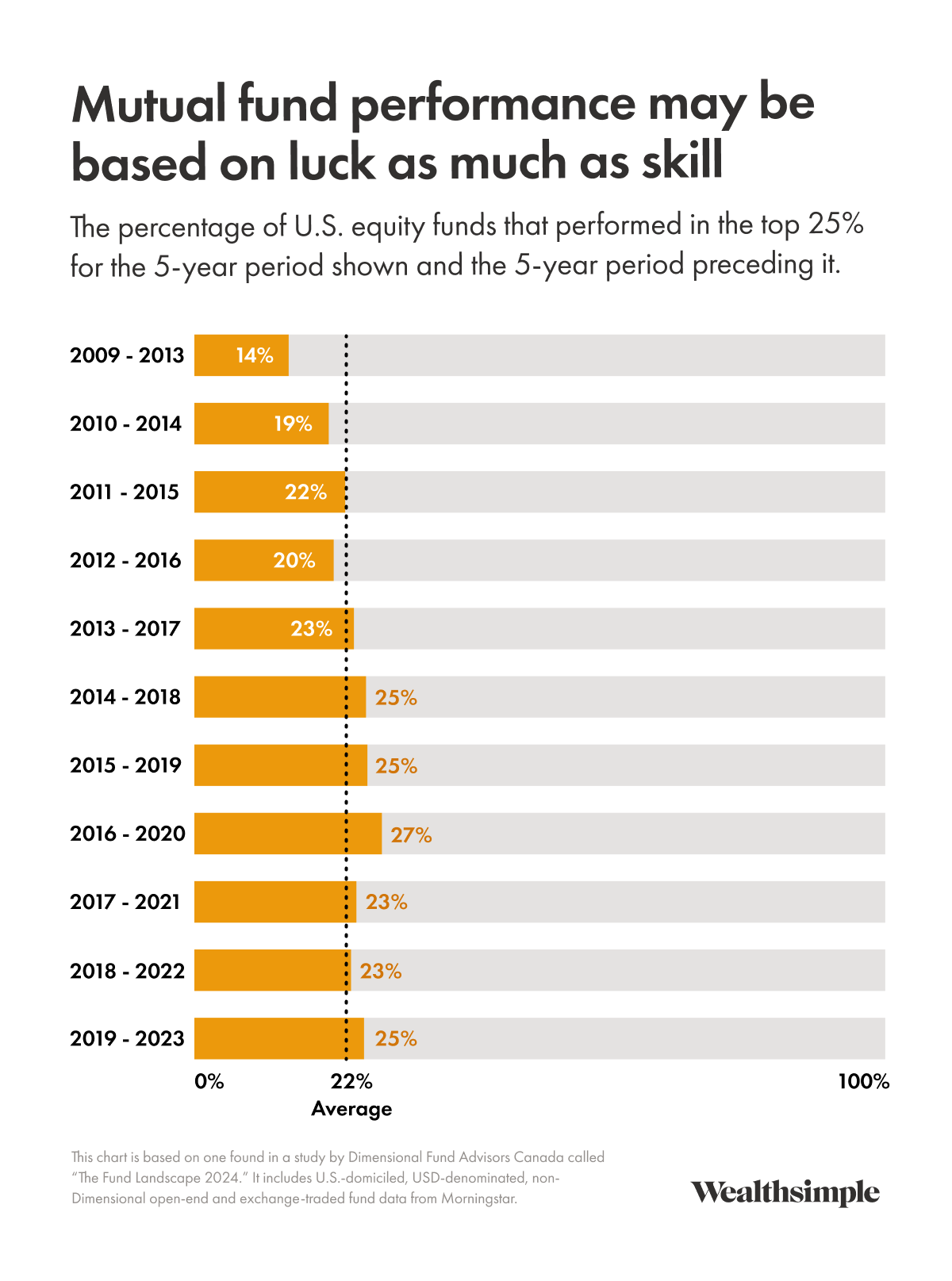

I’ve worked with a lot of clients who think they have unique insight into market movements. The problem is, markets effectively incorporate the expectations of millions of investors around the world, so that unique insight is usually not all that unique — and probably already priced in. That’s why beating the market is so hard. Even professional fund managers can’t often do it. And the more you trade, the more you can lose. For proof, just look at the day-trading booms of the late 1990s and early 2020s. One study found that individual investors who traded frequently and racked up high transaction costs underperformed compared to those who traded less.

3. Mistaking luck for skill

Called attribution bias, this is like crediting yourself for sunshine on your vacation (you picked the right week to come, after all) and blaming bad luck for any rain. We see it in investing all the time. When a high-fee mutual fund outperforms in a given year, for example, investors might see it as proof of the manager’s expertise, but in reality it’s likely the result of pure luck. During the 2008 financial crisis, some funds that had consistently beat the market for years collapsed, undermining the assumption that their past performance came from skill. You can make the same error about yourself too. Just because one hunch paid off doesn’t mean the next one will.

4. Following the crowd

Sometimes, when clients ask if they should invest in certain popular assets, it’s driven more by FOMO than proper analysis. They see others making money on something, and they want to make money on it too, whether the investment is sound or not. This kind of bandwagon investing can inflate asset bubbles, as we’ve seen during past market manias, and lead to significant losses when the bubble bursts. Take the recent cannabis stock craze, for instance. When Canada legalized recreational cannabis in 2018, investors flocked to buy the relevant stocks. They were drawn in by hype, not solid fundamentals, and many people lost money when the market corrected.

5. Anchoring and loss aversion

Anchoring involves fixating on a specific piece of information, such as an initial purchase price, and letting it unduly influence future investment decisions. Investors may be reluctant to sell a declining portfolio that’s trading at a loss, for instance, even when doing so would be in their interest.

Here's an example: in 2021, some investors with short-term objectives (such as purchasing a home) had taken on excessive risk to capitalize on the strong gains in the stock market. So when the market experienced a downturn in 2022, they became fixated on getting their portfolio values back to where they were before the decline, keeping their money in stocks instead of shifting it into the more secure assets we would have suggested for them in the first place, like high-interest savings accounts. This behavior ultimately made it harder, not easier, for them to achieve their short-term goals.

6. Home bias

Home bias leads investors to favour investments in domestic markets that they’re familiar with, concentrating their portfolios in local stocks only to miss out on growth opportunities abroad. It leads to underdiversification — and heightened exposure to local economic downturns. For example, Canadian investors gravitating toward dividend-paying domestic banks and utilities might inadvertently miss higher growth potential in international markets and overexpose their portfolio to risks specific to those industries.

So how do you avoid these mistakes?

Simply being aware of them is a great first step. After that, it’s a matter of coming up with an investment plan in advance and adopting strategies that align with your long-term financial goals, like:

- Diversification. It’s an investing cliche for a reason: it works. If all your eggs aren’t in the same basket, you’re a lot less affected by one of those baskets tipping every once in a while.

- Dollar-cost averaging. Investing regular amounts at set intervals removes emotion from the equation — and reduces the temptation to try to time things perfectly. It can help manage market anxieties and ensure that you are continually participating in the market’s growth.

- Tuning out the noise. It can be tempting to change your plan based on what you see happening in the market or in your friends’ portfolios. But if you’re confident in your approach, it’s often best to stick with it in both good times and bad.