TFSA vs. RRSP vs. FHSA - What's the best choice?

How to Make Sure Your Money’s in the Right Place

September 13, 2023

We get calls about all sorts of things, including the wisdom of putting all of your retirement savings in crypto or buying a motorcycle — even a really cool one — before paying off your credit card debt. But there’s one question that comes up more than any other: what registered account should I be saving in?

Picking the right one for you was challenging enough when you only had to choose between TFSAs and RRSPs. But with this year’s introduction of FHSAs, the decision for those who don’t own a home got a little tougher.

All three accounts have huge tax advantages, along with their own rules and contribution caps, which you can see here. But in case you don’t feel like reading all of that, we made a chart! It’s simple: just answer a few basic questions to get a sense of which choice might be right for you. And if you get to the end and would rather talk things out, we’re always here to help.

Is it better to pay down your mortgage or invest?

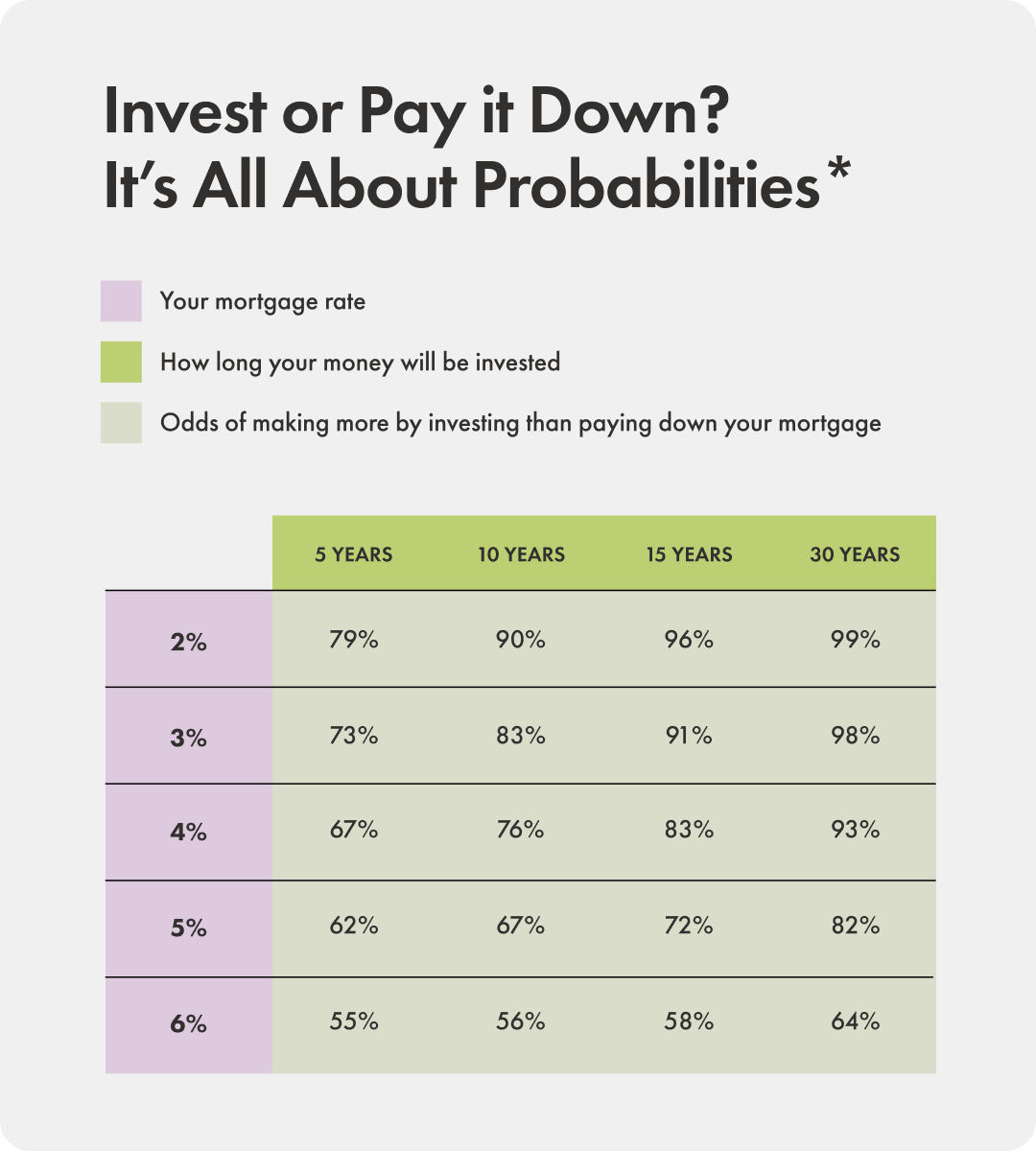

With mortgage rates much higher than they’ve been in a long time, a lot of clients have been asking if it makes more sense to pay down their principal and save themselves the cost of interest in the long run. That can be smart. Mortgages have a guaranteed negative return, after all. If you’re paying 5% in interest, you know you’re losing 5% on your money. But you also have to consider how much you might be able to make by investing that money somewhere else.

What’s right for you depends on a bunch of things — your financial goals, risk tolerance, cash flow, and propensity to save — but in the simplest terms, it mostly comes down to your particular mortgage rate and how much time you think you can keep your money invested. Here’s another chart to help you think that through. And again, we’re here if you need us.