Why you shouldn’t compare your returns to the S&P 500

Plus: Japan • copper • future expectations

July 30, 2025

— Originally published as Investor Insights newsletter July 2025

Winner: Copper investors

Prices have reached all-time highs following reports that Washington will impose 50% tariffs on imports. Futures surged 13% after the announcement, the largest ever one-day move.

Drawer: Nikkei 225 investors

Prior to a recent boost following last week's U.S. trade deal announcement, one of Japan’s top stock indexes was roughly flat on the year, thanks to a really rocky April.

Loser: Public buyers of private shares

The niche market allowing the public to buy shares in private companies like SpaceX and Anthropic stumbled when a big provider, Linqto, filed for bankruptcy after revealing investors may not have actually owned the shares they bought.

Investing 201: Why you shouldn’t compare your returns to the S&P 500

Anytime the S&P 500 delivers strong results, as it has over the past few years, we get questions from clients — and even from some of our colleagues — about why their portfolio performance lags behind. While that’s a perfectly reasonable question to have, what I’d like to address this month is how it’s not the right question to ask.

The S&P 500 is an all-equity index in a single country that, thanks to the dominance of a small group of big companies (Nvidia, Amazon, Apple, Meta, Microsoft, and Tesla), carries a lot of concentration risk. While it has performed well lately, it lacks geographic and asset-class diversification. And that makes it an incomplete option for long-term investors.

Comparing your investments to the S&P 500 is kinda like watching a Formula 1 race and then being disappointed that your own garage door opens up to a hybrid SUV. It’s just not practical for most people. As cool as F1 cars look and as fast as they go, they can get wrecked by a single pothole, and they’re really hard to park at the grocery store. That trustworthy SUV, on the other hand, can handle all kinds of bumps in the road — and still go fast when conditions are right. Just like a diversified portfolio.

For investors who don’t want to go all-in on risk — and we can safely call them most investors — the question is not, “Why am I underperforming the S&P 500?” It’s, “What should I be comparing my performance to in order to know I’m doing well?” That’s where the idea of a benchmark comes in.

What is a benchmark?

A benchmark is just context — something to judge something else against. The more detailed it is, the more helpful. For example, if you’re buying a house in Edmonton, it’s good to know the average price of a home there. It’s even better to know the average price of a 3-bedroom, 2-bath home that has its own driveway(!) and is in the school district you want. It’s the same with your portfolio.

How to create a benchmark

This part can get a little complicated. (That’s why, for managed clients, we’re building a feature that will do it for you, right in our app.) Just like with the housing example, you want a benchmark that is as specific to your portfolio as you can get.

To compare your past performance to actual, realized returns, you’ll need to find publicly available market indexes that represent the different assets held in your portfolio. For example, you can measure your Canadian stock performance against the S&P/TSX 60, and your Canadian bond performance against the S&P Canada Aggregate Bond Index. Individualization is what makes things really hard, since it means you may also need to find representative indexes to account for your investments’ geographic focus (e.g., domestic vs. international), market capitalization (e.g., large-cap, small-cap), and investment style (e.g., growth, value).

Here’s a super-simplified example. Say you’re in a balanced portfolio of 60% Canadian stocks and 40% Canadian bonds. A basic benchmark could be 60% of the S&P/TSX 60, which has returned about 7.8% through the first half of the year, and 40% of the S&P Canada Aggregate Bond Index, which has returned roughly 1.4% through the first half of the year.

Using a weighted average of the two returns (60% of 7.8% stock returns plus 40% of 1.4% bond returns) gives you a benchmark of 5.3% for the first half of 2025.

One thing to note: it’s important to compare your returns to your benchmark over an appropriate timeline. Any strategy can over- or underperform another over a six-month period, but zooming out gives you more fruitful comparisons. Ok, two things to note: it’s just as important to make sure you’re comparing performance over the same period. Mismatched timelines can skew your conclusions and lead you to bad decisions.

How to set your expectations going forward

As important as it is to look back on your investment performance with clarity, don’t forget to do the same with your future expectations. Yes, the S&P 500 has been a standout performer for what feels like a long stretch of time, but looking forward, there are real questions if that pace can continue. (Even the sun can’t burn forever!) It’s a great reminder not to blow up your portfolio and go chasing past returns — no matter how good they’ve been.

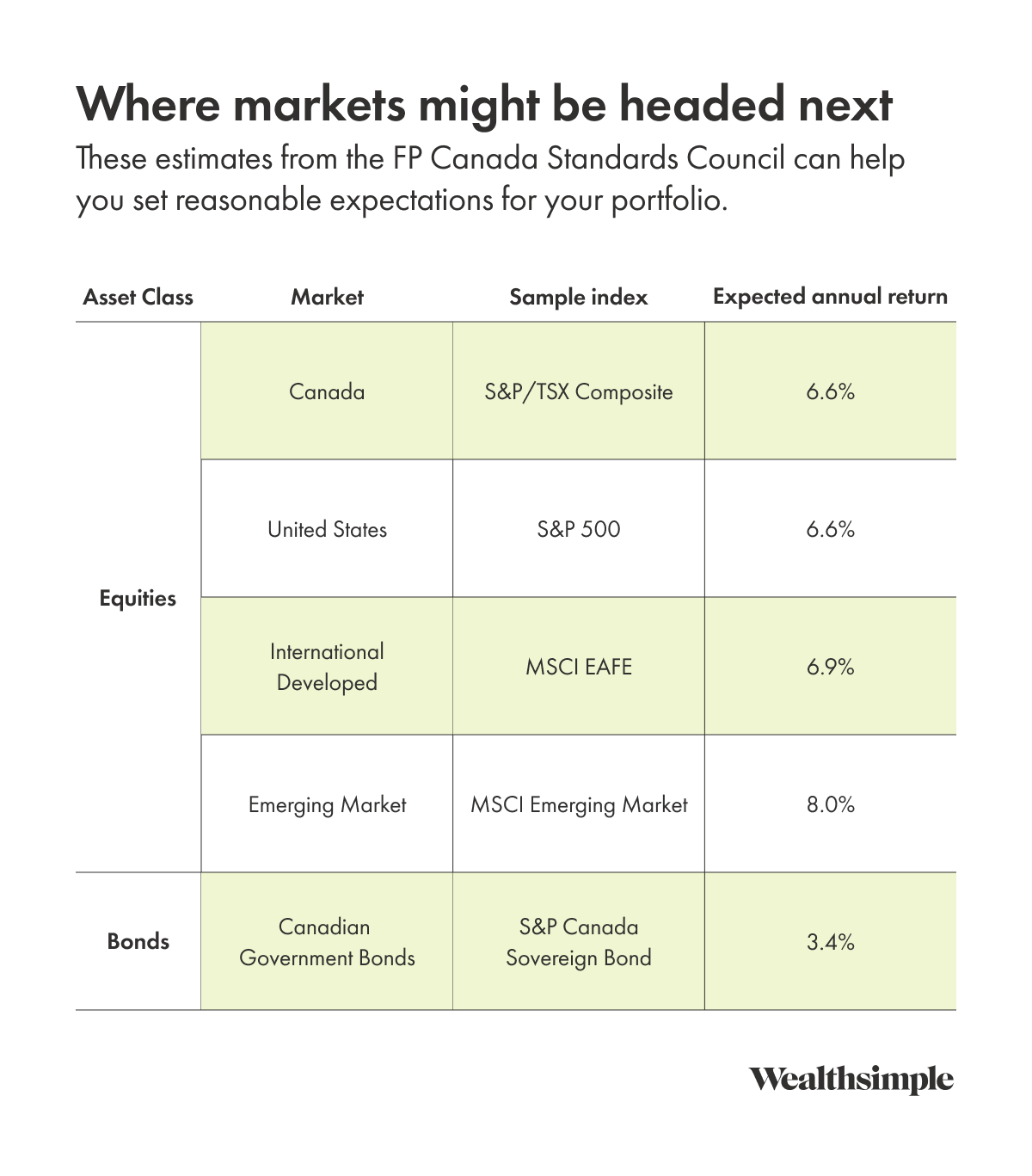

To help you get a fair sense of what investing success may look like in the next 10+ years, we put together this helpful chart using assumptions from the FP Canada Standards Council.

Just like you can create a benchmark for your past performance, you can use these numbers and the same weighted averaging to plan for what may come next.

connect to an advisor