Important questions about the new Wealthsimple Bond Portfolio

And important answers to them

January 27, 2025

Why did we make this bond portfolio?

This portfolio is designed for investors who want to earn more than they would by keeping their money in cash, while keeping potential losses below those typically seen in a conservative multi-asset portfolio. It may be appealing to:

- Investors with a short-term spending goal, who are willing to take on some risk with that money.

- Investors who, for peace of mind, want part of their asset allocation in low-risk assets where they can still get a return while they allocate to riskier assets elsewhere.

How does the bond portfolio work?

Bond investors receive returns from two sources of risk:

Duration risk is the opportunity cost of lending your money for a fixed period of time.

Credit risk is the risk of not getting paid back the full amount you invested.

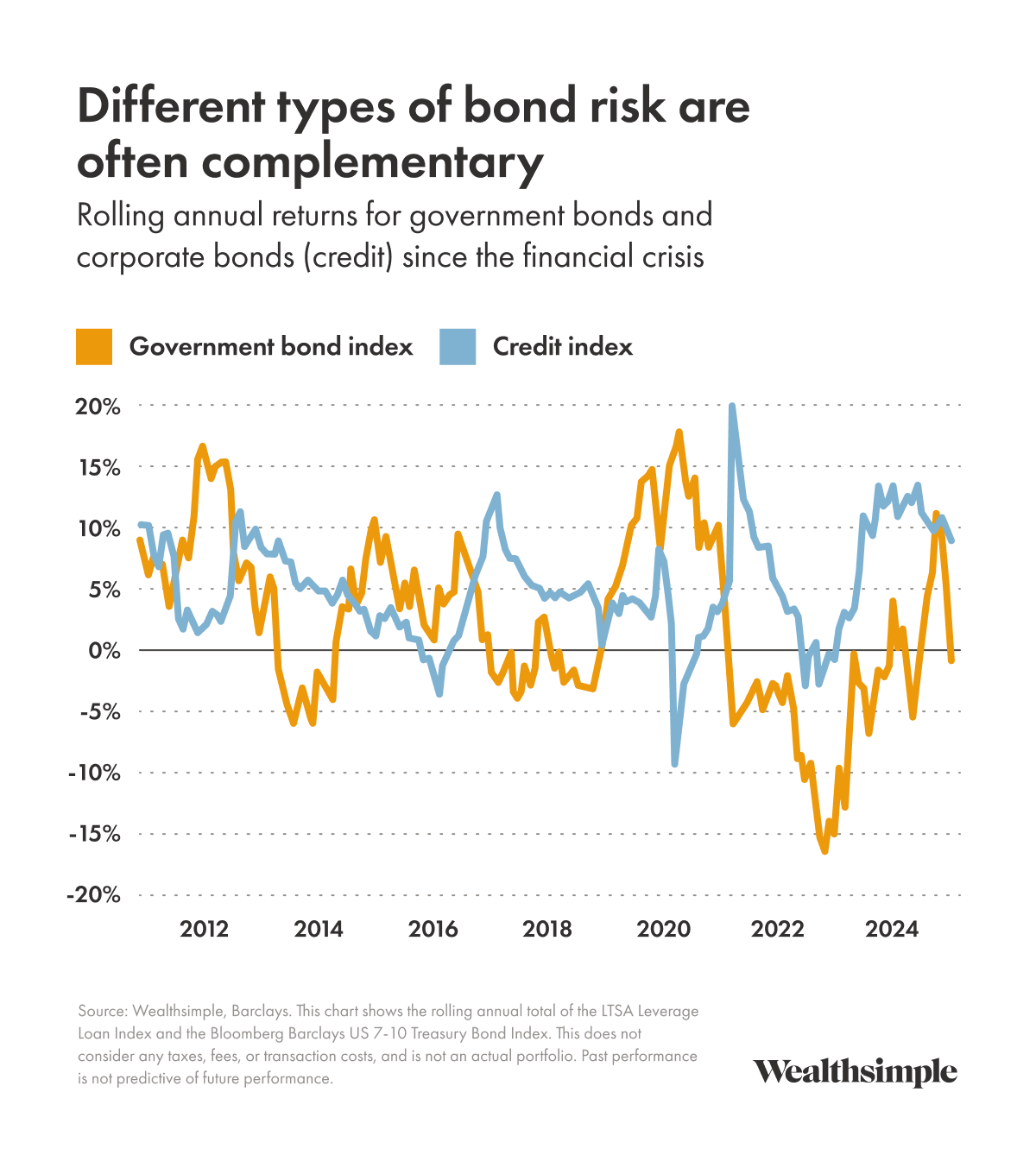

In most cases, in order to outperform cash returns, investors want to be exposed to both types, since they diversify each other. That’s because duration is tied to the value of government bonds. When economic growth declines, duration goes up. Credit, on the other hand, performs well when the economy is doing well because companies’ ability to repay increases. The chart below shows the often-complementary returns of a credit index and a treasury index since the financial crisis.

In constructing the bond portfolio, we target explicit levels of both types of risk. We use a model to set risk parameters, then evaluate a wide range of potential investments — including government bonds, short term investment grade corporate credit, floating-rate corporate credit, and collateralized loan obligations — against them. Our model includes stress scenarios, like the 2008 financial crisis and the post-Covid spike in interest rates. We’ve also evaluated the performance of similar portfolios as far back as the surprise interest rate increases of the 1980s.

We combine those risk parameters with simple indicators, like the slope of the yield curve or amount of credit spread at different risk levels, and construct a portfolio, which we then implement with ETFs.

As market conditions change, we trade in and out of exposures. For instance, when we launched the fund in July 2024, we allocated to floating-rate credit default swaps, which subsequently increased significantly in value (and diminished future expected returns). After expected returns declined and the shape of the yield curve flattened due to the Bank of Canada’s interest rate cuts, the different investments became more attractive. In response, we traded out of those swaps and into more investment grade corporate credit with a year or two of duration.

How is Wealthsimple’s bond portfolio different from a bond index?

Bond indices track groups of bonds. That’s it. They aren’t optimized for diversification or risk management in the short term. And they certainly don’t provide a calibrated balance between credit and duration. An index just takes the issuance of bonds as they come. So if the government issues a lot of bonds, you buy those. If risky corporations issue a lot of credit, you buy those. It’s not optimized for diversification or managing downside risk, which could leave you with unwanted losses in times of market stress — and with less return for the amount of risk you are taking.

Simply dividing risk equally between duration and credit can improve outcomes relative to a bond aggregate. The chart below shows an historic example of this. It compares the returns since 1997 of the U.S. bond aggregate with a 50/50 portfolio of credit and treasuries. The return-to-risk ratio of the 50/50 portfolio was much higher than the aggregate, the volatility was lower, and the returns were higher. Each component of the 50/50 portfolio had a lot more volatility than the aggregate — 5.9% for credit and 6.5% for treasuries — but the combination was actually lower. (It’s important to note that our portfolio is currently managed to a lower risk level, but the lesson about the power of diversification remains just as true.)

| Bond Aggregate | 50/50 Treasury and Credit Portfolio |

|---|---|---|

Return above cash | 1.9% | 2.7% |

Volatility | 4.1% | 3.8% |

Return-to-risk ratio | 0.47 | 0.71 |

Maximum loss | -17.2% | -10.3% |

Source: Wealthsimple, Bloomberg. This chart shows the historical returns of the Barclays Bloomberg U.S. Aggregate and an equal-weighted portfolio consisting of the USTA Leveraged Loan Index (representing credit risk) and the Barclays Bloomberg 7-10 Year U.S. Government Bond index, from January 1, 1997 through December 31, 2024. Cash returns represented by the Bloomberg Barclays U.S. 1-3 month treasury bill index.These returns are gross of all fees, taxes, and transactions costs. This does not represent an actual portfolio. This hypothetical example is used to illustrate a portfolio construction concept and is not a simulation of the Wealthsimple Bond Portfolio. Past performance is not predictive of future performance.

We also believe that bond ETFs like aggregate bonds will be too risky for many investors looking for a short-term return on their cash. For example, the Canadian bond aggregate declined by 24% between the end of 2020 and the middle of 2022. That can be fine in a long-term portfolio, but it does not fit an investor in this situation.

One other reason we think our bond portfolio is a stronger option than a bond index: it’s hard to invest in bonds on your own. Bonds can be more complex than equities, even when targeting a specific type of risk. For example, high-yield corporate bond ETFs and high-yield floating-rate ETFs have similar names and risk exposure. But they can differ in their mix of duration and credit risk — and in performance. In 2024, for example, high-yield floating-rate ETFs delivered a return of over 11%, compared to just over 6% for high-yield corporate bond ETFs.

How is Wealthsimple’s bond portfolio different from savings accounts and GICs?

High-interest savings accounts (HISAs) are a great option for investors who do not want to take on any risk at all. But that security means giving up potential returns.

GICs also have no risk of loss, but they often require you to lock up your funds for a specific period. Our fund doesn’t do that. Plus, it has offered yields in excess of most GICs we are aware of.