How to invest at any age

Life changes. So should your investment strategy.

July 19, 2024

For this month’s newsletter, I want to cover the importance of updating your investments (and your risk level) as you age. Most people probably wouldn’t watch the same TV shows in their 20s as they do in their 40s and 50s (unless we’re talking about Bluey!). It’s the same with investing. What you do with your money right out of university is pretty different from what you do with it when you’re watching your youngest kid walk across the graduation stage. That’s because a lot of things change as you get older, including your income and savings, your needs and goals, and, of course, how much time you have left.

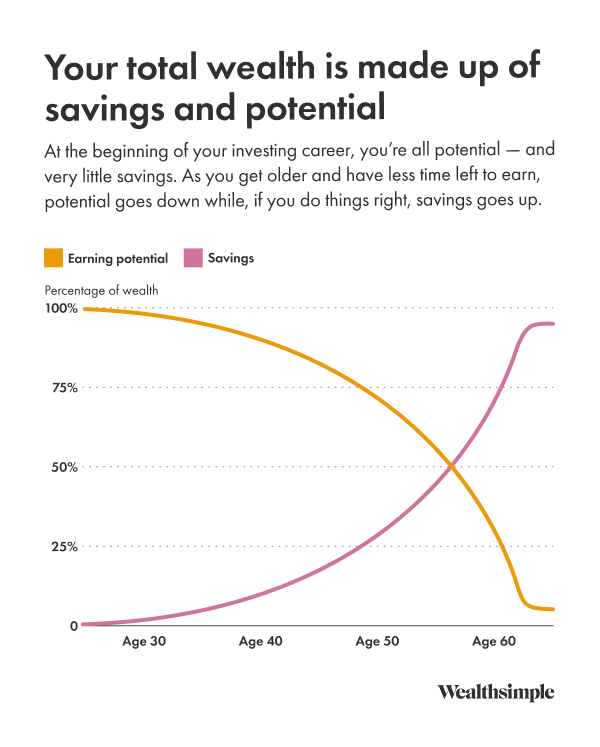

Wealth at any point in time is the sum of your savings (financial capital) and the future money you'll make from working (human capital). When you’re young, most people have little financial capital and tons of human capital. As you get older, your human capital gets converted to financial capital through saving and investing, and eventually those proportions switch (see the chart below).

The trick is knowing where you are on that path and how it impacts your financial priorities and capacity for risk. Below, I’ll get into how you might adjust your investing perspective based on your age. (You can decide on your own when to stop watching Bluey.)

How to invest in your 20s

There are four main things to do, preferably in this order:

- Pay off high-interest debt, which saps your ability to build wealth.

- Set up an emergency fund: three to six months of expenses in an interest-bearing savings account that you can grab if you lose a job or your radiator decides to stop working.

- Take advantage of any employer-sponsored retirement plans. Contribute as much as you need to in order to maximize their matching. That’s free money.

- Get in the habit of saving and investing. If you can afford to put aside 20% of your paycheque each month, do it. Some young investors don’t know how to start and can be paralyzed by the options. But what specific investing strategy you take at this point is relatively unimportant, because these returns won’t have a significant impact on your eventual accumulated wealth. We usually recommend investing in a low-cost, diversified portfolio, preferably in a tax-advantaged account like a TFSA, an RRSP, or an FHSA.

How to invest in your late 40s and 50s

The 40s and 50s are peak earning years for most people. But they come with more pressure (and reading glasses 😞). With retirement on the horizon, this is a good time to start defining your goals more precisely.

By now, you’ve accumulated enough wealth that how you invest and how much risk you take can have significant consequences. We encourage clients to think about the full range of outcomes their investments could experience, not just the most likely scenario. With fewer years of saving remaining, it becomes more challenging to adjust to and make up for poor results.

With this in mind, many investors begin reducing their exposure to equities. But keep things in perspective: you could still have 20 years to go until retirement. That’s a relatively long timeline, and the chances of experiencing significant losses even in a high-risk portfolio over that period are extremely low.

Everyone is unique, and your approach should be informed by how on track you are for your retirement goals. If your savings are well above your goal, you can often feel comfortable taking on more risk knowing that your needs are likely to be met even if you get a bad outcome. On the flip side, if you find yourself off track, a bad outcome in the stock market might leave you in an unacceptably bad position for retirement. As a result, you might prefer to reduce your risk to mitigate the odds of that happening — even if it means you can’t get to your original goal.

One more thing to consider: if the interest rate on your mortgage is higher than what you expect to make (after taxes) by investing in a non-registered account, you may want to think about putting extra savings toward your mortgage. Reducing a negative return like mortgage interest is just as good as generating a positive one. Plus, it’s guaranteed.

How to invest in your 60s and beyond

By your 60s and 70s, most investors are often partially or fully retired with considerably less employment income. You have a much lower ability to offset material financial setbacks at this point, so it can be smart to reduce investment risk by increasing your allocation to bonds and cash equivalents.

Not that you should give up on risk entirely. If things go your way, you still have decades left. A little risk can help you keep your savings growing, counter the effects of inflation, and limit the chances of running out of money too soon.

Now can also be a good time to think about permanent life insurance. (Term insurance, at this point, becomes less important, since your human capital is winding down.) These plans cost more than term insurance, but they also provide a guaranteed payout to your heirs upon your death, which can help pay for things like executor costs for your will and getting you a fancy coffin. You’ll want to check in with an insurance advisor.

And finally, it’s important to maximize the wealth you’ve so diligently saved. You can do that in two ways:

- Taking government pensions at the right time (for you). A lot of Canadians take their benefits as soon as possible, which isn’t usually the best strategy. You can take a reduced Canada Pension Plan (CPP) retirement pension from the government as early as age 60. But you can also defer both CPP and the federal Old Age Security (OAS) pension payments as late as age 70 in order to receive more each month. How do you choose? Some people like to think about their break-even age, or how long you’ll have to live to make those first five or ten years of not getting paid worth it. This calculation suggests that it’s beneficial to take CPP when you hit 65 instead of 60 if you expect to live past 74. If you expect to live past age 82, the breakeven suggests deferring CPP until you’re 70. Of course, that’s just a rough guide. There are many other factors to consider, which an advisor can help you think through.

- Withdrawing from the right accounts — in the right order. Although you can’t avoid taxes in retirement, you can influence how much you are taxed, so it’s important to be thoughtful in your approach. For example, rather than waiting until you turn 72, when the government forces you to start withdrawing from your RRSP/RRIF, many people would benefit from beginning those withdrawals sooner. That lets you smooth out your taxable income and lower your overall taxes. One common approach is to withdraw just enough from your RRSP and other registered retirement accounts so that, when it’s added to OAS and CPP, your annual income falls just inside the lowest possible tax bracket. Any extra money you need can come from non-registered accounts or TFSAs, which have already been taxed. It can get complicated, so I’d suggest catching up with an advisor or a financial planner.