How to build a budget

It’s hard to build wealth without a budget

May 16, 2024

While budgeting is a terrible topic to bring up at a dinner party (I’d rather catalog my health issues or even panic-shout, “where’d you get those shoes!?” first), it’s an important one for a newsletter about being smart with your finances. Plus, it’s spring. You might as well treat your budget like another neglected closet and clean it up.

If you’re already budgeting, that’s great! But only about half of Canadians do — and everyone benefits from revisiting their budget, especially as you get older. The more your income, goals, and interests change, the more important it is that your budget change with them.

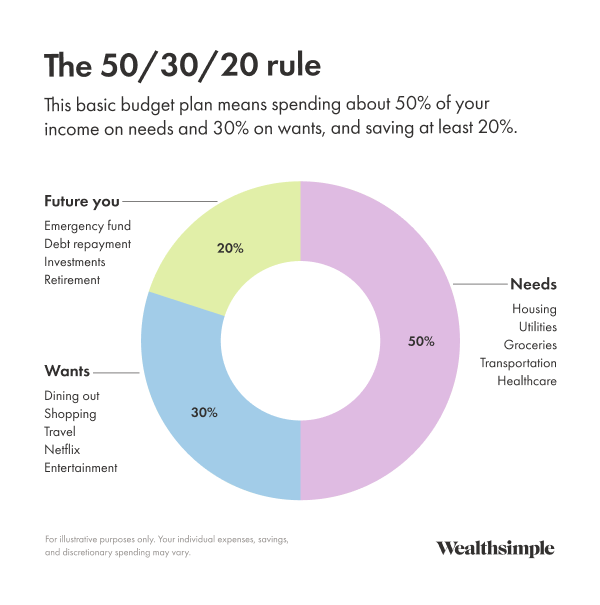

Budgets are the most effective way to make sure you’re bringing in more money than you’re spending. They make it harder to slip into debt and easier to make progress (and actually see yourself making that progress) toward your goals. The 50/30/20 approach below is one of the best, least-complicated ways I’ve found to set a budget. And it works whether you’re fresh out of university or about to join your first canasta club.

50% of your income is dedicated to must-haves like housing, food, and the electric bill. If half of your take-home pay isn’t enough to cover these items, you’re likely spending too much. You’ll need to try to find ways to cut back, whether that’s running the AC less or getting a car with a cheaper monthly payment. (And turn the lights out when you leave a room, please. Even if you don’t need the extra money.)

30% of your income goes toward wants, like travel, fancy dinners, or, if you just can’t help yourself, a pair of those hideous New Balance loafers. Being able to splurge a little helps your budget feel sustainable, and you want something you can stick with.

20% of your income is reserved for financial goals. So stuff like paying down credit card debt, saving up a cash reserve, and investing for retirement (ideally in that order, like we covered last month).

How do you follow your budget? Automatic bank transfers help. You can set your paycheque to be immediately distributed to separate accounts. Also, keep in mind that while a budget can initially feel like a straitjacket, it can actually be freeing. If you live within your means, you can do the fun stuff without feeling guilty.

One caveat to all of this: not everybody has the luxury of being able to save. In fact, 44% of Canadians didn’t save anything at all from 2022 to 2023, thanks to inflation, rate hikes, and unaffordable housing. If this seems wildly ambitious, just do the best you can. Putting away 6% of your paycheque will still make important progress toward your goals.