How to be smart with your tax refund

What should you do with extra money?

April 30, 2025

Two-thirds of Canadians will get tax refunds this year (the average is around $2,100). If you’re one of them, you may be wondering just how guilty you should feel if you blow the money on a nice vacation. While I’m not here to guilt you, I can help you think through the smartest ways to use your extra money. From there, it’s up to you.

Whether it’s a tax refund, an inheritance, or your high school locker combination finally coming up in the Lotto 6/49, unexpected windfalls are basically shortcuts to future wealth — but only if you can resist the temptation to spend them. Here are four steps to think through (in priority order) the next time you come into some extra money. And yes, one of them does let you buy yourself something fun.

Step 1: Get rid of high-interest debt

If you’re paying double-digit interest on anything — credit cards, student loans — any extra cash should go toward paying off that debt. Why? A 20% interest rate on a credit card is a guaranteed negative return. Paying it off is effectively earning 20%, which is more than what you’d make putting the money nearly anywhere else.

Step 2: Set up an emergency fund

Before you worry about your future wealth, make sure you can take care of your current self. Having three-to-six months of living expenses saved (I’d recommend investing it in low-risk assets in an accessible account like a TFSA) means if you lose your job or the car conks out, you won’t need to put a bunch of charges on your credit card and go right back into high-interest debt to deal with the situation.

Step 3: Invest!

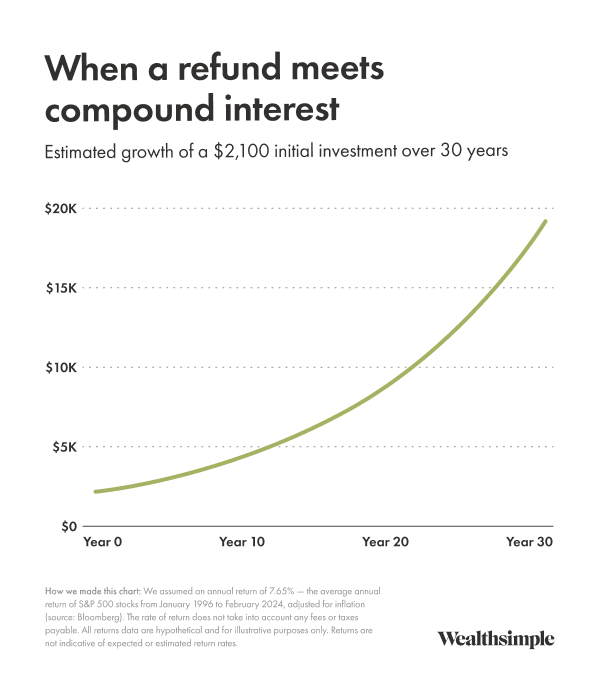

The sooner your money is invested, the more time it has to grow. Just check out the chart below. After 30 years in the market, your $2,100 tax refund could be worth nearly $20,000. So even if you’re still four decades away from your first wayward ear hair, you should be thinking about maxing out your TFSA and RRSP accounts when possible. And if there’s even a chance you might one day buy your first home, FHSAs basically combine the tax benefits of TFSAs and RRSPs. Here’s a simple flowchart to help you think through the best place for your investments.

Step 4: Treat yourself

Finally, the fun part! Money should be used for enjoying life, after all. And not just in retirement. As long as your high-interest debt is gone, you’ve got an emergency fund, and you’re investing, you deserve a little fun. A healthy relationship with money (which is to say, one that lets you indulge once in a while) can keep you from hating your financial plan — and help you actually stick with it.