How much investment risk do you need?

How much risk should you take

July 17, 2024

Seeing as we’re in the thick of the holiday season, I have a very special gift for all of you: a newsletter about risk! Sorry. I know it’s not the most fun thing to talk about, but it is one of the most important. And I think one of the most misunderstood.

By now you probably know the basics, but they’re worth repeating. As an investor, your potential returns are directly related to the underlying riskiness of the assets you own. That’s because investors are paid a premium for putting their money into something that has a higher likelihood of failure, otherwise there’s no incentive to invest.

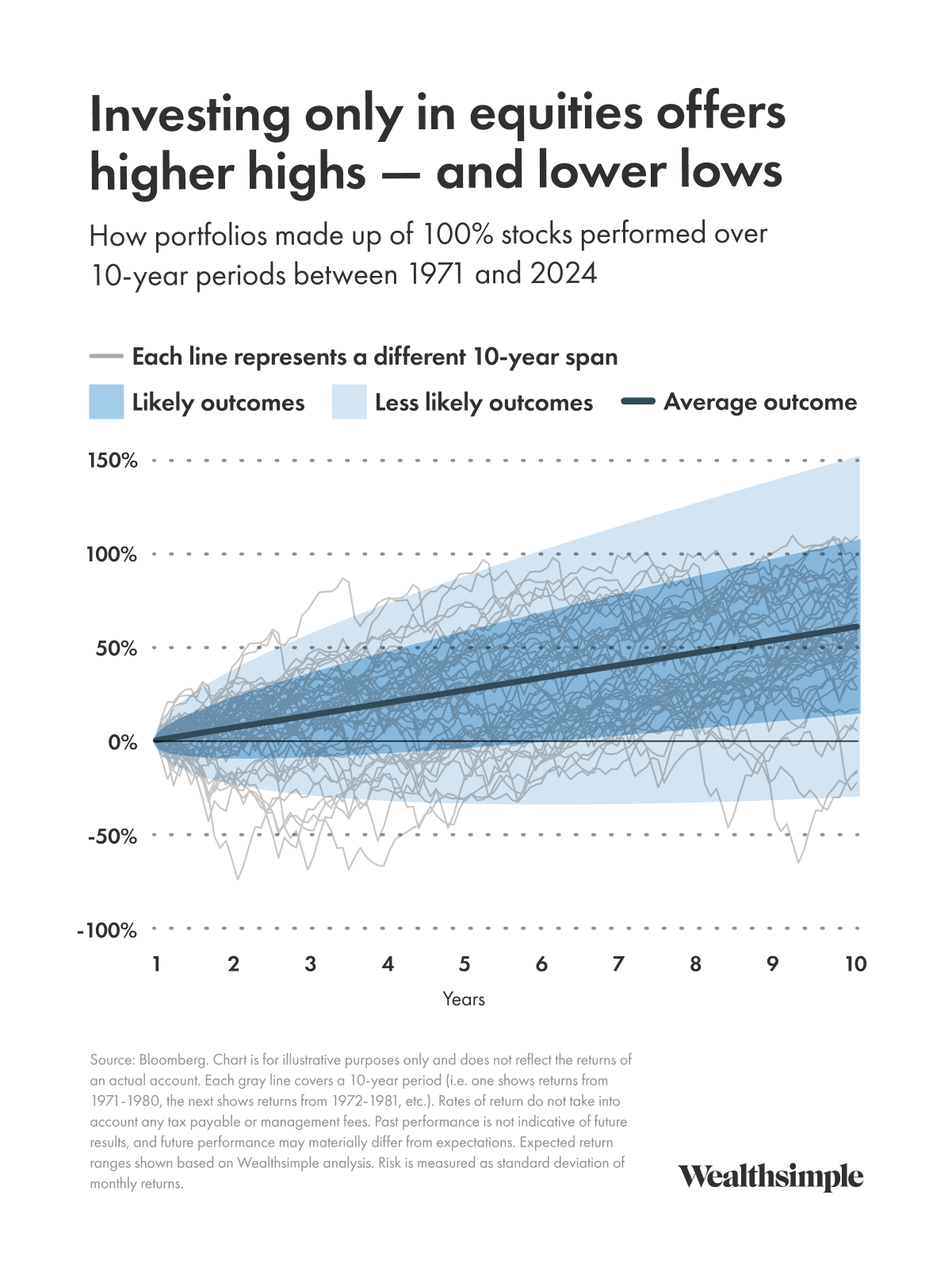

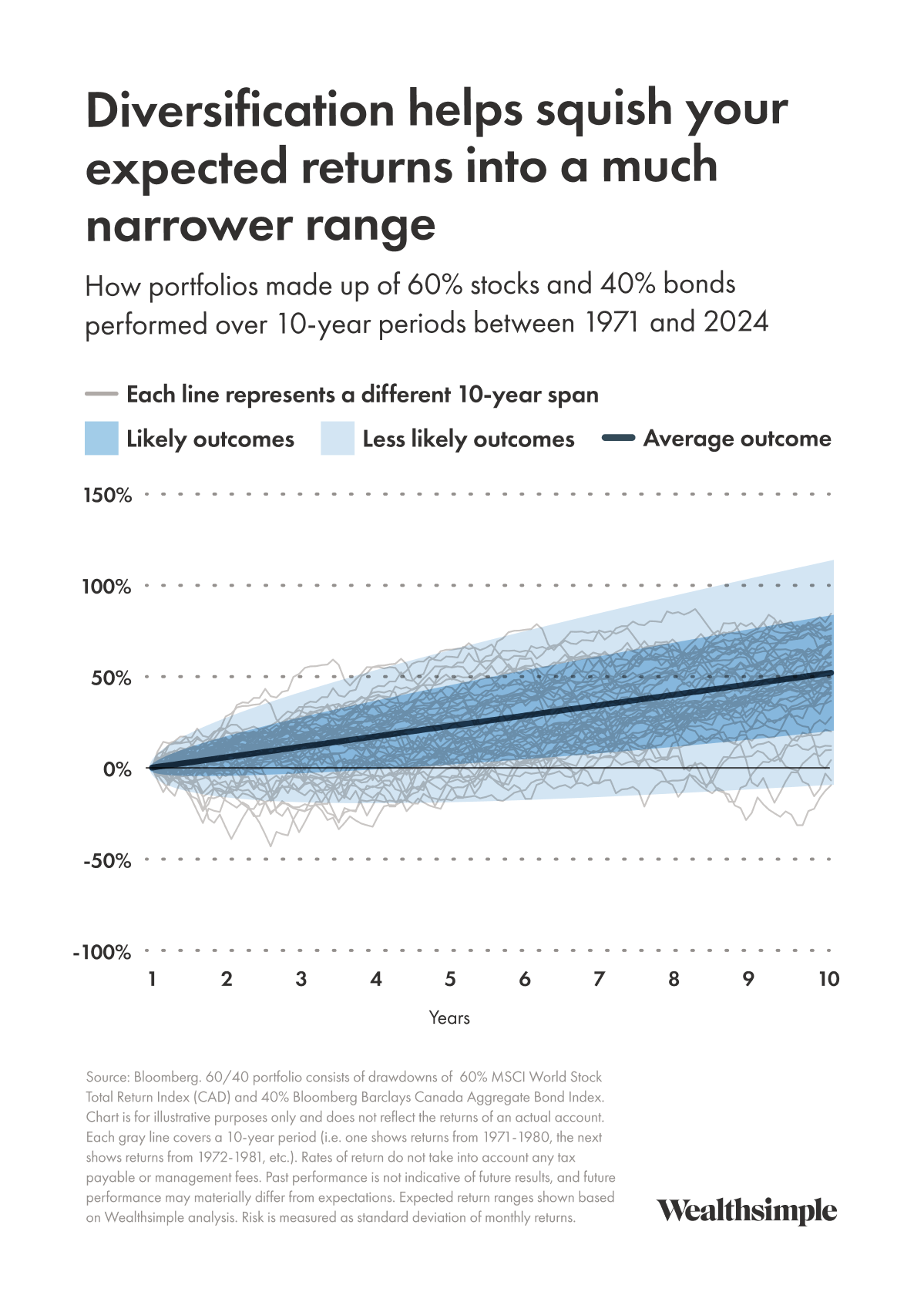

How much you invest in each asset class can determine the range of possible outcomes for the return of your portfolio. As the chart below shows, if you’re in an all-stock portfolio, you could have a lot more money after ten years than you might with a diversified, less-risky portfolio made up of 60% stocks and 40% bonds. But you could also have a lot less.

Finding the right risk for you

If you’re saving money to buy a house in three years, you could invest everything in some “can’t miss” stock you learned about on Discord, but you’re much more likely to end up with the downpayment you need by taking a slightly more cautious approach. Similarly, if you’re not planning on retiring for 30 years, you probably don’t want all of your money locked into GICs.

To help my clients end up with a risk level they’re comfortable with, I look at three factors:

- Risk required. This one is partially determined for you. If, in order to achieve your goals, you need five times the money you currently have in a span of a year, you’re also going to need to take on extra risk.

- Risk capacity. This one covers your ability to take on risk without jeopardizing your financial stability or goals. So if you have a retirement fund that already has enough to take care of you — and you still have twenty years to retirement — you have more capacity to take on risk.

- Risk tolerance. This one reflects your ability to handle losses without making panic-based decisions. If you’re the type of person whose response to seeing a single deer tick in the yard is to replace the grass with tick-proof mulch and duct tape the kids to the couch, you’re going to be better off in low-risk assets. There will always be ups and downs in investments. But part of being a good investor is knowing just how much noise you are going to be able to tune out.

If you rank high on all three factors, you may want to consider a high-risk portfolio. But if your stomach flips when you assess your own risk capacity or tolerance, you could be better off with a less-risky approach.

We made a chart that shows how that plays out with three different people and three classic types of managed investing portfolios. (We put it in a separate link, here, so that it’d be a little easier to read if you happen to be on your phone.) In this setup, the low-risk portfolio would hold 30%-40% in equities, with the rest in fixed-income investments like bonds. Medium risk would be closer to 50%-65% in equities, and a high-risk portfolio would be comprised of 75% equities or more.

Where some people mess up

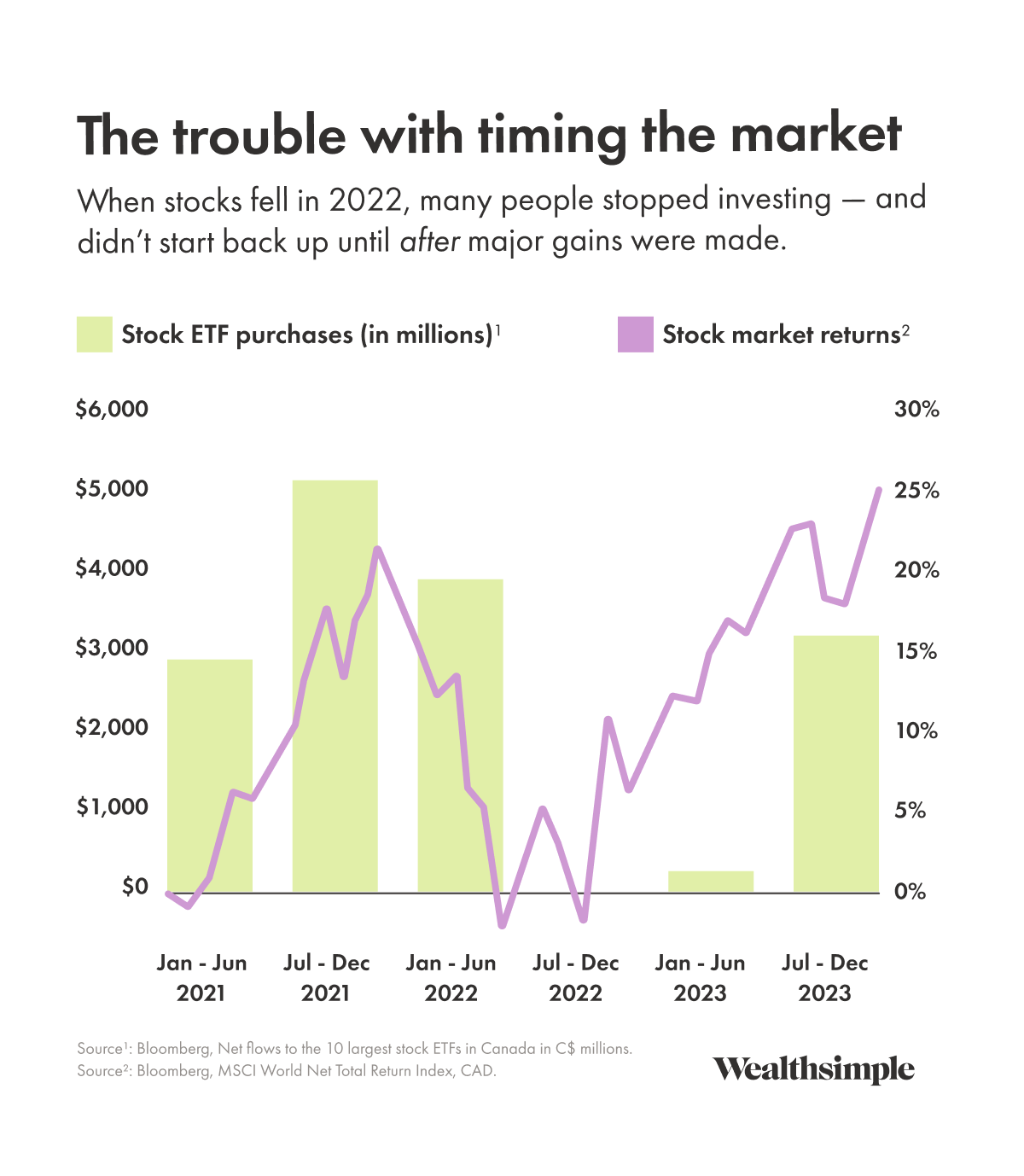

Many people fall into the trap of expecting recent market performance — whether good or bad — to continue indefinitely. That can lead to adjusting your portfolio so that it no longer aligns with your goals. You may take on too much risk when markets are performing well, which can hurt you when they take a turn. Or you may reduce your appetite for risk when markets are doing poorly. And that can mean missing the recovery when things eventually head back up.

The chart below shows a time when investors let the current state of the market affect their investing plan. The stock market's robust performance in 2021 led to a surge of money flowing into equities. But when markets tumbled in 2022, many investors stopped investing altogether. They waited for signs of recovery before beginning to invest again, which meant missing out on a lot of the gains that came with the rebound. For someone who needed their money in the short term, these losses could have derailed their plans.

Sticking to your plan can help avoid those situations. But remember to reassess your goals periodically. Because they change as your life changes. Your investment plan will need to change too.