Gold’s recent runup — and what it means for you

Real yield • Bonds • U.S. markets

April 29, 2025

Winners, losers, draw-ers

Winner: Gold investors

The streak continues. (See below.)

Loser: U.S. dollar

The world's reserve currency has had that status called into question, as the odds of U.S. isolationism increase.

Drawer: Bonds

Almost all Canadian fixed income is flat this year, as investors wait and see how the tug of war between inflationary pressures (bad) and recessionary ones (good) will play out.

Investing 201: How to think about gold

Investors have rightly been preoccupied by this months’ wild stock market swings, but we’d like to call your attention to another asset class having a pretty wild run of its own: gold. Gold prices are up more than 60% since the start of 2024. And unlike most other assets, gold has extended that strong performance through the start of this year.

Perhaps because of this, we’ve seen a lot of clients adding more gold to their portfolios. Gold can be an important part of a portfolio, of course. But as with any asset, it needs to be understood to be optimized. That’s why we want to take this opportunity to encourage proper caution and provide a bit of education.

What is gold like as an investment?

Although many investors view gold as a stable store of value, it’s actually quite volatile and riskier than stocks. Gold tends to do well in the following circumstances (both of which have contributed to its current rise):

- Times of inflation. Since there is a limited amount of gold, when there are suddenly a lot more dollars (due to banks printing money or currency being debased) gold sellers demand a higher price.

- Geopolitical uncertainty. When other currencies and financial assets start to feel risky, many investors see gold as a safe haven.

One important thing to remember is that gold offers no natural yield. As a result, it often moves in the opposite direction as assets that do have a yield. This means gold’s value can drop when something called the “real yield” rises, which tends to happen when inflation falls or central banks increase rates.

The real yield is the amount you earn on your cash after accounting for inflation. So if the cash yield is 3% and inflation is at 2%, the real yield is 1%. The higher that number is, the less attractive gold becomes. There are exceptions, however. Much of the current run-up, for example, has been during a period of rising real interest rates.

What is the role of gold in a portfolio?

Gold can help protect against inflation and diversify your portfolio. Given its volatility, however, it doesn’t take much. A small allocation of 2% - 10% is often enough to provide meaningful diversification for many investors. (For context, our classic portfolios have 2% - 4% in gold, which has been beneficial the past couple of years.)

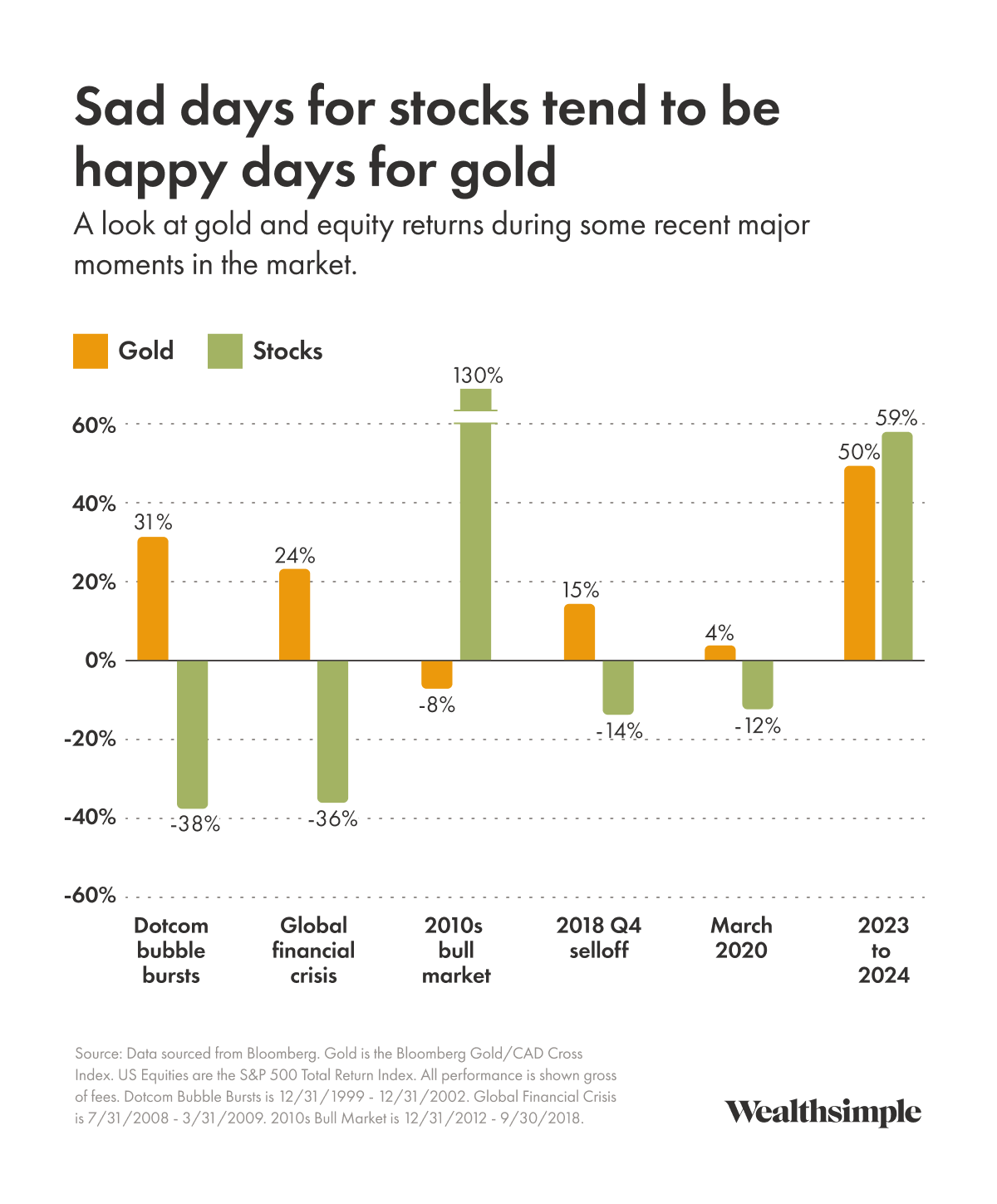

One critique you’ll see from some investors is that, because gold doesn’t pay dividends or earn you rent like many other asset classes, it doesn’t belong in a portfolio. However, its diversifying properties are so helpful (particularly when equities slump), that you would want to allocate to gold even if you expected it to have no real return at all.

How to actually add gold to a portfolio

If you are interested in investing in gold, there are a few ways to do it that don’t involve a pickaxe:

- Gold ETFs. These funds, which we use in our classic portfolios, are typically backed by physical gold held in trust on behalf of investors. They offer low-cost, easy ways to track the price of gold.

- Gold mining stocks. You can either invest directly in companies that actually extract gold or ETFs that track a basket of miners.

- Gold royalty and streaming companies. Some corporations provide financing to miners in exchange for future revenues or the right to buy a portion of the mine’s gold production (usually at a discounted price).

- Physical gold. Think bullion bars or gold coins. The benefit is that you own the gold directly, but the trade-off is that you then have to figure out how to store, insure, and sell it.

Four things to remember when investing in gold

- Understand its role. As a diversifier, gold is meant to behave differently. It could underperform when the rest of your holdings are doing well, but that is by design. Gold is there to have its shining moment when you need it to

- Don’t chase returns. It’s easy to focus on what’s happened lately and invest based on the assumption that that streak will continue. It’s also easy to end up buying at the top.

- Don’t overcommit. As attractive as some returns might be, putting too many of your eggs in one basket can mean putting your future in a precarious position. With gold, even a small amount can help balance risk and smooth your expected return.

- Don’t forget to rebalance. This can be tough when certain parts of your portfolio have done a lot better or worse than others. But systematically rebalancing your gold position back to its target weight — withdrawing gains after booms and adding to your position after busts — ensures that you take advantage of its volatility.

One great read

Is this the end of the U.S. exceptionalism trade? Bloomberg's excellent Odd Lots podcast digs into what could change for investors if Trump’s tariffs end the almost-20-year era of U.S. market dominance.