From our CIO: What is a stock market cycle?

How the Stock Market Cycle Works

May 31, 2024

Back in February, I talked about how individual stock markets can have periods of 10 or more years during which results are primarily driven by large-scale structural changes — like the negative returns brought about by inflation in the 1970s, or the two decades of high returns following the post-World-War-II investment boom. But most market movement is driven by simpler things and comes in much shorter cycles.

A market cycle is the time it takes to move from a market low to a peak and back again. Understanding what drives one can make it easier to:

- stick to your investment plan when things seem bleak, and

- temper expectations when things are booming.

Peter Oppenheimer wrote an excellent book on stock market cycles called The Long Good Buy. And while I can’t do it justice in an email, I can at least summarize his main points.

The biggest thing to understand is that most periods of high and low returns in a market cycle are caused by the market anticipating what will happen to corporate profits in the future.

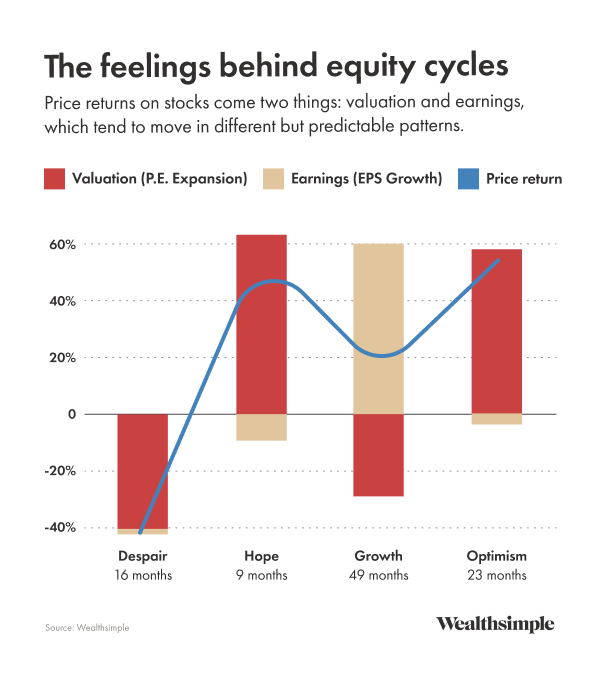

We can observe this by breaking stock market returns into two components:

- the profits that companies generate, called earnings or earnings-per-share (EPS) growth

- expectations for future profits, called price-per-earnings expansion or valuations

Changes in actual earnings, which measure current performance, tend to occur more slowly than changes in valuations, which anticipate future performance and can swing wildly. Because of that, returns for any given company or portfolio are often disconnected from how well the economy is currently doing. After periods of optimistic, valuation-driven surges, though, actual earnings will either deliver on what was anticipated — which usually drives a moderate level of further returns — or they won’t, in which case there can be large declines.

It’s important to understand each element of the cycle: despair, hope, growth, and optimism. We’ll start with the saddest one first.

Despair

Bear markets happen when investors start to anticipate a recession, creating a sharp decline in valuations. At this point, corporate earnings are generally slowing, but not terrible. This is why bear markets are often surprising: they start when the economy is weakening, but not necessarily bad, and there’s not always an obvious catalyst.

Hope

The hope portion of the cycle comes well before profits trough and actual performance reaches its nadir. During this period, when valuations are low and pessimism is widespread, investors who correctly anticipate a recovery can capture significant returns by increasing their position before their positive outlook catches on and valuation shoots back up.

Growth

Hope can often shift to growth as corporate performance then catches up to valuation. Valuations decline slightly in this phase, because the market is delivering the earnings growth that was anticipated when the economy was weak, but the positive actual earnings balance out those declines, creating long phases — they average about four years — during which overall returns are modestly positive. This is basically corporations delivering what the market expected.

Optimism

Finally, after a long period of economic expansion, valuations start to rise even higher as overoptimistic investors increase expectations even more. Companies often can’t deliver enough profit growth to sustain the new valuations, so, while returns can be very high at this point of the cycle, these periods often end in recession, and the cycle starts again.

Should you try to time market cycles?

Probably not. Since 1973, declines in S&P 500 bear markets have averaged “only” 35%, while growth during expansionary periods has averaged 80% — and it can be very hard to understand where you are in the cycle. What you’re seeing in the economy is generally already anticipated by the market, and the best returns occur during some of the worst economic performance, so it’s often been best to stay in the market even in the depths of despair. While this is not a tradable strategy, it can provide a good mental map for understanding what you will experience as an investor.

What I'm looking out for

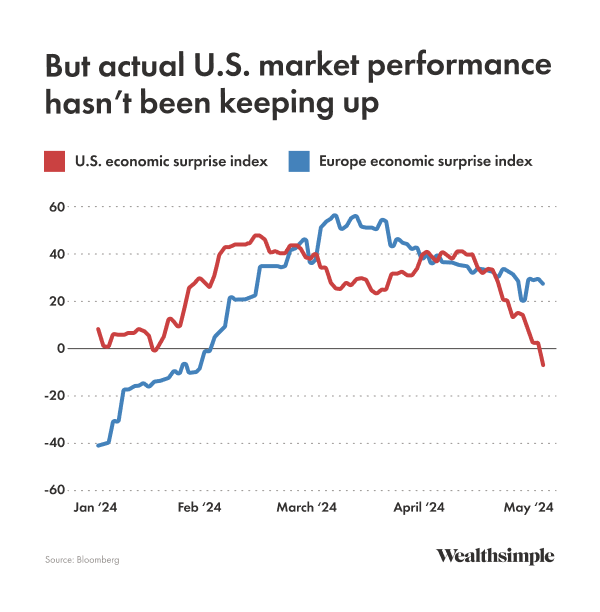

Over the last year, consensus economic forecasts have been steadily rising for the U.S. and falling for the E.U. as it verged on and entered into a recession. Economic surprise indices, which measure how economic outcomes deviate from what forecasters expect, have recently turned negative for the U.S. and positive in the eurozone, despite relatively stronger economic performance in the U.S. Why is this interesting? As we discussed above, growth relative to expectations often creates the largest changes in returns, so European companies now have a much lower performance bar to clear than U.S. companies. It could be worth considering for investors who expect continued U.S. outperformance.