From our CIO: What investors can learn from CPP

How to decrease risk without decreasing expected returns

June 27, 2024

The group that controls the Canadian Pension Plan's $630+ billion took some heat last month after sharing its latest annual report. In the 18 years since switching to active management, the CPP has underperformed its own much simpler reference portfolio (which it uses as a benchmark for acceptable risk) by an average of 0.1% each year.

The news had people wondering why the Canadian Pension Plan Investment Board (CPPIB) would use its complex investing strategy instead of just going with the lower fees and higher relative performance of a simpler, stock-heavy portfolio. I don’t think that’s the right way to look at it. The board’s approach makes sense for them, and the debate has some instructive implications for all of us as investors.

If you need to manage current and future liabilities and want to maintain a stable contribution rate of taxpayer dollars, achieving a reliable outcome regardless of the swings of the stock market is extremely important. As an institutional investor, CPPIB has more options than most investors to diversify in a way that maintains or even enhances expected returns. Specifically, the board invests in more than passively held public stocks — credit, real assets, private equity, and active trading strategies. They manage these assets actively, and use leverage to add additional diversification. The result is a portfolio that may not hit the same highs when the equity market booms, but also won’t hit the same lows when it doesn’t.

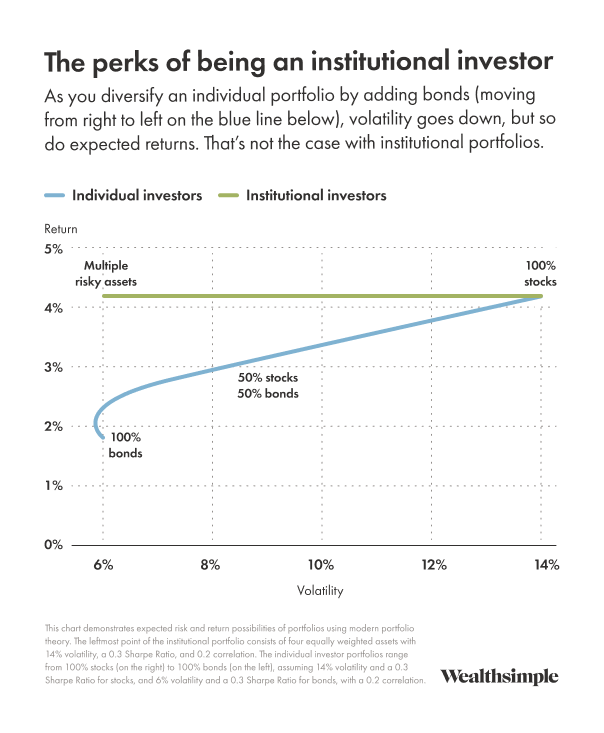

Risk and return tradeoffs of conventional portfolios

Over the long term, a risky stock portfolio can yield attractive returns, but with relatively wide swings. There are, however, strategies that index investors can use to improve expected returns and risks to create a more resilient pattern of returns: geographic diversification, choosing stocks that perform well at different times (like defensive stocks and commodity-producer stocks), or adding diversifying asset classes like gold or riskier government bonds.

For most investors, as you add stocks and bonds together, you reduce portfolio risk and return, mostly because bonds are less risky than stocks.

Risk and return tradeoffs of institutional portfolios

Institutional and higher-net-worth investors can use leverage and alternative investments to create diversifying assets to stocks and a better return-to-risk ratio. This lets them reduce overall risk without sacrificing expected return.

This approach clearly has some appeal, although it does require taking on other types of risk. For one thing, you need to choose good managers, which is hard and requires skill. And you need to manage leverage, which requires attentive oversight. It also requires what’s happened to CPPIB: deviating from (and potentially underperforming) the world public stock market, even for extended periods of time.

Two big lessons for individual investors

- You can do very well investing in the stock market, assuming you are able to ride out wide swings in performance (some that last ten years or more) that other investors can’t afford to manage, given spending needs or struggles with risk composure.

- You can improve expected outcomes if you are willing to invest differently. But know that you have to bear the costs, both of relative performance and of finding a way to choose managers and/or manage your leverage carefully. A few ideas for individual investors include using managed ETFs like RSSB, NTSX, or RPAR that add diversifying asset classes using derivatives, or adding alternative investments like private credit or private equity to your portfolio.

What I'm looking out for

Canada 5-Year Interest Rates

A lot of the focus in popular discourse has been on the timing and pace of rate cuts, but very few people are talking about where rates will eventually settle. To me, that is arguably as important, since the five-year rates form the basis for a lot of credit that consumers use — most notably mortgages. Currently, the market is forecasting interest rates of 3.3% in five years for Canada, which is about 1% to 2% higher than it was before Covid, and only 1.5% below where short-term interest rates are today.