From our CIO: Q2 managed portfolio performance

A look back at Q2, and what’s ahead

July 31, 2024

Most portfolios offered in Wealthsimple’s managed accounts continued to grow in the second quarter as optimism around artificial intelligence pushed global stocks up (again). All of the money being poured into AI, along with the belief that users will pay for AI upgrades, had companies including Nvidia and Apple posting extremely strong returns. Because Big Tech makes up such a large portion of the world’s equity markets, this caused equities overall to increase — even though the markets for most developed countries outside the U.S. saw only modest gains (or in the case of the TSX, declined).

Managed portfolio performance

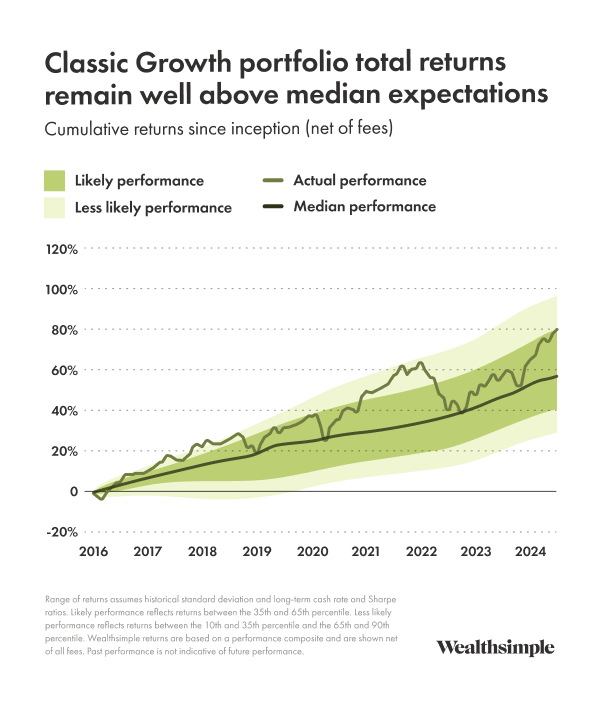

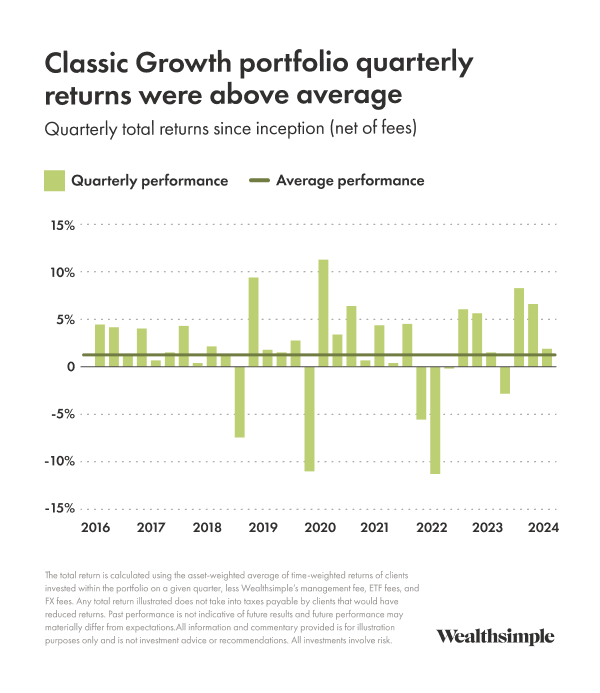

Our Classic Balanced 60/40 portfolio returned 1.6%, and our Classic Growth portfolio returned 1.9% (see chart below). That brings year-to-date returns to 6.5% and 8.9%, respectively. Annualized returns since inception are now 5% and 7.1%, respectively.

SRI and Halal portfolios had lower returns because they don’t hold as many big technology companies. Our SRI Balanced portfolio declined 0.9%, and our SRI Growth portfolio declined 1.3%. Year-to-date returns are 2.2% and 3.5%, respectively. Halal gained slightly, thanks to more exposure to gold. The Halal Balanced portfolio rose 0.3% over the quarter, and Halal Growth returned 0.2%. That brings year-to-date returns to 6.9% and 7.7%, respectively.

The overall market rally has continued into the third quarter. This month, classic portfolios have already returned another 2.5% (Balanced) and 2.7% (Growth). SRI portfolios are up 3.8% (Balanced) and 4.6% (Growth). And Halal gained 3.7% (Balanced) and 4.4% (Growth).

Alternative investments

These funds allow our qualified Managed Investing clients to invest alongside institutional investors in strategies that offer higher expected returns or attractive returns and diversification. Wealthsimple Private Credit invests in senior-secured floating-rate loans (that just means we’re first in line to get paid back, and payments go up or down with interest rates) to medium-size companies. Wealthsimple Private Equity offers a globally diversified portfolio of private companies owned and operated by private equity managers who work aggressively to improve their value. Both funds are managed by experienced, institutional-quality investors, with track records of steady performance across economic cycles and aligned incentives.

We believe both options provide an excellent way to build wealth and diversify portfolios, and we’re proud to be able to bring them to our Managed Investing clients. In fact, we’ll soon be lowering the requirements from $100,000 in total investable assets to $50,000 in order to give access to even more investors who meet other eligibility criteria.

Private Credit

Private Credit returned 2.5% in the second quarter, bringing total returns since the fund’s June 2023 inception to 12.5%. The fund is distributing income at a 9% annualized rate,1 and borrower health is strong. The loan-to-value ratio2 (a measure of how much collateral a company has compared to how much they borrow) is a healthy 41%, and all borrowers are making regularly scheduled interest payments. Our management team is continuing to find attractive lending opportunities.

Private Equity

Our Private Equity fund returned 9.0% in the second quarter. That brings total returns since inception in December 2023 to 27.6%, which is at the high end of our expectations. The fund is growing nicely, with a diversified portfolio of more than 300 companies. The majority are split roughly evenly between the United States and Europe, and a few are in Asia.

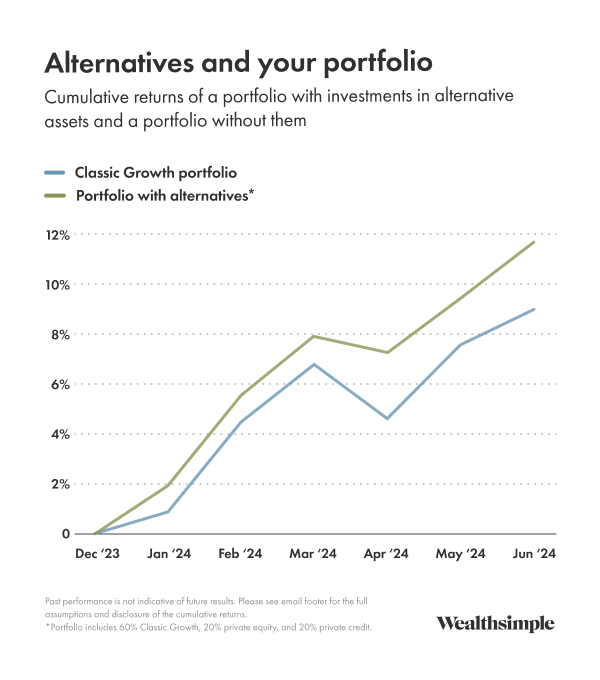

How alternatives can help a portfolio

As I mentioned before, we think alternatives can be a great way to diversify portfolios and increase your overall returns. The chart below compares the historical returns of two different portfolios:

- Our Classic Growth portfolio, and;

- A hypothetical portfolio based on actual performance that includes allocations to Wealthsimple Private Equity and Private Credit. (The data begins this year, with the inception of our Private Equity fund.)

While it is early days for these funds, including alternatives in a portfolio would have added value so far.

Outlook

The performance of the U.S. stock market, and U.S. technology stocks in particular, has led to a historically large concentration of world markets in a few companies (aka Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). This has investors asking questions.

On one hand, they want to keep earning returns from companies that are poised to profit from AI — a technology that could transform the entire world economy. The U.S. has also been the world’s best performing economy for many decades, with the deepest and most liquid markets. If AI delivers on its promise, and the U.S. economy grows without another spike in inflation, returns could continue to be strong.

On the other hand, having concentrated exposure in anything increases the risk of sharp losses. A number of other realistic scenarios — stagflation (when inflation and unemployment are high, and economic growth is low), recession, all this AI spending failing to pay off, or unanticipated growth elsewhere in the world — could result in an extended period of U.S. underperformance.

That’s why I always come back to the same point: a portfolio diversified across geographies, stock types, and asset classes continues to be a good strategy to anticipate a variety of economic scenarios. It’s how we build our portfolios, and why we encourage other investors to do the same.

What I'm reading

I get a lot of requests for book recommendations from friends who are looking to get a better understanding of finance. In case it’s helpful, I wanted to include a couple recent favourites here. And because I also like to read books that have nothing to do with finance, I threw in one of those as my third pick.

- “Bull! A History of the Boom and Bust, 1982-2004” by Maggie Mahar. We can escape our current conventional wisdom by understanding how it has evolved in the past. This book displays what common knowledge looked like after the 2000 market crash.

- “Master, Minion” by Paul Podolsky. My former colleague at Bridgewater used his insider’s knowledge of complex finances and geopolitics to write a page-turning thriller about the assassination of a Russian central banker. It’s a murder mystery that also stealthily teaches you how money and power work.

- “The Summer Book” by Tove Jansson. Through a series of vignettes, this 1972 novel tells the story of a 6-year-old and her grandmother as they spend a summer together on a tiny island in Finland. It’s about living in and closely observing nature, being open-minded and tolerant, and respecting each other.