From our CIO: Q1 portfolio performance

Here’s what happened in Q1

April 25, 2024

That was a strong first quarter. Global equity markets continued their bull run, primarily due to two factors:

- increased investor optimism, which is reflected in stocks’ high valuations (the price investors are willing to pay for them relative to expected earnings).

- corporate earnings exceeding expectations.

Inflation remained high, however, delaying expectations for interest rate cuts and causing government bonds to decline slightly. Gold rose due to a variety of factors, including central bank demand, increasing geopolitical risk, and high retail demand in Asia.

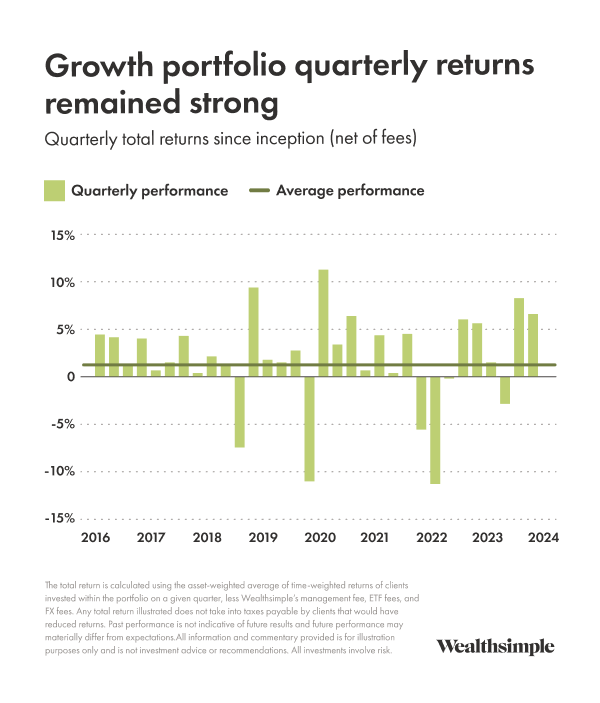

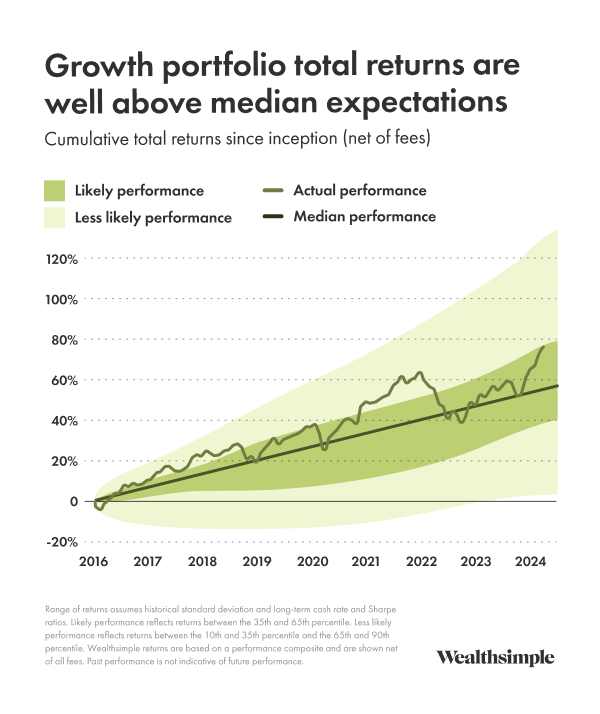

Portfolio performance

In the first quarter, all of our portfolios performed near the higher end of expectations. Our Balanced 60/40 portfolio returned 4.8% and our Growth portfolio returned 6.9% (see charts below), bringing annualized returns since inception to 4.9% and 7.1%, respectively. Our halal portfolios gained 6.4% to 7.5%, matching their annualized returns since inception. And our SRI portfolios gained 3.1% and 4.9%. Their annualized returns since inception are now 4.3% and 6.4%, respectively.

Private credit

Wealthsimple Private Credit returned 2.6% in the first quarter as borrowers continued to make regularly scheduled interest payments. The fund has distributed income at a 9.1% annualized yield.1 Since its June 2023 inception, returns are 9.8%,2 which is at the high end of our expectations. Overall, borrower health also remains strong, with a loan-to-value ratio of 44%.3

Private equity

Although March results are pending for a few more weeks (we’ll post an update in the app for investors as soon as they’re available), our private equity fund returned 13% in January and February — also at the high end of our expectations. This performance is primarily due to the revaluation of assets initially acquired at discounts, as well as the successful sale of one of the fund’s holdings, Systems Control. The fund remains well-diversified with more than 300 underlying investments in companies across North America, Europe, and Asia.

Outlook

Since late 2022, much of the market’s returns were driven by optimism toward the potential of Microsoft, Alphabet, Nvidia, and a handful of other technology companies. But this past month, a broader group of companies performed well, particularly in the energy sector and in industries that are more sensitive to economic growth, like tourism, luxury goods, and cars. This suggests that investors have a more positive economic outlook.

High valuations like the ones we’re currently experiencing have tended to be associated with lower returns going forward. But periods of valuation-driven increases in stock prices can persist for much longer than they have so far, so that isn’t necessarily a signal of an imminent decline in the market.

There are plenty of things that could derail the current market trajectory, including geopolitical risk, the persistence of inflation, and the economy slipping into recession. While these factors might affect short-term performance, patient investors should continue to expect positive returns over the long term. Those returns just may come from different sources — and if you’re well-diversified, you’ll be ready to take advantage of them.

What I'm looking out for

After two slow years, the market for companies making their initial public offerings (IPOs) has gotten much busier: companies raised USD $8.4 billion through IPOs in the first quarter of 2024 as compared with USD $2.6 billion in the same period a year ago. This likely reflects increased investor risk appetite and company valuations getting high enough that private company owners are finally willing to sell again. If it continues, that’s a great sign of investor optimism.