From our CIO: Introducing private equity

Why I like private equity for (some) investors

December 22, 2023

We recently introduced private equity as an option for clients, and I’d like to talk about how it can fit in a diversified portfolio.

For those who might be unfamiliar, private equity is the ownership of a stake in a private company. (By contrast, stocks are sometimes referred to as public equity.) Private equity funds look for companies that they believe are well-positioned to increase in value, buy them, make improvements to them over a period of time (often five to ten years), and later look to sell them at a higher price.

Although there is risk involved, which I’ll get into below, I like it for a lot of our clients with long investment horizons because of the potential for high returns. From 2001 to 2023, private equity returned 10.5% vs. the global stock market’s 5.7%.1 Given the current economic conditions, going forward we estimate private equity to continue to outperform by about 3%, net of fees. Over a long period of time that extra 3% can improve outcomes considerably.

The risk I mentioned is a big driver of those outsize returns. Underlying companies are riskier than the broader market, and investors are compensated for taking on that risk. Also, private equity managers tend to use more leverage than typical companies, which increases returns and adds more risk. There are implementation risks to private equity, too. They include illiquidity and a lack of index funds, which means you can’t invest in the overall market — and which puts a lot of pressure on finding the right fund manager.

We’ve done a few things to mitigate risks in this asset class:

- We partnered with a manager who not only has a track record of above-median returns, but is a co-investor, which makes them highly incentivized to manage for returns instead of simply gathering assets to collect more in fees.

- We intentionally found a fund that invests only in the secondary market at a discount (the market average is currently 17%) or at market prices for new direct investments. This avoids the problems with many existing open-ended private equity funds, which contain deals that debt financed at low interest rates (which may be hard to maintain in times of stress) and whose valuations may be high relative to what the underlying assets would face in a sale (because they have not yet been marked down in line with public markets).

- Our partner uses less leverage than the industry average. It has not been a meaningful contributor to their approach or returns.

For investors who can bear these risks, we think private equity is a valuable addition to portfolios as part of your managed investing relationship with Wealthsimple. But as I mentioned above, it’s not suitable for everyone. We’re making Wealthsimple private equity available to clients with $100,000 or more in deposits, a long enough time horizon to ride out volatility, and enough flexibility to deal with the fund’s relative illiquidity. If that sounds like you, you can apply to add it to your investment portfolio or read more here.

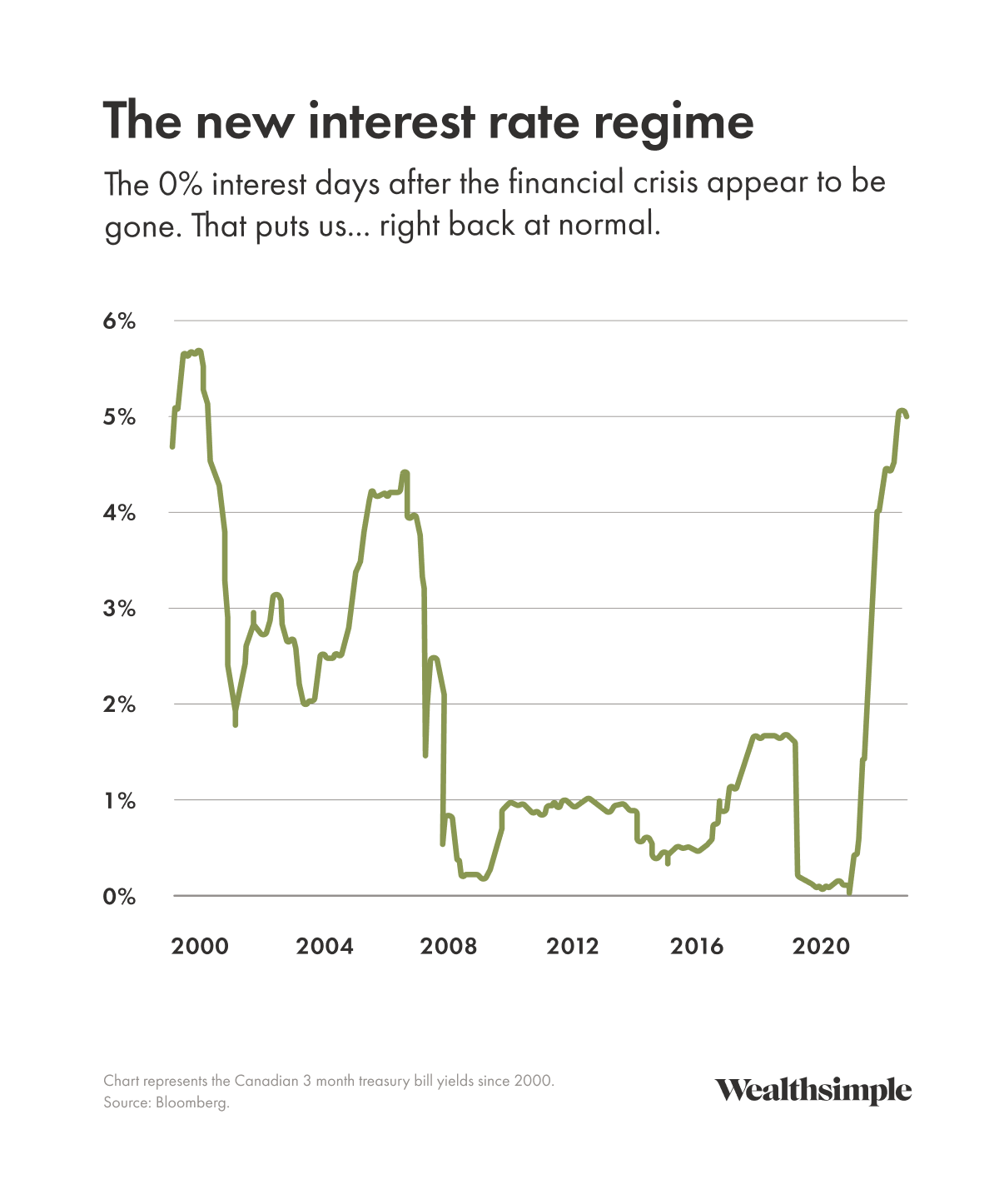

Chart of the month