From our CIO: How to use booms to prepare for busts

You can’t know when markets will drop. But you can be ready.

February 23, 2024

Over the past couple of years, I often found myself playing the role of stock market cheerleader. Wherever I went, everyone seemed to ask the same question: in light of 2022’s market nosedive, why risk investing in equities when interest rates were so high (and guaranteed)?

The mood these last few months is entirely different. As U.S. stocks hit all-time highs, fear has been replaced by euphoria. And I’ve started getting a new question: why not invest everything in U.S. stocks?

It’s not an unreasonable inclination, considering the U.S. market has outperformed most major markets over the last 15 years and remains one of the highest-returning indices in history. For anyone who asks me that question, I always suggest that they consider the possible outcomes before making their decision.

The benefits of diversification

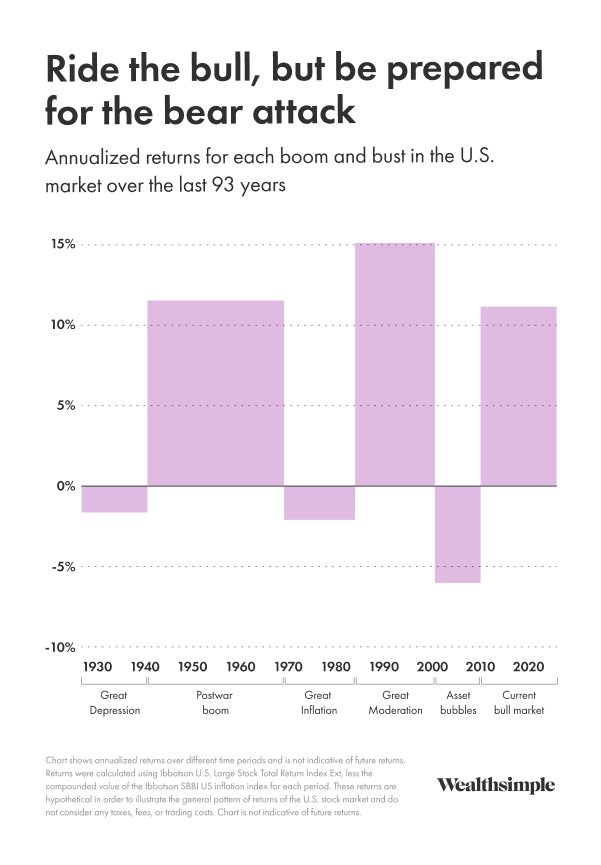

Looking at history is a good way to set expectations for the long term. With the S&P 500 in particular, we can break up the past 100 years into six periods of booms and busts. (See the chart above for details.)

Nearly every investor experiences a few of these down periods in the course of their investing career. Bear markets often feature a decade or more of negative returns, which is much more punishing than the relative blip of losses we experienced in 2022. And while you can’t avoid downturns, you can prepare for them — by being diversified.

Investing in a geographically diversified, rebalanced index gives you excellent odds of performing as well as the top markets in the world — sometimes better. This is true mathematically and also shows up in market history. (For example, from 1971 to 2023, an equal-weighted index of six developed market countries would have returned 7.5% cumulatively after inflation, compared to 7.2% for the U.S. market.) Diversifying with defensive equities (low-volatility stocks) and by asset class helps even more.

There is one important caveat to all of this: rebalanced, diversified portfolios will underperform a single index during boom times. But in exchange for that, they tend to outperform during the inevitable bust. They also mitigate the risk of periods of extreme losses and enable more consistent wealth-building.

What’s right for you

It all comes down to what you’re comfortable with as an investor. If you invest only in the U.S. index, you need to accept that decade-plus periods of low to negative returns are a strong possibility (for example, the U.S. had an annualized return of -6% after inflation during the bubble periods of the 2000s). Get through those, and you will still probably experience good returns over longer periods. Or you can be more diversified, accept that you’ll get lower returns in a boom, and achieve more consistent returns if the U.S. stock market follows its historical pattern of booms and busts.

Chart of the month

What I'm looking out for

In another sign of the growing impact of geopolitics on the economy, global shipping costs have risen 200% to 400% from 2019 levels because of Houthi attacks in the Red Sea, the Russia-Ukraine war threatening passage in the Black Sea, and a drought-induced slowdown through the Panama Canal. That’s not actually a lot compared to the 1,000% spike we saw during COVID, but shipping cost is only a small portion of the cost of goods. If these issues begin to limit shipping volume, we could be in store for supply chain shocks — and more inflation.