From our CIO: How to be smart about long-term risk

Investment risk, a rise in gold, and the future of China

September 27, 2024

The big news this month was about the U.S. central bank cutting interest rates after having kept them above 5% since May of 2023. Stocks rallied on the move, particularly the companies that are more indebted and exposed to interest costs. Looking at history, the fact that there have been cuts doesn’t predict much about future returns. That’s up to the economy and how it performs.

But what I want to focus on this month is risk and how to reduce it efficiently — which is to say, without lowering your potential returns right along with it. This is one of the most important features we bring to clients who use our Managed Investing portfolios, but it’s also something that can be done by self-directed investors. I’ll get into how and why it’s even possible below, and cover a few more topics I think are worth knowing about. As always, please let us know what you think (positive or negative — I’ll take it all) by tapping one of the feedback options at the end of this email.

Winners, drawers, and losers

Winner: Chinese stocks

China’s private sector has too much debt, and the government is not willing to bail out debtors, which is leading to a grim growth outlook. (More on that in a minute). But policy moves in the past three days have upgraded that outlook, leading to the best returns in a decade.

Drawer: U.S. government bonds

They rallied into the short-term interest rate cuts but sold off when the cuts actually happened, as the market now expects longer-term rates to be slightly higher than before.

Loser: oil prices

This may be a winner for consumers, but oil prices have declined thanks to new sources of supply. Recent news suggests that Saudi Arabia, which had been curtailing its production to support the price, may abandon that policy.

How to think about long-term investment risk

A core part of our investment philosophy is managing risk based on our investors’ goals. We do this by managing the bottom end of our clients’ expected range of outcomes over the time period that matters to them. The logic is simple: an extra $100,000 in retirement savings matters a lot more to you if you have $1,000,000 instead of $2,000,000, so you want to make sure your portfolios are resilient to a variety of market conditions.

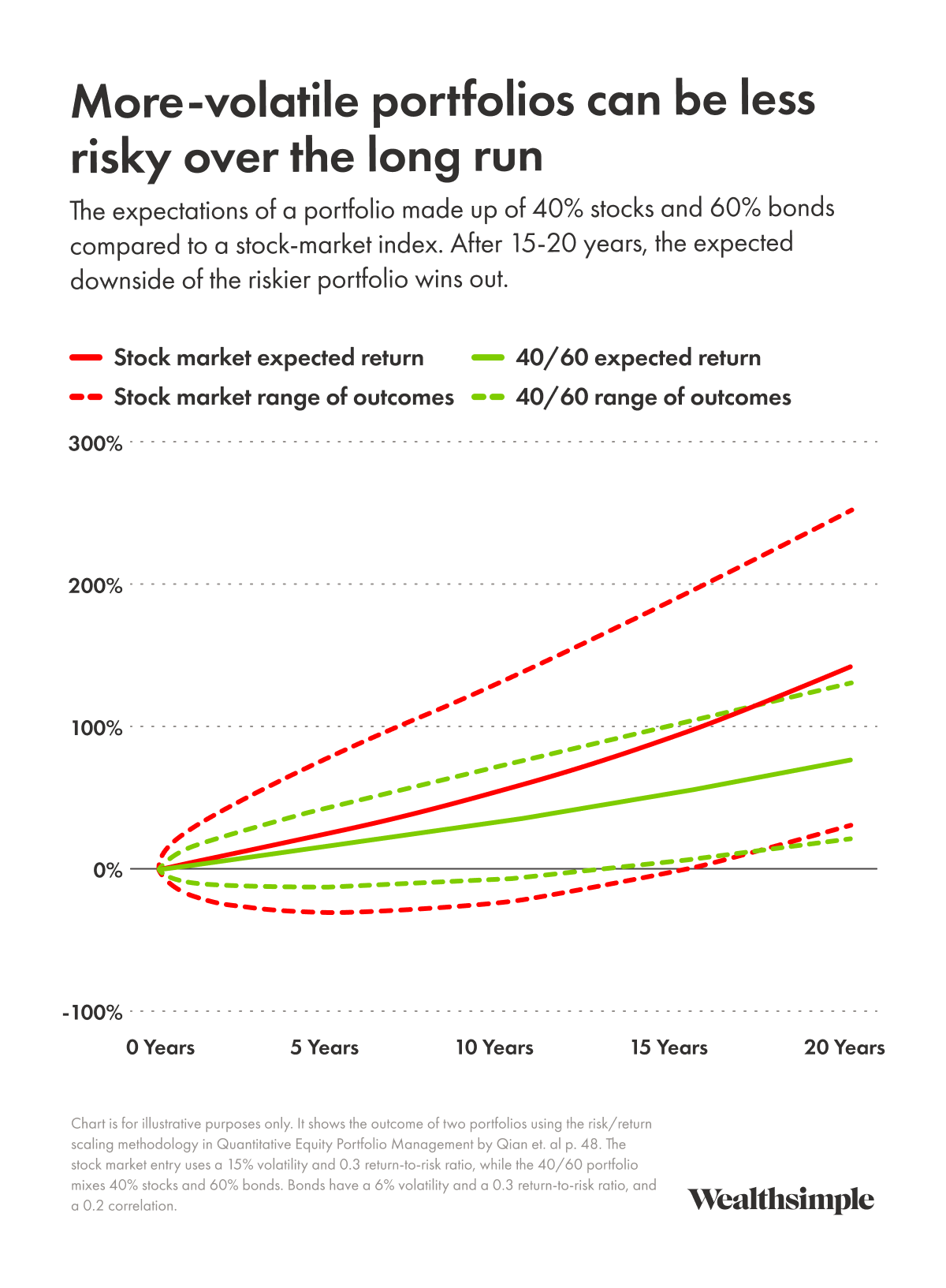

It’s not as simple as trading stocks for bonds to reduce volatility. For investors with long time horizons, adding less-volatile assets to manage risk is not effective because it reduces expected returns. You’re drastically lowering your likely upside in exchange for minimally raising your likely downside, and only temporarily: over time the higher expected returns of most reasonably diversified risky portfolios eventually win out despite the higher volatility. In fact, as the chart below shows, after a long time period (somewhere between 10 and 20 years, depending on your assumptions and the risk traded off), the higher-risk portfolio can actually have a higher expected range of bad outcomes and thus a better chance of helping you meet your goals even if market returns are weak.

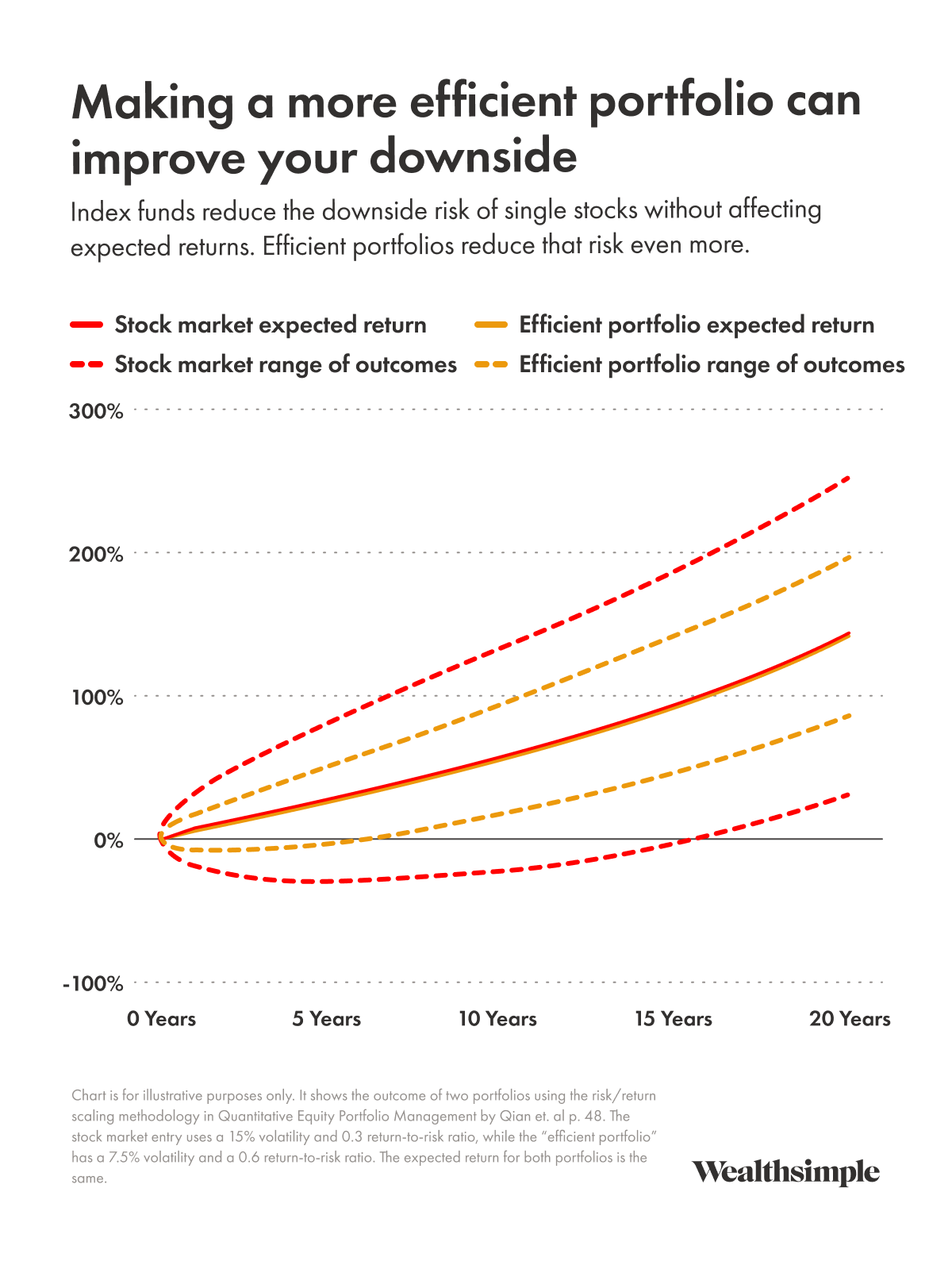

If you can reduce risk in a more efficient way, you can improve your downside materially while preserving or improving expected returns. This can be done by adding assets like defensive stocks that have similar expected returns but also perform well at different times. This approach does give up on some upside, but it also reduces the risk of a bad outcome, while keeping expected returns the same.

Why does this work?

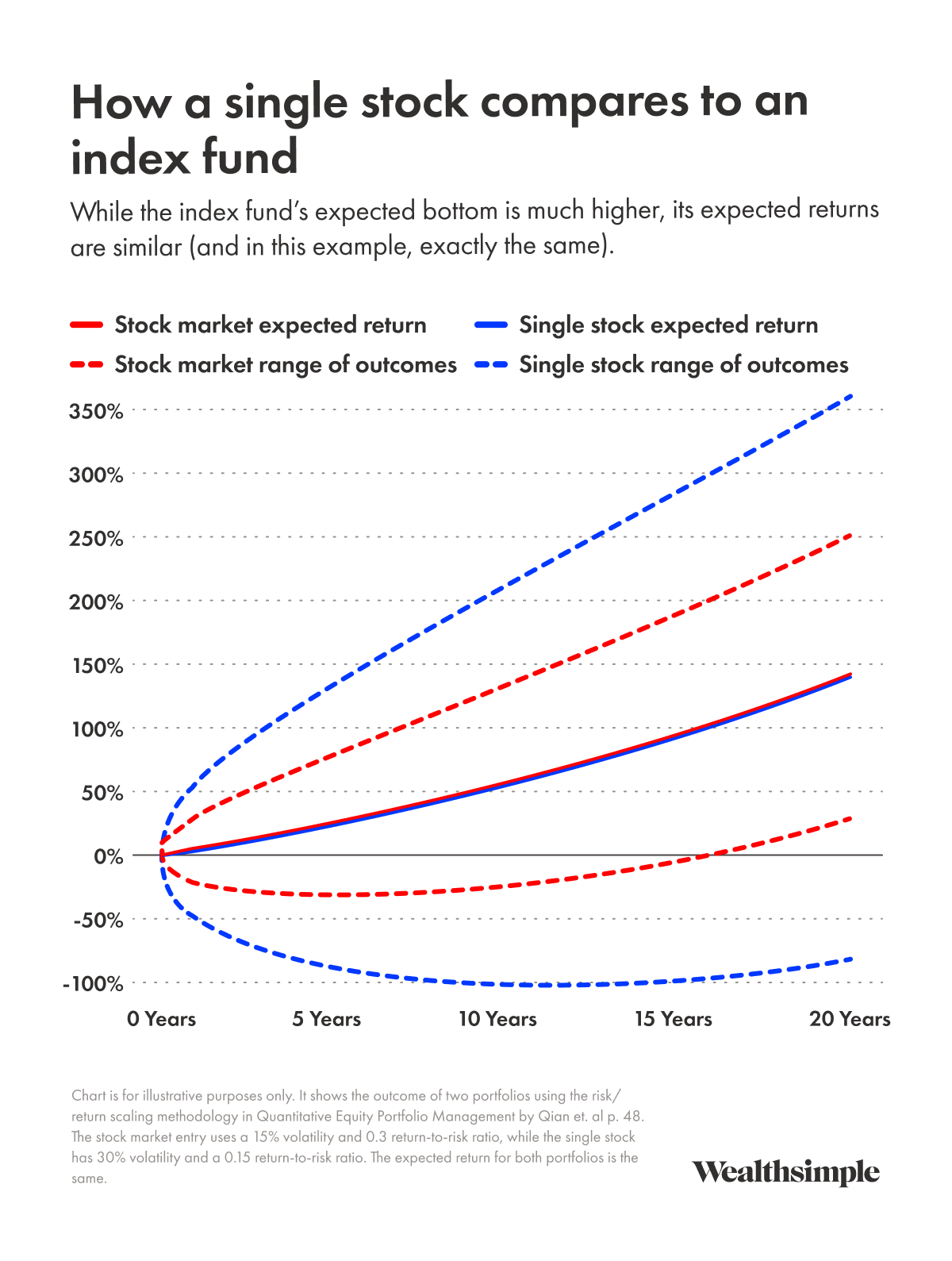

Let’s look at what many investors are already doing: investing in an index instead of in a single stock. As the chart below shows, the expected returns may be the same, but most investors would appreciate the diversification that comes with investing in the index, even if the single stock upside is much higher. By adding a bunch of other stocks with similar expected returns, you reduce the riskiness of your overall portfolio, since your retirement no longer hinges on a single bet. Of course, you do increase the jealousy factor when your neighbour tells you all of their portfolio has been in Nvidia, but it’s still generally the smart move.

But we suggest taking it a bit further. As I explained last month, focusing on a single stock index is relatively inefficient, since being diversified across more high-returning asset classes can also improve your expected outcome (similar to CPP’s strategy). This next chart compares a single index to a portfolio having the same return but about twice the return-to-risk ratio as the stock market as a whole. That’s about as good as it gets for most institutional portfolios that I have seen. It can be achieved in a variety of ways, but in our Managed portfolios we take steps in that direction by being globally diversified and including alternatives like private credit. Those assets won’t necessarily outperform a market-cap-weighted index, but they should have similar, diversifying returns and can really help your expected range of outcomes.

What it all means for you

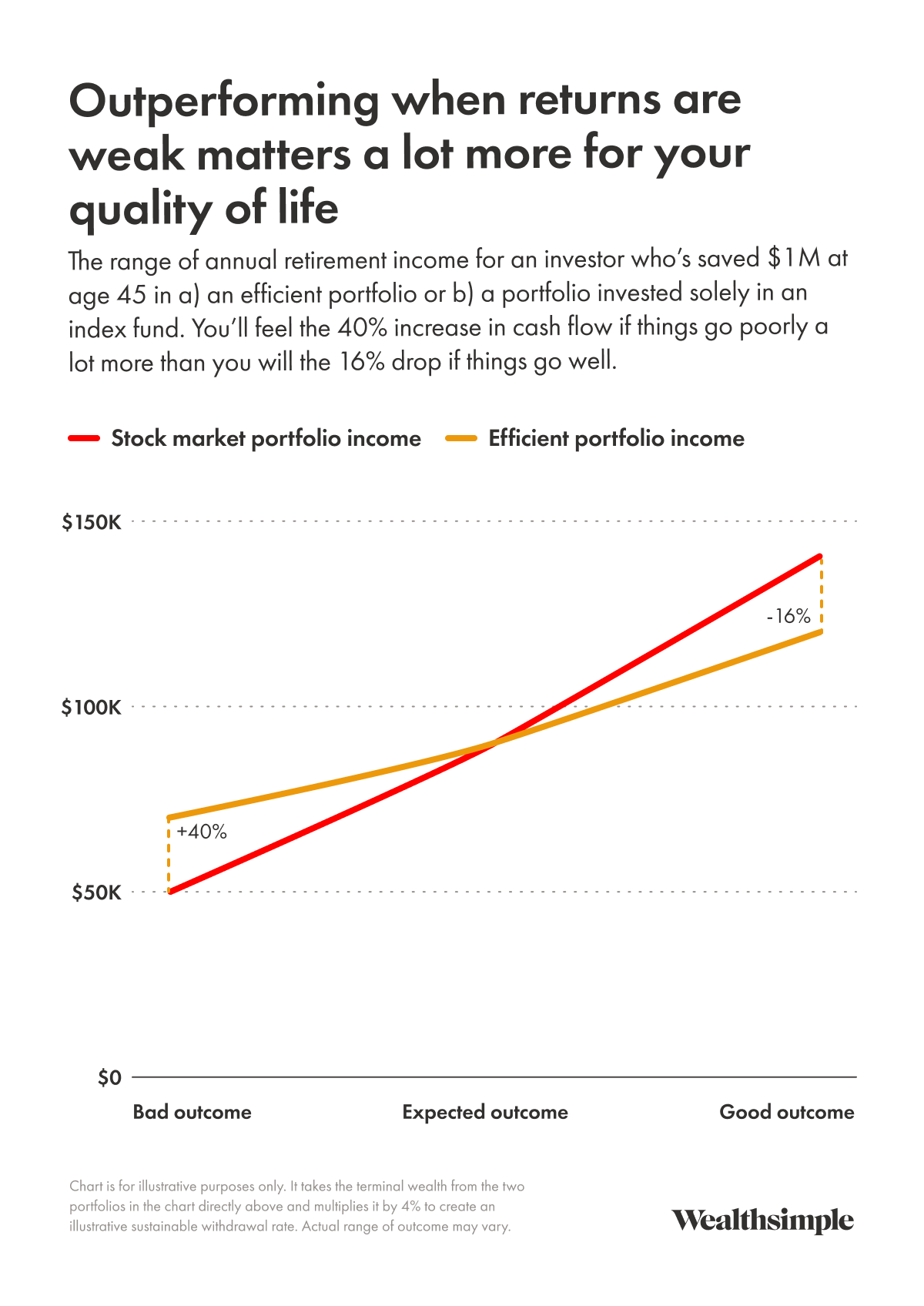

Let’s take an example of a 45-year-old saving for retirement. If they’ve saved $1,000,000 already, here’s their range of expected safe withdrawal rates from that amount in 20 years.

When you’re talking about living off of $50,000 or $70,000 a year, that extra $20,000 makes a big difference, increasing your ability to spend by 40%. This can cover essential expenses or let you do something nice for yourself or someone else that you might not otherwise be able to. But on the other end of the spectrum, that same extra $20K, while nice, adds 16% to your spending — which is already more than double that of the bad outcome. It would be less meaningful since you would already be able to meet more of your spending goals.

One good read

For my fellow finance nerds, I recently read The Corporate Lifecycle, a book by Aswath Damodaran, one of the world’s greatest experts in corporate valuation. He explains how to think about the stages of corporate growth, how companies mature, how to value them, and what to do as they age. It’s fascinating throughout, with insights about management, economics, and valuation. If you want a little preview before spending the $86, Damodaran wrote a blog post that outlines many of the key themes.

What I'm keeping my eye on

As the world’s second-largest economy, China has knock-on effects for all of us. Currently, the country is suffering from low growth and inflation thanks to unsustainable debt and overbuilding in the real estate sector. When building slowed, incomes and consumption declined with it. To fix this problem requires two policy responses: stimulating consumption and finding a way to write down all of the bad debt. This week’s interest-rate cuts and stimulus measures were a step in the right direction, but in my view much more demand stimulus is probably needed to turn things around.