From our CIO: How do you actually diversify?

What we mean when we talk about diversification

March 28, 2024

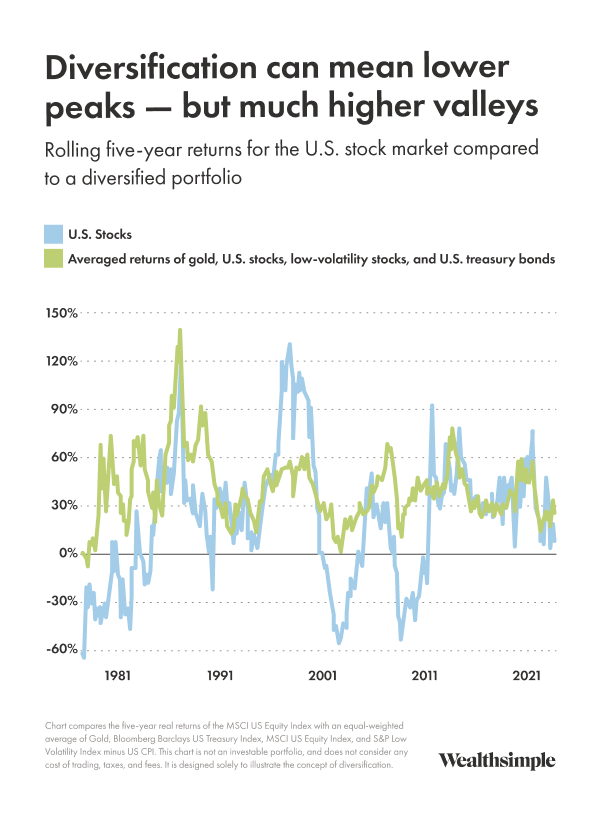

In my last letter, I talked about how investors can diversify their holdings to avoid over-relying on the U.S. stock market, since it too can go through periods of extremely low returns. Many of you followed up to ask for more specifics. Here are a few ideas to get you started.

How to diversify away from stocks

Economies don’t always beat expectations, so it can help to have assets that outperform when the economy struggles. Bonds are a classic example: because interest rates tend to decline when the economy struggles, bonds that were issued during periods of higher rates (and therefore have a higher yield) go up in value. The key is to take on enough risk that this outperformance will be meaningful. Some investors do this by purchasing longer-term bonds, which carry more risk because investors need to be compensated for giving up their money for longer. Others use derivatives like bond futures, allowing them to add bond exposure without reducing equity risk, since derivatives give the returns of an index but don’t require all of the cash up front. Because using derivatives is complex, can be risky, and requires regular maintenance, many investors use ETFs like RSSB, NTSX, or RPAR. Buying into them executes these strategies on your behalf.

Another risk to consider is inflation. Many companies’ stocks don’t do well in inflationary periods because inflation eats into profits. One way to diversify against this risk is by buying stocks in commodity producer equities — mining companies, for instance. Because commodity prices react quickly to inflation, they can do well when inflation rises. One caveat: commodity producers can be painful to hold on to when they are underperforming and the broader market is doing well — this is the nature of holding a highly diversifying asset.

Gold is another way to diversify against inflation, particularly monetary inflation — a sustained increase in the amount of money being put into the economy by the government (for example, stimulus spending during COVID). Gold offers the added bonus of doing well during financial panics. But it does have a weakness: as an alternative form of currency, gold typically struggles when interest rates rise and cash becomes more appealing. It’s also important to note that the expected return on gold is lower than that of stocks. But because gold’s price isn’t historically correlated with stock prices, most equity-dominated portfolios would have had higher returns in the long run if they included some gold exposure through funds like CGL, KILO, or GLDM. Even a small allocation (in the single-digit percentages) can make a big difference.

How to diversify your stock exposure

The risk we covered last month was underperformance relative to expectations that are priced into markets. To protect against this, you can add regional diversity to your stock portfolio. Long-term trends can reverse themselves, and entire countries and parts of the world can have bad years or decades (for example, emerging markets stocks have underperformed over the last 10 years after having great returns from 2000 to 2010).

One easy way to account for this is by buying country or regional indices, which you can get pretty cheaply from major ETF providers (e.g., EWJ, BBJP, or DXJ for Japan, which is highly diversifying to the U.S. and Canada), and rebalancing between them (selling some of the ones that go up and using the proceeds to buy others).

Another way to diversify stock exposure is by buying lower-volatility stock funds like GLOV, ACWV, or VVO, which tend to perform better when riskier stocks struggle. Or you can weight your portfolio equally, instead of letting companies with larger market capitalizations take up the most room. Studies have found that these types of assets and approaches tend to outperform major indices over long periods. You get exposure to the same market, along with some diversification, but the different pattern of returns increases your odds of a good result.

The key to diversification

As important as diversification is, it can be hard to execute. Sticking to your plan gets challenging during those moments when less-diversified investors are making more money than you. But if you believe in the strategy, diversification may have immense benefits for wealth building.

Chart of the month

What I'm looking out for

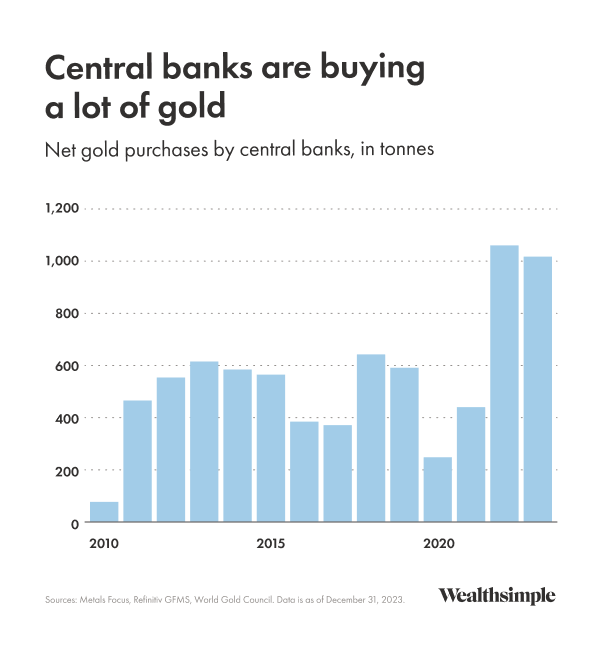

While the U.S. dollar remains the reserve currency of choice, in recent years foreign central banks have increased their purchases of gold reserves (see below). This is a sign of fragmenting international order, as a growing number of governments split from the west. Buying gold is a hedge against market crashes and breakdowns in international economic cooperation. The trend is worth following as geopolitics assume a greater role in markets than they have over the past 30 years.