From our CIO: How do bonds work?

A primer on bonds, the Trump effect, and what it may take to keep the U.S. market booming

November 25, 2024

Hi there,

The big event in markets this month was the election of Donald Trump in the United States. It’s too early to tell what its full impact will be, because it’s not clear what policy mix is going to actually occur. And many of the policies Trump has announced have effects that are inconsistent with his stated policy objectives. But the signal from the market so far is higher expected inflation, higher expected interest rates, and a stronger U.S. dollar.

Winners, losers, draw-ers

Winner: Cryptocurrencies

Bitcoin has rallied by about a third since the election, thanks to expectations of a more friendly policy environment from a Trump administration, and a lot of momentum trading.

Loser: International equities

They sold off following the election and are now down more than 3%. Most foreign economies would likely be negatively impacted by tariffs and other “America-first” policies proposed by the president-elect.

Drawer: The S&P 500

It’s about flat over the past month, despite the drama and volatility caused by the U.S. election. With valuations currently high, profit growth is needed for more strong equity market performance.

Investing 201

A brief(ish) guide to low-risk assets

Before central banks started cutting interest rates this summer, we saw a lot of investors moving to cash. Money market funds are setting all-time-high records for holdings. It’s an understandable choice: people haven’t seen interest rates in the 5% range since the early 2000s.

But then inflation fear receded and was replaced by concerns about economic growth. When central bank rates started dropping (we’re down 1.25% in Canada and 0.75% in the U.S. since June), cash interest rates went right with them, and many investors started looking toward bonds. Here’s a quick guide to understanding them.

How bonds work

Bonds are a contracted promise to pay from a borrower to a lender. Unlike stocks, your upside is capped to the yield of the bond, but in exchange you get more security, since bond investors generally get paid before stockholders.

On the spectrum of risk and return, bonds tend to sit between cash and stocks. Cash has generally (but not always) kept up with inflation. Depending on their riskiness, bonds return between the cash rate and about 4% higher than the cash rate. And historically stocks have returned 4% or more over cash.

Investors receive returns in a fixed-income asset like bonds from two sources of risk: duration risk (the opportunity cost of lending your money for a fixed period of time) and credit risk (the risk of not getting paid back the full amount you invested). In most cases, in order to make more than cash returns, investors want to be exposed to both types of risk, since they diversify each other and each have a risk premium.

Types of bonds

Government bonds are pure duration risk — since they’re issued by national governments, there’s little risk of default. They’ve historically delivered returns in excess of cash. Recently, however, central banks have been heavy participants in the government bond markets, pushing prices up and yields down, so the returns on offer relative to cash have been low. Even so, government bonds can be very helpful as part of a portfolio, diversifying stocks when the economy struggles.

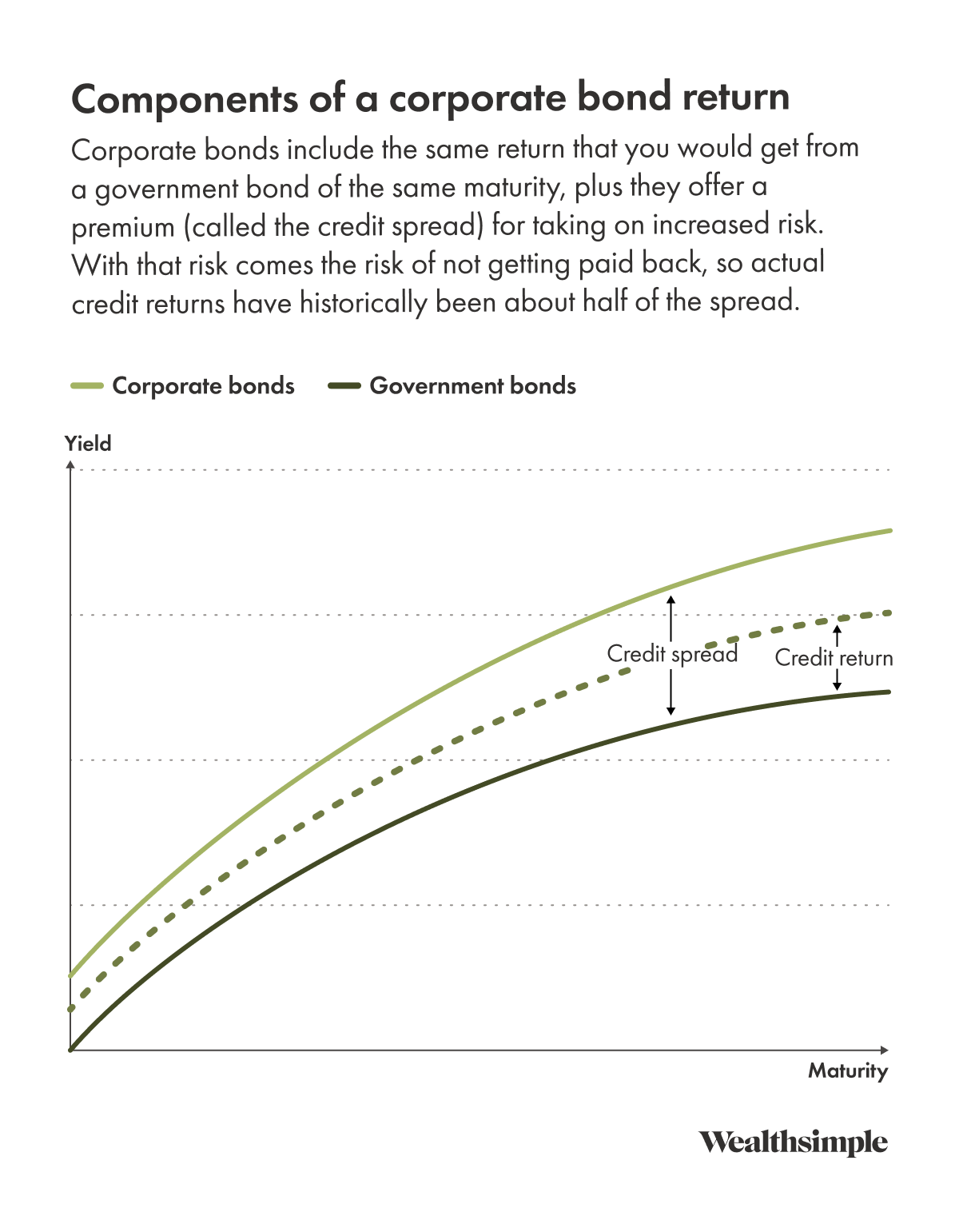

Other types of bonds (e.g., corporate bonds, which are issued by companies, and municipal bonds, which are issued by states, cities, and government entities) generally offer investors higher returns than government bonds of the same maturity, thanks to the addition of credit risk. That difference in yield is called the credit spread (see below). Historically, bond investors taking on credit risk have received about half of their promised payments in excess of the government bond returns.

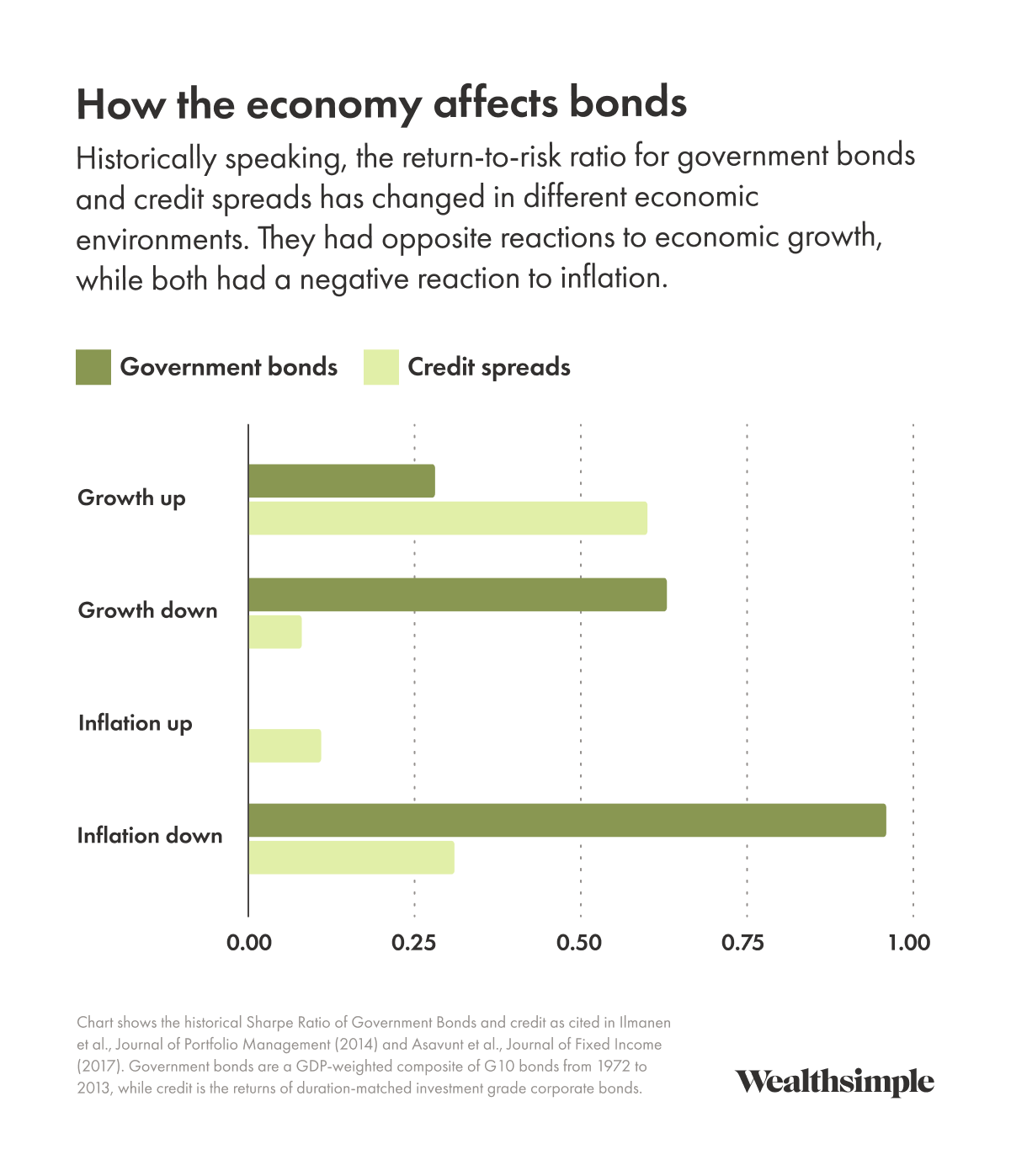

As this next chart shows, these sources of return can diversify each other.

How to incorporate bonds into your portfolio

The principles of investing are the same for bond portfolios as they are for multi-asset class portfolios: target a risk level you’re comfortable with and be diversified across different types of assets.

If you have a shorter time horizon and/or tolerance for risk, you may want to use shorter-term credit or government bonds. The bonds you would typically hold in a diversified multi-asset class portfolio (like a bond aggregate) may have more short-term risk of loss than you would like. If you have a longer time horizon, however, using riskier bonds increases your portfolio’s expected returns and return-to-risk ratio.

While it can be tempting to target higher yields with non-investment-grade fixed income, it makes sense only as part of a broader portfolio that includes assets like different kinds of stocks, government bonds, credit, and gold. This is because your return-to-risk ratio is going to be higher as you add more sources of return that perform well at different times. That will generally give you a higher return and can manage risk pretty well. (This is also why we counsel clients to add private credit alongside other risky assets in a diversified portfolio.)

The state of the bond market

While the cash rate is currently attractive, it is projected to continue to fall. A survey conducted by the Bank of Canada in September showed that market participants expect short term rates to be at 2.75% in two years — exactly what was embedded in bond market pricing at the time. That means investors didn't project any premium to compensate for the opportunity cost of tying up capital. Given that President-elect Trump’s stated pro-growth, protectionist policy goals will put upward pressure on inflation and thus interest rates, it’s something for investors to keep in mind.

The other thing to consider are credit spreads, which are extremely low by historical standards. They’re still consistent with returns in excess of the cash rate, but not as attractive as they have been for most of the past 25 years. This dynamic tends to occur during economic expansions, and spreads can remain low for long periods of time.

In light of these two factors, it could be helpful to use floating-rate bonds, which have interest payments tied to the short-term interest rate instead of a fixed rate. That allows you to maximize your exposure to the two parts of the fixed income world that are paying attractive returns: cash, which should significantly outperform inflation, and credit, where there is a risk premium.

Things to consider when investing in bonds

As I described above, longer-term bonds can still play an important role in your overall portfolio. However, if you’re only going to invest in bonds, here are a few recommendations:

- A managed, short-term bond fund can give you exposure to the areas of highest return relative to risk. Bond managers also have access to instruments that are hard to access, like very-short-term debt, central bank lending facilities, and synthetic debt instruments that offer attractive returns. But pay attention to fees. If the expected return of bonds is 1% over cash, and you are paying 1% to 2% in fees, your added risk only benefits the manager.

- One of the simplest ways to invest in bonds is with low-risk short-duration corporate credit funds, or by finding a fund earning the Bank of Canada rate while the returns are still good.

- Hold bonds to maturity using target maturity funds. This doesn’t manage risk any better than a bond fund — you are still subject to credit and duration risk and may take sudden losses — but some investors find it psychologically easier to hold bonds to maturity and ignore price movements.

What I'm keeping my eye on

Long-term bonds are the foundation of the valuation of stocks because assets compete with each other for investment. As the yield of bonds increases, investors will pay less for the same corporate earnings if they can earn more through bonds without taking risk. That would depress valuations and stock market returns. With valuations currently very high, bond yields are the key risk to watch. If they stay where they are due to stable expected inflation and a low risk premium, we could see more of a U.S. stock market boom as regulation and antitrust enforcement are reduced and corporate taxes stay low under President-elect Trump.

One good read

If you want to get more in-depth on the importance of long-term bond yields, here’s a smart analysis from veteran trader Andy Constan.