From our CIO: Has your portfolio gotten too concentrated?

Portfolio concentration, utilities, and where we might be in the market cycle

August 27, 2024

It’s been a volatile quarter for markets so far, marked most memorably by those couple of scary days earlier this month, where we experienced sharp declines followed by equally strong recovery. But for now the quarter has produced solid gains for most major stock and bond indices — and, as a consequence, most investors’ portfolios. It’s also been interesting to see how, after several years of tech-stock domination, long-term treasury bonds, gold, and Canadian stocks took over as the strongest performers. (I’ll get into how that shift might affect the way you think about your portfolio balance a little later on.)

The most important takeaway, from my perspective at least, is that most of our investors took the volatility in stride and kept investing through the turmoil. Declines in value like what we just experienced (and even bigger selloffs) are totally normal, and it’s important to stay disciplined when investing for long term goals.

Finally, we’ve added a few new things to the newsletter this month. Please let us know what you think by tapping one of the feedback buttons at the bottom of this email. I hope you like it, and thanks for reading.

Winners, losers, and drawers

Winner: Utilities

These assets tend to offer solid returns across the economic cycle. They’ve rallied 10% this quarter, reflecting lower interest rates and a weaker economic outlook.

Drawer: Information technology

Returns have been about zero so far this quarter. Earnings have been solid but investors are questioning the immediate revenue potential of AI.

Loser: Interest rates

Investors are pricing in weaker growth and lower inflation, leading rates to decline by 0.3 to 0.4% across the yield curve.

How to think about concentration risk in the current market

Whether it’s at the end of a webinar or just in the casual conversations I have at client events, I’ve been getting a lot of questions about what, if anything, investors should do to limit concentration risk in their stock portfolios now that major stock indices have so much weight in technology stocks.

Concerns over portfolio concentration are very fair. Recent asset returns have been dominated by the S&P 500, and in particular by the few largest stocks within the index. I think it’s always too risky to put all of your assets in a single index, but the risk is heightened now for three main reasons:

- Valuations are high, which might depress expected future returns.

- The six largest stocks in the S&P 500 make up 30% of the overall index — and they are all large technology stocks. That reduces the diversification you normally get from holding an index.

- Historically speaking, the largest stocks tend to underperform. We’ve seen the opposite to an extreme degree — and it’s not unreasonable to expect to return to the norm at some point.

Some other countries find themselves in a similar position. Taiwan, for instance, is actually the top country for returns over the past five years — and it offers even-more-concentrated tech exposure. Forty percent of Taiwan’s index is TSMC, the world’s leading manufacturer of high-end semiconductors (and Nvidia’s primary chip maker).

While it may be tempting to sell everything and buy Taiwan, you’d effectively be betting on only two companies. Although they’re obviously much more diversified, in my view U.S. large-cap stock indices share some traits with Taiwan and should be looked at with similar skepticism.

The wider perspective

Market leadership tends to rotate for a few reasons: new competitors can come and take out the leaders, new macroeconomic themes take over, and market participants price in enough good news that it becomes hard to outperform. The cliche about past performance not predicting future results is cliche for a reason. It’s in the data: over long periods of time, outperformers and underperformers are equally likely to outperform (or underperform) the index in the future.

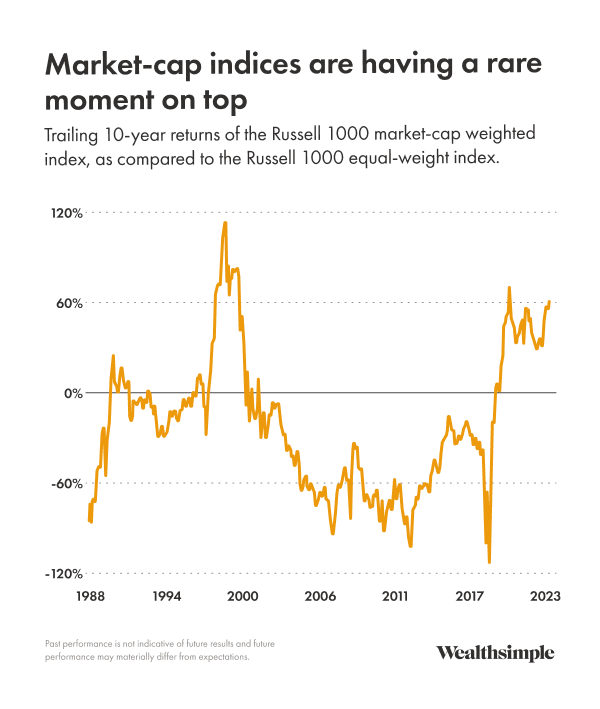

Even if you believe there will be continued outperformance, it’s generally been a bad idea to bet on the largest stocks, as the largest companies in the index tend to underperform by more than the average stock. Equal-weighted equity indices (where all of the stocks in the index are given the same weight, regardless of size) have generally outperformed market-capitalization-weighted indices (the more a company’s outstanding stock shares are worth, the more space they get in the index). This has not been the case recently, but it has been across many equity indices over time. Just take a look at the chart below.

While market-cap outperformance tends not to persist, we’re not necessarily facing doom when it ends. Yes, sometimes the index is concentrated and the market corrects. But at other times the rest of the market catches up on positive economic news.

So what can you do about it?

Instead of trying to time the market (a difficult task most professional investors haven’t mastered), I usually advocate doing nothing and accepting cycles as they come. That’s what diversification helps you do, and it’s why I mention it so much. But the right choice for you depends on what kind of investor you are.

If you have been primarily an S&P 500 holder and want to stick with it, you’ve done great, and you should probably continue to outperform cash. Just be prepared: if history is a guide, you might underperform some other indices.

If you want to diversify beyond the S&P 500, it can make sense for many people to invest across weighting schemes (market cap, equal weight, etc.) in addition to styles (defensive stocks, growth stocks, value stocks, etc.) and geographies. This is exactly what we do for our Managed Invest clients already. The approach balances FOMO when the market-cap-weighted index is outperforming, since you still have some exposure to it, and your portfolio benefits from the additional diversification and resilience.

If you are holding a concentrated portfolio of the largest tech stocks and think the U.S. tech sector will continue to outperform, consider how long you expect it to last — and figure out what signals you need to see in order to reduce or exit your position. The outperformance will end at some point, and you want to be prepared.

The best thing I've read

“ Now, both old and new gateways for seaborne commerce — responsible for handling 80% of the world’s $25 trillion in annual merchandise trade — are economic fortresses in the great-power struggles of a multipolar world.”

This quote from the Bloomberg News article “A $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics” really stuck with me. Lately I’ve been fascinated by the way geopolitics is affecting shipping, whether it’s disruptions from armed conflict and climate change or large-scale capital expenditure that enables governments to achieve their geopolitical objectives. This is a change from most of my career, where more of these decisions were driven by private sector incentives like profit maximization.

What I'm keeping my eye on

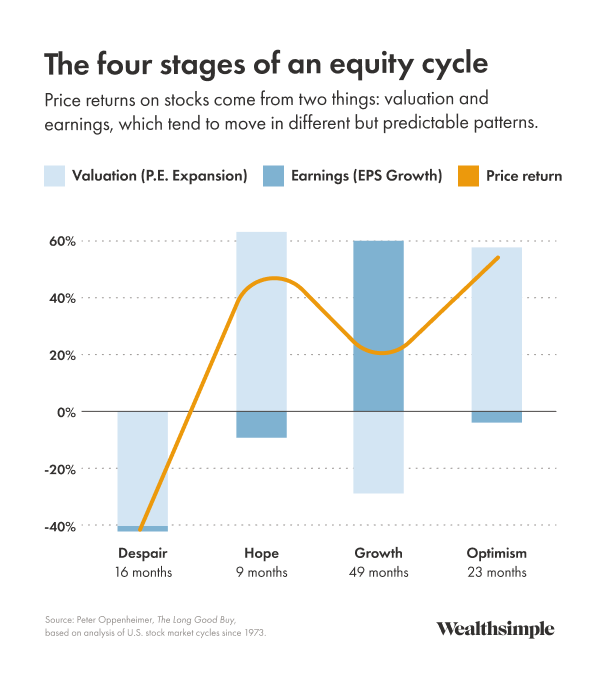

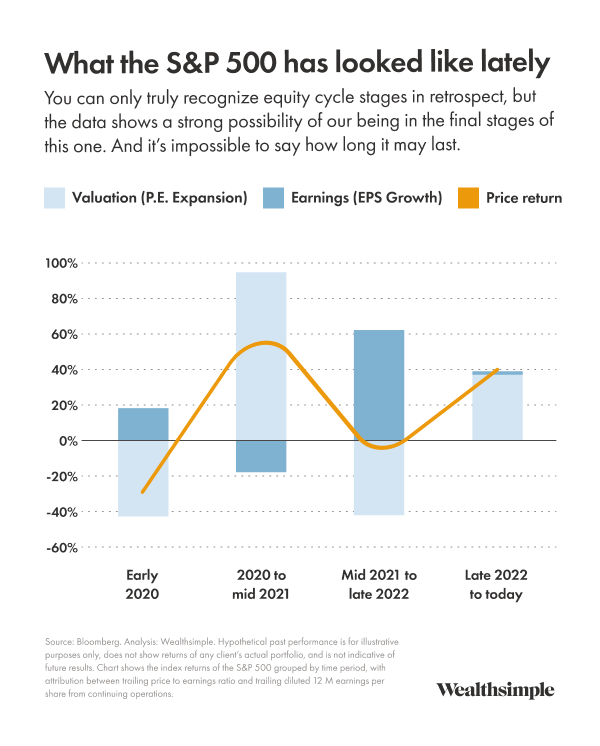

In the May newsletter, I talked about the four stages of the stock market cycle, which is the period of time it takes to move from a market low to a peak and back down again. The final phase, optimism, is marked by growing valuations and stagnant earnings. While it can be difficult to tell exactly where we are in a cycle, for the last two years we have seen valuations grow in a way that has not, at the broader index level, been supported by earnings growth — and two years is about the average length of the late-cycle period. This stands in strong contrast to the returns from 2020 to 2022, where the U.S. market anticipated earnings growth from 2020 to mid-2021 that was subsequently delivered from mid-2021 to late 2022. So it’s important to see what happens next. If companies actually deliver on their increased earnings expectations, the rally would appear to be more sustainable. If earnings disappoint, then we’re in shakier territory.