From our CIO: Don't lose a decade in the market

Don’t let the short term distract you from the long

September 29, 2023

A lot of investors have been staying away from the markets lately, preferring to pile into cash instead. It’s not an unreasonable move: the current yields are attractive, and there’s something nice about feeling comfortable amid all of the recent volatility. But that’s a short-term solution that can get in the way of a long-term opportunity.

Instead of worrying about the immediate value of cash vs. risky assets (the vast majority of the time, risky assets have typically won that fight in the long run), it can be more effective to focus on your investment timeline — and on having a mix of return streams to support reaching your goals. In other words: diversify.

Just like “buy low, sell high,” diversifying your portfolio is one of the most classic investment tips.

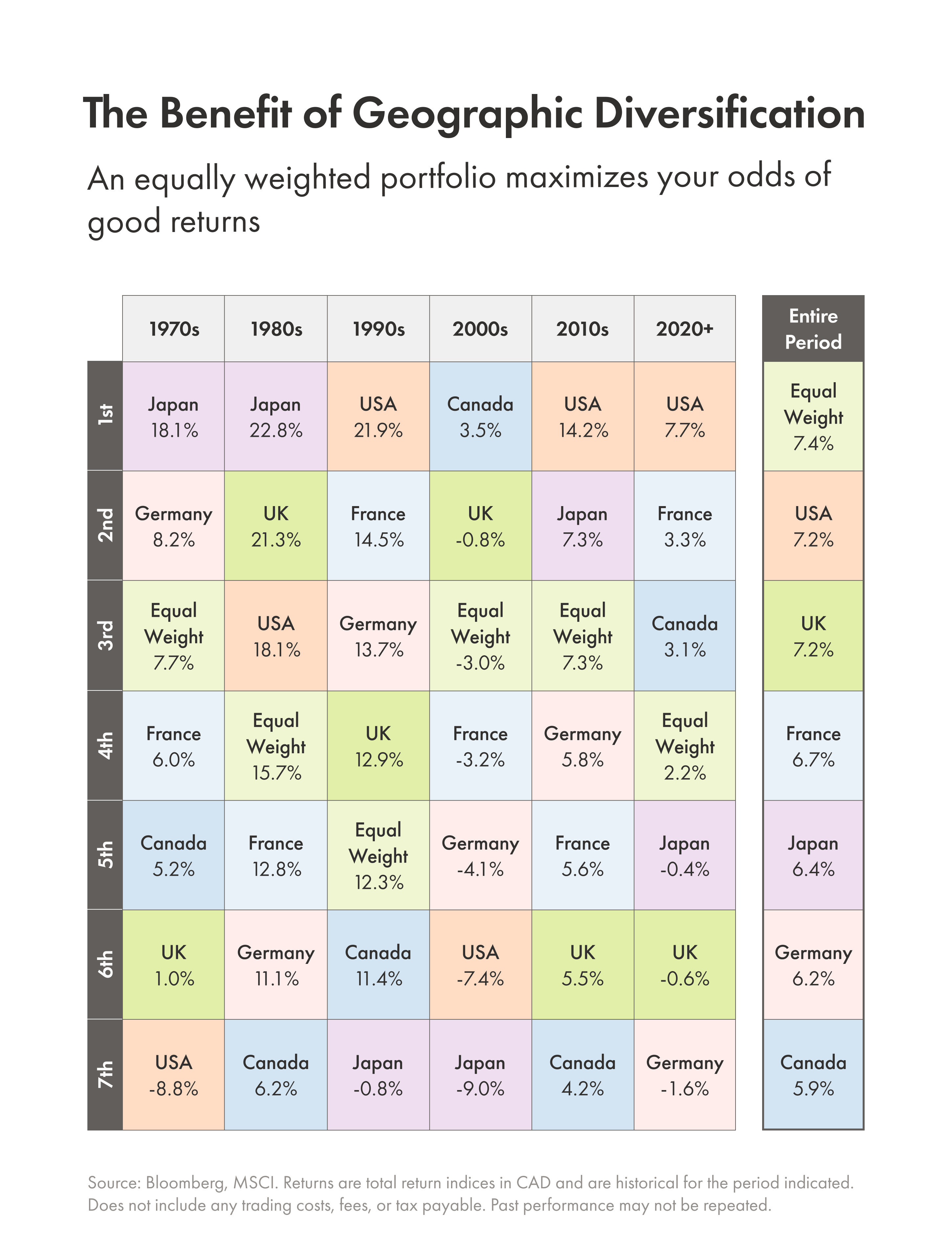

Why? Markets move in cycles. Periods of high returns tend to be followed by periods of low returns, and the inverse is also true. So if you’re heavily invested in U.S. stocks, which have outperformed other assets lately, you might be kind of nervous. The U.S. stock market had negative real returns in two of the last five full decades (the 1970s and the 2000s). While we’re not saying that such a period is imminent, investors should consider how to avoid extended downturns.

Note: while diversification can help limit downside, it can also limit upside in the short and medium term. There will be moments when a specific market outperforms a diversified portfolio. But over time, on average, the diversified portfolio can often win out.

Here are some ways we diversify portfolios at Wealthsimple:

Embrace asset class diversification

Spreading out your investments among stocks, bonds, and alternative assets like private credit (and putting meaningful risk into each of them) can help insulate you from big drops in one particular area. They all respond to changes in the economy in different ways. The current high interest rates, for example, led to some of the worst returns on record for bonds. But they’ve also boosted the yields on an asset like private credit, which relies on floating rates.

Think beyond North America

A rebalanced global portfolio can give you much better odds of good returns, while a concentrated portfolio goes through wilder boom and bust swings (like the ones we mentioned in the U.S. above). For example, since 1955, the average real return of developed country stock markets has been about 7%, which is similar to the returns of the U.S. market.

Don’t forget defensive stocks

While it’s easy to think that higher volatility stocks lead to higher returns, it’s not always true. Historically speaking, lower-volatility stocks have actually performed as well as or even slightly better than the risky stuff. That’s not to say you should pile all of your money into defensive stocks. If you did that, you’d miss the times that volatile stocks outperform (often during rallies and bull markets). Some investors choose to hold both instead of betting on either — an attempt to reduce a portfolio’s risk without reducing its long-term expectations.

You can read more about how we diversify our managed portfolios here and more about private credit (including who might be eligible to invest) here. As always, if you have any questions about your portfolio, we’re here to help.