From our CIO: An update on the markets

A third-quarter market update

October 27, 2023

The dominant theme in markets last quarter was a sharp increase in bond yields (the annualized return an investor expects over the lifetime of a bond). This shift happened because the economy has been stronger than expected, leading investors to think central bankers will keep interest rates higher for an extended period. Since bond rates are set by investors’ expectations, when those expectations went up, so did yields.

As a reminder, bond yields have an inverse relationship to bond prices. So when yields on Canada’s aggregate bond index rose from 4.3% to 4.9% in the third quarter (the highest yield this millennium), returns dropped 4.5%, putting us in the worst bond market on record. Stocks were also affected, but less so: after experiencing strong returns over the previous nine months, major world stock indices declined by 2%-4% last quarter.

As a result, Wealthsimple’s classic portfolios declined by 3%-4%, with more stock-heavy portfolios outperforming more bond-heavy portfolios. This period demonstrated the benefits of diversification. For example, our private credit fund, which does not have a negative sensitivity to interest rate changes, returned about 4% for the quarter, providing diversification for investors who added it to their portfolios.

Long term, this is normal

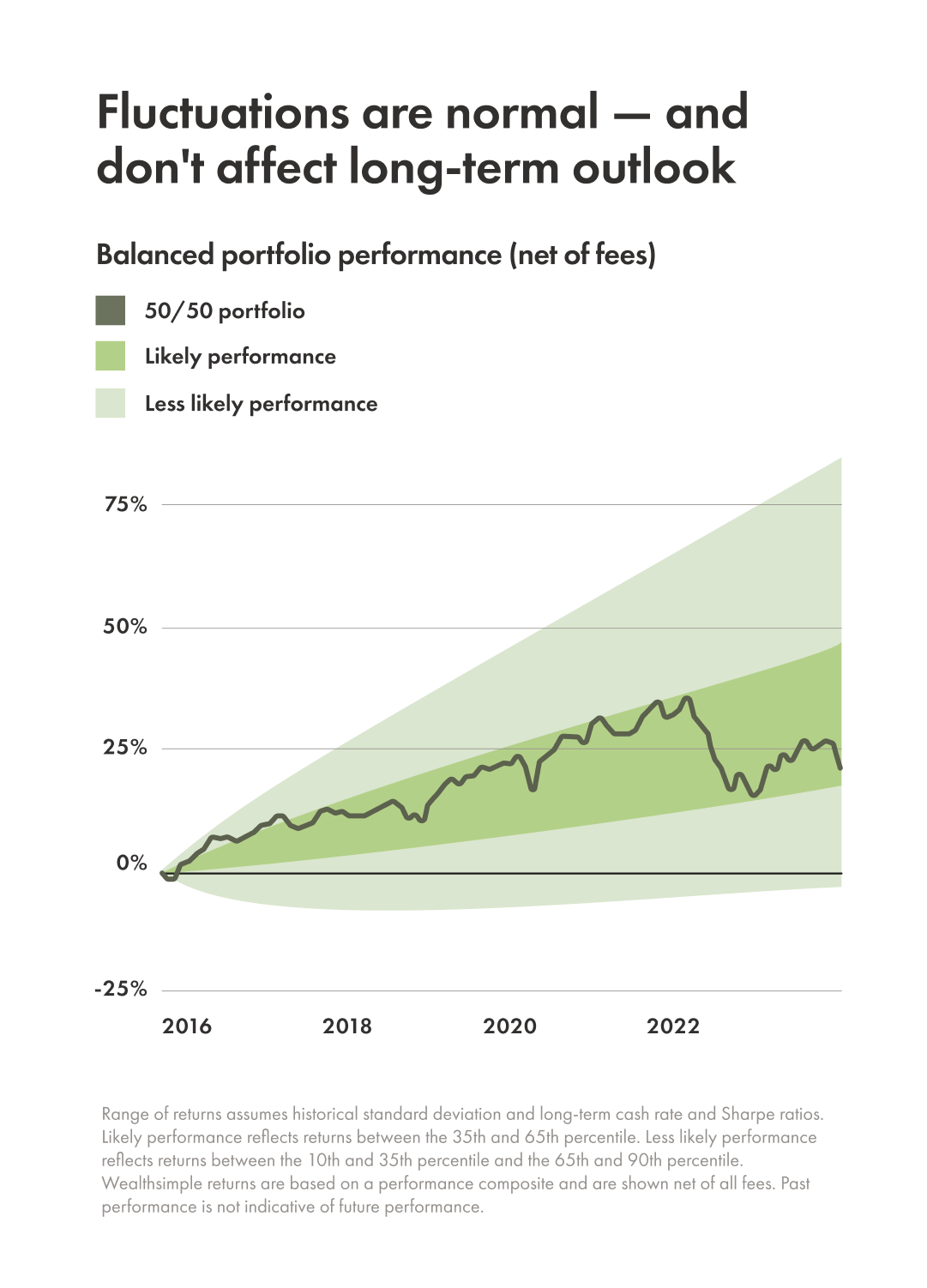

While this is not the kind of quarter many investors want to see, these fluctuations are not unusual. You can see that in the cone chart below, which shows the range of expected outcomes alongside the actual performance of a Wealthsimple balanced portfolio made up of 50% stocks and 50% bonds.

Stocks and bonds typically outgain cash (e.g. savings accounts, treasury bills) by 2%-4% per year because, generally speaking, you trade uncertainty for more positive returns. The longer your investment horizon, the higher your odds of earning positive returns relative to cash become: about 65% of one-year periods will outperform, 75% of three-year periods, and over 90% of ten-year periods.

It’s yet another reminder that investors have traditionally been best served investing through market cycles and remembering that recent returns are not a great guide for what will happen in the future.