From our CIO: A look back at 2023

The best plan for 2024? Be boring.

December 22, 2023

As we near the end of the year, I wanted to take this opportunity to reflect on some of the lessons we, as investors, can take away from it. For me, focusing on long-term investing and planning principles instead of what’s happening in the headlines is the better way to set yourself up for long-term success. Other than that, I wanted to wish you and yours a happy and healthy holiday season. Thanks for reading — and for being clients.

Most investment letters, particularly end-of-year letters, offer thoughts on the macroeconomic and investing environment. They do this because it’s interesting and entertaining. Maybe more important, it constantly changes, so there’s always something new to write about. As fun as that can be, I’d actually argue that prognostication isn’t the best source of investment advice.

It really has been a fascinating year: 2023 brought much better economic performance than most people anticipated (in late 2022, Bloomberg famously predicted a 100% chance of recession within a year). Inflation dropped from 8% to, at the latest reading, 3.1% — a long way to the long-term target of 1-3%. At 6%, unemployment is much lower than expected and still below levels from early 2022. Plus, interest rates are now positive after adjusting for inflation (i.e. you’re paid enough interest on your cash to more than cover the value lost to inflation). That’s more in line with long-term norms than the extremely low interest rates of the last fifteen years.

Here's the big secret, though: while that was very important to the year we just completed, it does not matter all that much in terms of what you should do next. Successful investing is largely detached from the daily or even monthly goings on in the market. As in much of life, it’s about doing the boring things consistently — sticking with a few principles, no matter how hard it may be.

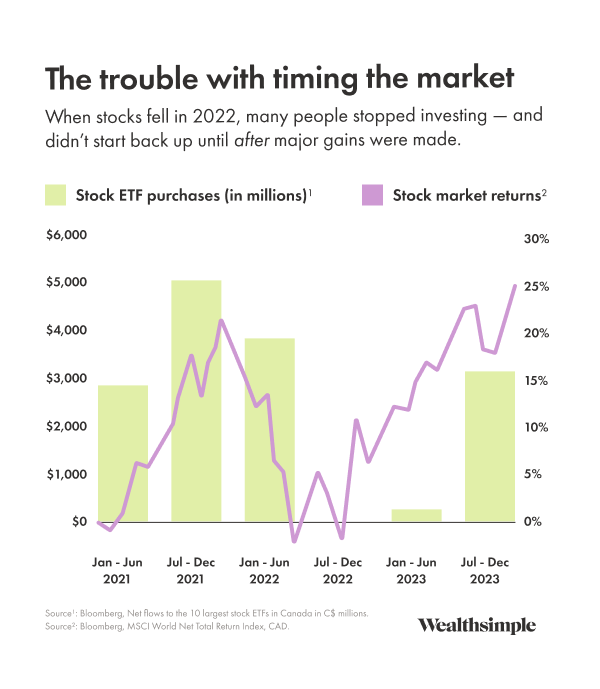

Unfortunately a lot of investors failed at this over the past year. Many people followed those doomsday analysts and gave into the temptation of high-interest accounts, putting new savings into cash instead of diversified portfolios. Since June 2022, when the flows into cash started to pick up, that bet has underperformed. Badly. Our portfolios outperformed cash 20% (growth portfolio) and 16% (60/40 portfolio) to 6%. The right moment to time the market had already passed, and those investors were left behind. Being boring in that situation would have been very smart.

Here are a few (boring) principles to lead you through 2024.

Stocks and bonds are more volatile than cash, but they increase the odds of future wealth.

Stocks and bonds tend to beat cash roughly two out of every three years — offering significantly more wealth creation if you have the patience to ride out that volatility. Over the last 120 years, stocks have delivered 4-5% more return than cash per year; bonds have offered about 2%. In any given year, the return of the stock market can be +/- 20% (or more in rare cases) relative to this long run average. That’s part of the deal of investing and fundamentally why you get those attractive returns that help you build wealth over time.

If you want to improve your portfolio beyond stocks and bonds, you can also consider alternative investments like private credit and private equity. They can offer attractive returns and, in the case of private credit, diversification relative to our ETF portfolios.

Good investors reflect on their risk tolerance — and change it as their priorities change.

The best portfolio is the one you will stick with. The new year is a great opportunity to reflect on what portfolio and strategy is right for you. If you’re in the right one, you should be comfortable staying invested through volatility like we have experienced recently.

If this year showed you that your risk tolerance is actually lower than you thought, you might be better off reducing the riskiness of your portfolio (although most portfolios that offer good returns will involve periodic losses). Or, you can decide that you want to behave differently in the future and stick with it more than you did this year. The key is being honest with yourself about who you are and what you need. We’re here to help with our surveys and with in person advice, but it’s ultimately a matter of self-reflection.

Returns are not within your control. But management fees and expenses (and some taxes) are.

You know the mantra: investing consistently in a diversified portfolio is the most reliable way to build wealth. But you can do more to improve your outcomes, like focusing on reducing fees and taxes. They are guaranteed (and within your control), while returns are not. Over a lifetime of investing, paying a 0.7% management fee instead of a 2% fee can save hundreds of thousands of dollars. Depending on your tax bracket and capital gains situation, tax loss harvesting can save you 0.15%–0.5% each year. Tax-aware security selection can save you another 0.2%. Your future wealth is worth the time it takes to figure things out.

By following these three principles, you will have set yourself up for long-term success — and freed yourself for a much more important task over the next month: spending time with friends and family.

Chart of the month

What I'm keeping an eye on

The price of oil is affected by a lot of things — the economic growth outlook, the cohesion and viability of the OPEC+ coalition to constrain supply, changes in fossil fuel investment due to climate change concerns, and geopolitical events — and it can have profound impact on governments and markets.

Much of the recent news has led to declines in the price of oil: most notably a receding of contagion risk in the Middle East and a perception that OPEC+ may not be able to sustain production cuts. But if any of these trends reverse, we could be in for significant impacts on asset prices and consumer spending.