From our CIO: A look at Q3 performance of our managed portfolios

A look back at Q3, and what’s ahead

October 29, 2024

Q3 portfolio performance

July 1 - September 30, 2024

As you can see in the chart above, all of our portfolios grew significantly in the third quarter thanks to strong asset-market returns. These high returns are normal, but are at the top end of what investors can expect in a quarter. The main cause for them, in my view, was the U.S. Federal Reserve surprising investors with a 0.5% interest rate cut. This led to sharp increases in the value of rate-sensitive stocks like utilities, real estate, industrials, and financial services, along with similar jumps in the value of long-term government bonds (+9%) and gold (+11%). The S&P 500, which had rallied on strong performance of large technology stocks previously, posted more modest but still strong returns of +4%.

Managed investing portfolio performance

Our strategy is to offer diversified portfolios of assets that perform well at different times in order to maximize our clients’ chances of achieving their investing goals. We do this by adding assets like defensive stocks that offset the typical equity boom-bust cycle over the particular time periods that matter for our investors. We believe that having better returns when markets are weak matters more than having good returns when markets are strong, because extra income matters more to investors when they have less wealth. (We covered this in more detail in last month’s letter).

Being diversified means that you have assets that perform well at different times. In this quarter, our defensive stocks performed best, while in recent years it's been our U.S. stocks. Having both and rebalancing between them offers the potential for a more resilient portfolio and better chances of a secure retirement.

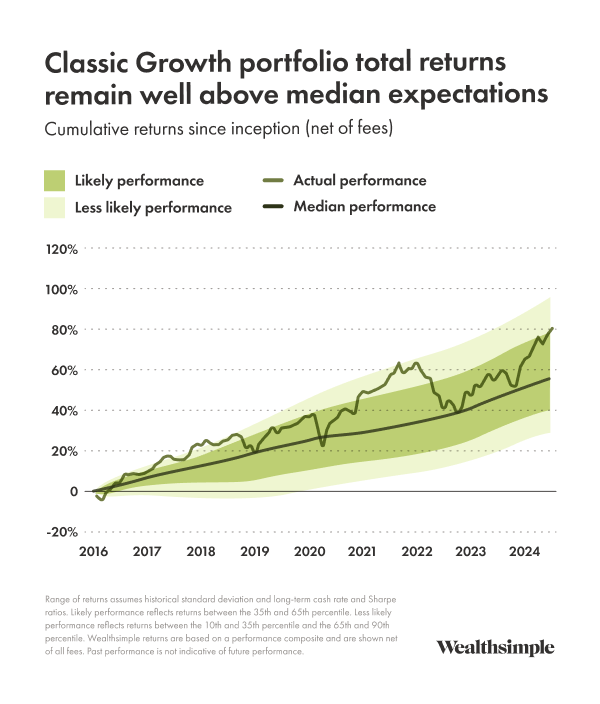

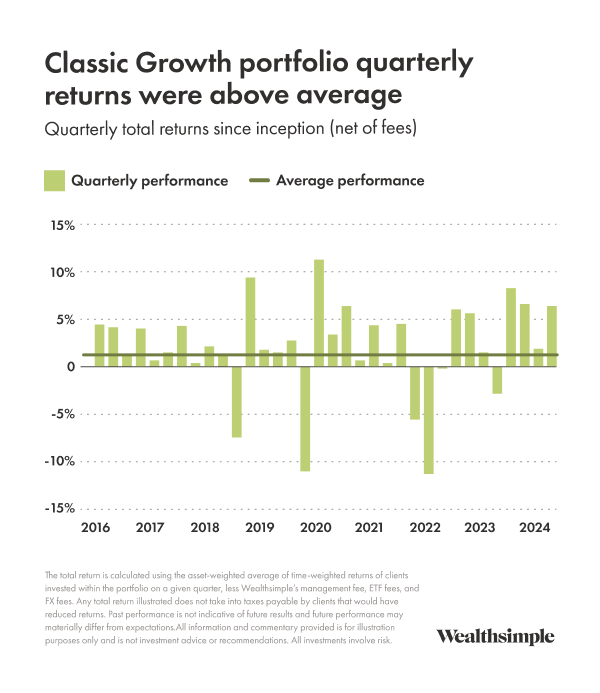

Here’s a look at the broader performance of our Classic Growth portfolio.

SRI and Halal portfolios outperformed because they hold fewer of the large technology stocks than the general indices.

Alternative investments

These funds allow our clients to invest alongside institutional investors in strategies that offer higher expected returns or attractive returns and diversification. Both funds are managed by experienced, institutional-quality investors with track records of steady performance across economic cycles and aligned incentives.

Wealthsimple Private Credit invests in senior-secured floating-rate loans (that means we’re first in line to get paid back, and payments go up or down with interest rates) to medium-size companies. It returned 2.3% in the third quarter and is distributing income at a 9% annualized rate.1 Annualized total returns since inception in June 2023 are 11.1%. Total annualized returns since inception in June 2023 are 11.1%.

Wealthsimple Private Equity offers a globally diversified portfolio of private companies owned and operated by private equity managers who work aggressively to improve their value. It returned 0.3% in the third quarter, bringing total returns since inception in January 2024 to 28%, which is at the high end of our expectations.

We believe both options provide an excellent way to build wealth and diversify portfolios, and we’re proud to be able to bring them to our clients. As I mentioned last month, we’re currently working to lower the requirement of $100,000 in total investable assets to $50,000. There are still other eligibility criteria to meet, but this will allow access to even more investors.

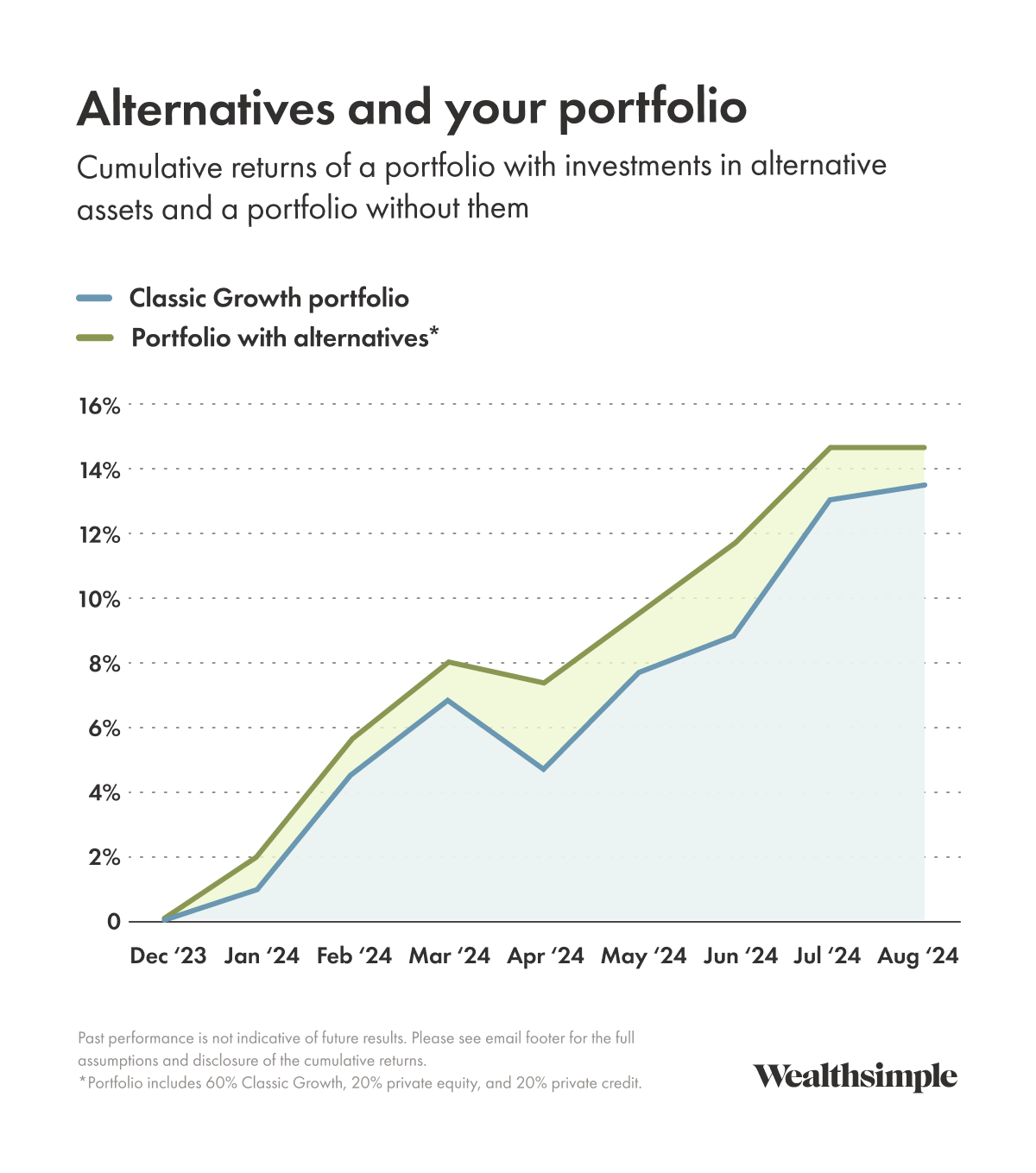

How alternatives can help a portfolio

Instead of just telling you that alternatives can be a great way to diversify portfolios and increase your overall returns, I wanted to show you that in theory in action. The chart below compares the historical returns of two different portfolios: 1. our Classic Growth portfolio, and 2. a hypothetical portfolio based on actual performance that includes allocations to Wealthsimple Private Equity and Private Credit. (The data begins this year, with the inception of our Private Equity fund.)

Our outlook

With inflation having declined significantly and unemployment rates ticking up modestly, global central banks are now more focused on stimulating growth than reducing inflation. Because of this, markets are forecasting an easing of monetary policy combined with strong earnings growth (about 9% globally, which is above long-run averages), short-term interest rates in the developed world of 2.5% - 3.5%, and moderating inflation.

Asset pricing reflects a very optimistic view of the future. In order for the markets as a whole to continue delivering these high returns, the economic outlook needs to stay extremely strong.

Other factors to watch in the next quarter include:

- The U.S. presidential election. There can be a lot of volatility around the election, and some short-term moves in the market. There's usually a boost after the election as policy uncertainty is resolved. As we go through it, it’s worth remembering that which party is in power generally has very little to do with market outcomes.

- Stimulus in China. In the last week of the 3rd quarter, the Shanghai composite rallied 25% on announcements of monetary and fiscal stimulus. Historically, large-scale stimulus in China has resulted in returns of more than 100%, but the size of this stimulus is not yet clear. What’s been officially announced to this point is not nearly big enough to adequately improve demand, and markets have declined recently as a result.

- Inflation. Markets are betting that inflation is under control, but cutting rates is stimulative, and the economy is strong, so it’s not guaranteed. Higher-than-expected inflation combined with lots of expected interest rate cuts is a recipe for a challenging period of returns.

At times like these, it’s worth remembering that stock market investors generally receive high returns for taking risk. And risk generally means losses of a magnitude and length that are painful. In my view, the best approach continues to be to manage your emotions, have exposure to assets that perform well at different times, and invest through the inevitable market cycles.

One good read

In a new article, Greg Jensen at Bridgewater suggests that the AI Bubble may be ahead of us, and that an investment boom much greater than what we have seen so far may be coming. It’s a great mixture of historical analysis of how markets work and a practitioner’s view of the promise of AI.