From our CIO: A look at portfolio performance

Here’s what happened in Q4

January 26, 2024

As we finish off the first month of 2024, I’d like to talk about the end of 2023 and how it affected Wealthsimple’s various portfolios and assets.

The markets ended last year with a pretty dominant theme: optimism. Thanks to the progress made in reducing inflation, investors began to anticipate the end of the recent cycle of interest rate hikes and priced in significant interest rate cuts over the next two years. This is a big change from the previous quarter, when many people expected the hikes to continue, and it was reflected in all risky asset prices, with stocks, bonds, credit, and gold posting large gains.

Portfolio Performance

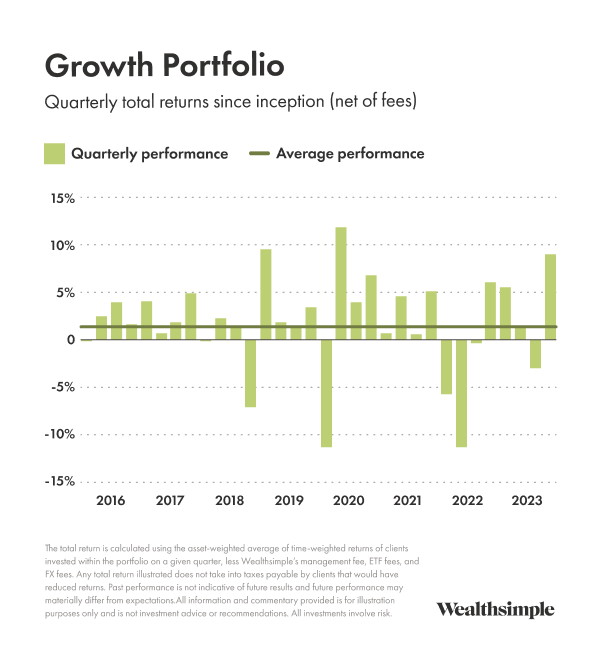

Wealthsimple’s managed portfolios experienced extraordinarily strong quarterly performance (see below). All of our classic portfolios increased in value by 8-9%. Our Halal portfolios were up 5-7%, and SRI portfolios rose 9-10%.

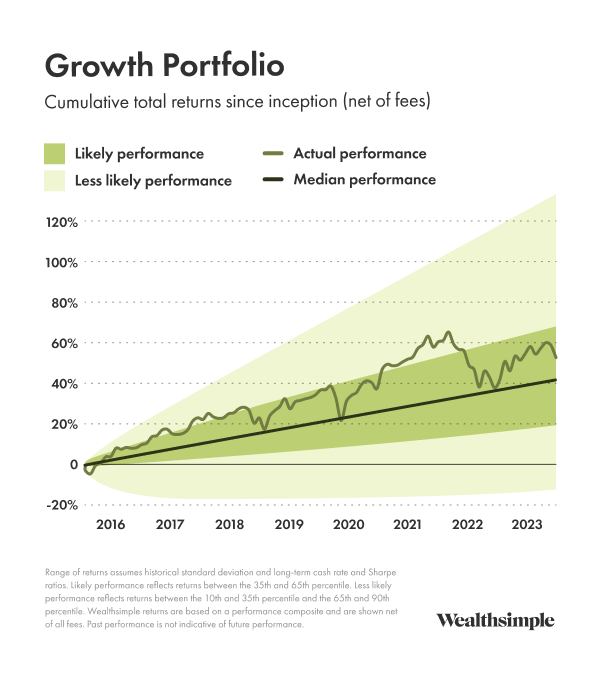

For the calendar year, Growth portfolios were up 13%, and our Balanced 60/40 portfolio rose 11% — both well above our long-term return expectations. Since inception, they both also beat median expectations, with the stock-heavy Growth portfolio (see below) out-performing those expectations even more than bond-heavy portfolios. This is not surprising, given that the stock market has performed better than usual and the bond market worse than usual since the beginning of our performance history, in 2016.

Private Credit Performance

Since it launched in June, total returns (the overall increase in the value of the fund) are at 7%, with 5% coming from income distributions. Increases in the value of the loans comprise the remainder of the total return. In terms of credit quality, the weighted average loan-to-value1 (the amount of money borrowed in comparison to the value of the collateral) is a conservative 43%, and all borrowers are making their agreed-upon payments.

Private Equity Performance

We launched our Private Equity fund in late December with LGT Capital Partners, along with three other institutional seed investors. The fund is globally diversified across North America, Europe, and Asia, and includes more than 200 companies in more than 20 sub-sectors. Half of the portfolio consists of investments in existing private equity portfolios purchased at significant discounts, while the other half is in direct positions in deals including Worldpay, Medivet, and Aldinger. We will continue to ramp up the portfolio in the coming months.

Outlook

Going forward, expected returns remain relatively normal, with assets that have outperformed over the past 5-10 years (like US stocks) having lower expected returns than those that have underperformed over the same period, like European and emerging-markets stocks.

What’s normal? World stocks have earned about 5% more than inflation over the long term. Bonds tend to return roughly what their starting yield is when purchased, meaning Canadian investors should expect about 3.25% from their bond holdings over the long term. Expected returns for private credit are relatively strong with a sustainable distribution yield of 9%; even with rate cuts of 1% or more, which would reduce the distribution yield, expected returns remain attractive.

What I'm keeping an eye on

Microsoft and Tesla will kick off earnings season for the “Magnificent Seven” on January 24th. These seven companies (which also include Apple, Amazon, Nvidia, Meta, and Alphabet) represent 30% of the market capitalization of the S&P 500 and have driven a significant portion of equity market returns over the past several years. Those returns were due more to increased expectations for future growth than actual changes in realized earnings, so any shift in that outlook could have a large effect on the broader market.