Everything you need to know about CPP2

What you should know about CPP and CPP2

October 25, 2024

I’ve had a lot of conversations about retirement planning over the years, and one thing is clear: most people don’t fully understand how the CPP fits into their future. Some aren’t even sure what those letters mean (it’s Canada Pension Plan, if you happen to be among them).

With the introduction of the CPP2 this year, which increased earnings limits, there’s even more confusion than normal. That’s why, for this month’s email, I wanted to break down what CPP, the CPP enhancement, and CPP2 are, how it all works, and how you can get the most out of it.

First off, what is CPP?

CPP is a taxable government program designed to replace part of your income in retirement. It’s like a piggy bank that you have to pay into in order to be paid back in the future. The more you earn, the more you pay (up to an annual maximum). And the more you pay, the more you get paid back in retirement.

CPP isn’t going to get you on the beach in Boca. The maximum monthly payment is a little over $1,300, and the average payment for 65-year-olds as of July was $815. But it’s a solid foundation that should be factored in alongside other income sources (OAS, RRSPs, work pensions, rental income, etc.). Primarily, it helps manage:

- Longevity risk: this is one pot of money you’ll never see the bottom of. You earn CPP up until your very last year on earth, no matter how long you make it.

- Inflation risk: CPP is indexed to inflation, so your income adjusts with the cost of living.

- Market risk: even if all of the markets crashed and burned, CPP payments are effectively guaranteed.

What about the CPP enhancement?

In 2019, the government made changes known as the CPP enhancement. It’s a phased rollout that increased the maximum amount that future retirees could get, from 25% to 33.33% of their working income per year (up to a cap). For those already close to retirement, you won’t see much of an effect. Since you don’t have much time to put extra money in, there’s less potential to take more out.

Okay, so what’s CPP2?

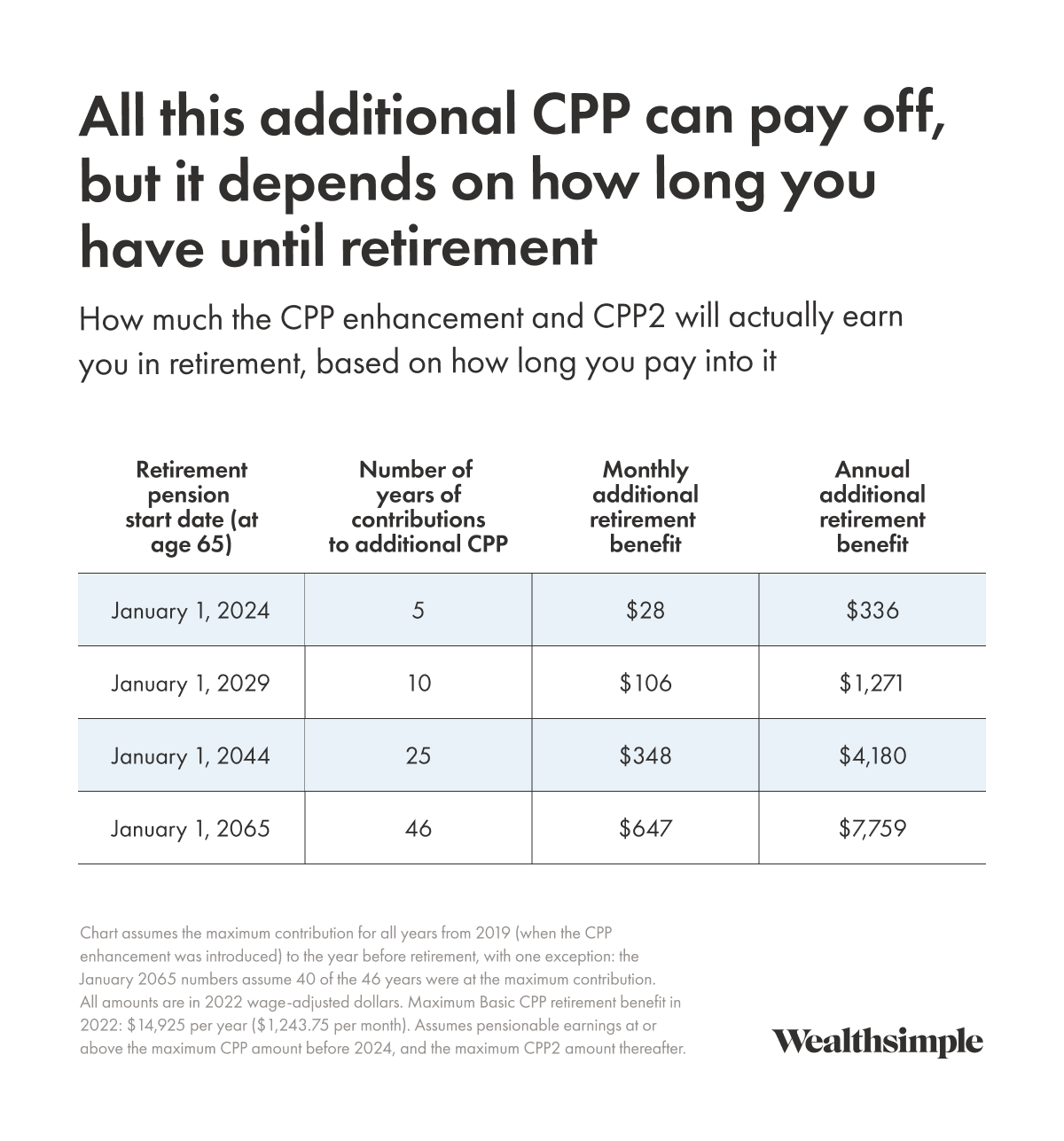

The CPP2 benefit was introduced this year for the benefit of higher earners. If you earn less than the income cap for CPP ($68,500 in 2024), CPP2 doesn’t change anything for you. But if you make more than that, CPP2 kicks in. It effectively raises the income cap (to $73,200 in 2024). So you’ll pay more into the pension — and you’ll earn more when you retire. As with the CPP enhancement, CPP2 won’t have a huge impact if you’re within 5-10 years of retirement. There just isn’t much time for those benefits to accrue. This chart shows you how much it could affect your eventual payout.

What are the concerns with CPP?

Here are the three biggest criticisms of the program I hear, along with my take on each.

- “I could invest better on my own.” That might be true! I have faith in you. Plus, the CPP has been criticized in the past for underperforming a stock-heavy portfolio. (Wealthsimple’s Chief Investment Officer Ben Reeves explained why the CPP invests the way it does.) But the CPP does one big thing you can’t: it offers guaranteed, inflation-protected income for life.

- “It won’t be there when I retire.” According to the chief actuary of Canada — who assesses sustainability every three years — CPP isn’t going anywhere. The fund’s most recent report shows that the plan will be comfortably funded beyond the year 2100.

- “If I die young, I’m just paying for other people’s retirement.” CPP includes survivor benefits, which pays up to 60% of your pension (depending on your partner’s age when you die and their own CPP payments) to your spouse and children.

When to start taking CPP

I touched on this a little bit in a past newsletter, but this decision causes a lot of stress for people, so I want to cover it here too. You can start receiving CPP as soon as you turn 60 or delay it until 70. The earlier you start, the smaller your monthly payments. The opposite is true, too: if you delay, your payments increase. In fact, taking your first payment at 70 as opposed to 60 will more than double your monthly take-home.

The right decision completely depends on you. If you’re in good health and have other income, delaying and maximizing your payments is often the right choice. But if you need the income sooner, start sooner.

The whole topic can be pretty complicated. Hopefully I helped straighten things out, but if you still have questions, it's important to get them answered. The best way to be confident in your future is to plan for it — well before you get there.